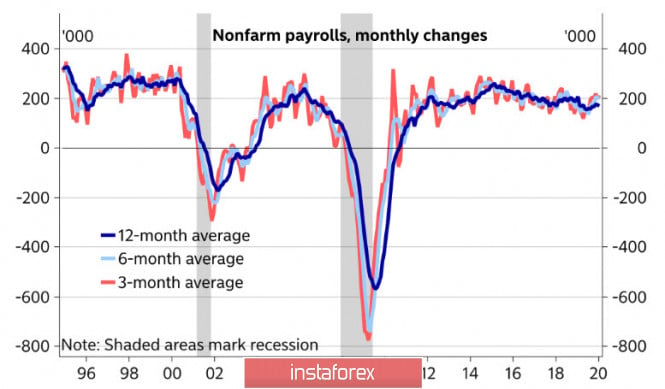

The report on the US labor market for January was expected to be strong, with 225 thousand new jobs created in the non-agricultural sector of the economy (an increase of 160 thousand was forecast), and data for November-December were slightly revised upward.

Despite the fact that unemployment increased from 3.5% to 3.6%, this indicator did not add negativity, since the level of participation in the workforce increased from 63.2% to 63.4% at the same time. In addition, the salary level showed an increase in January of 0.2%, which is worse than the forecast + 0.3%, but the annual growth was 3.1%, due to the fact that the data for December were revised upwards.

The report should contain at least 2 important conclusions:

The first of these concerns the Fed rate. The probability that the regulator will take a break before the election increases, and therefore, the markets reacted by selling bonds and falling their yields. Stocks were also sold, which was somewhat unexpectedly amid a strong report, but may indicate the need to fix the level reached earlier. The reversal of the ISM indices is clearly related to the Fed's reaction to the repo crisis last fall; a powerful stimulus package gives results.

The second conclusion is even more obvious - the US economy is growing steadily despite the fact that the rest of the world is closer to stagnation than to growth. Does this growth count on the growth of the dollar? The report on this issue is far from obvious.

The Congressional Budget Committee published a review of the US federal budget for January. According to it, the deficit for the first 4 months of the current fiscal year amounted to 388 billion, which is 78 billion, or 25% more than a year ago. Revenue growth is significantly offset by rising costs, while the difference is 40 billion in January alone compared to January 2019, that is, the deficit growth tends to accelerate.

Moreover, the Treasury will add $ 200 billion to the US banking system over the next month, which will increase liquidity and, in general, play in favor of increased demand for risky assets. On February 13, some decisions on repurchase transactions will be made public and the Fed's Treasury purchase schedule will be published, estimated at 60 billion a month. These measures will contribute to the growth of the dollar supply, which may lead to its corrective decline, especially if the general macroeconomic background shows an increase in positive. As a result, demand for risky assets is likely to increase this week. At the same time, the long-term trend in the dollar index remains bullish, while the CFTC report showed an increase in the total long position in the dollar for the week.

EUR/USD

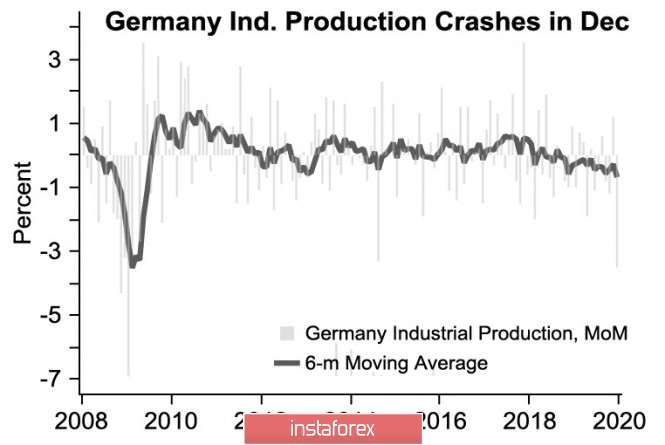

France and Germany presented extremely poor data on industrial production in December (-2.8% m / m and -3.5% m / m, respectively), which turned out to be noticeably worse than forecasts and cast doubt on the ability of the eurozone to overcome industrial failure.

The euro still looks vulnerable, and it is still too early to expect a reversal. The speculative position on the euro has become even more bearish, the net short has grown again, and now the maximum advantage since October.

Technically, EUR/USD remains under bearish pressure. The support at 1.0935 / 45 may provide a technical rebound to 1.0965 / 75, but a stronger growth is in doubt.

GBP/USD

Net shorts declined at the end of the week according to the CFTC report, which indirectly indicates a change in sentiment in favor of slowing the fall of GBP. In the absence of significant macroeconomic data, the pound follows the market. Now, strong movements are possible on Tuesday, data on industrial production and the trade balance in December, investments in the 4th quarter, and an estimate of the GDP growth rate from NIESR in January will be published.

On the other hand, the confrontation between the UK and the EU on a future trade agreement intensifies, which will put pressure on the pound. The support at 1.2881 is weak, if risk appetite in global markets is confirmed, then growth is possible to 1.2945 / 50. However, the trend remains bearish for a long time and there is no reason to wait for a reversal.

The material has been provided by InstaForex Company - www.instaforex.com