Oddly enough, the long-awaited signing of the first phase of a comprehensive trade agreement between China and the United States has not changed anything. Surprisingly, there was nothing new in the full text of the agreement, except that everyone already knew. China allegedly pledges to increase imports of goods and services from the United States by $ 200 billion over two years. But more importantly, at least all tariffs and customs duties remain unchanged until the presidential election in the United States. That is, there will be no new restrictions on Chinese goods on the American market, which means that the existing imbalance in mutual trade between China and the United States will continue. Moreover, this is an imbalance in favor of China and you can talk as much as you like about that Beijing's commitments to increase imports from the United States will supposedly close this imbalance. In fact, the agreement itself does not contain any specifics as to what will happen if China does not fulfill this promise. Moreover, the agreement does not have an extremely important point, which has remained practically without the attention of the general public. The United States Department of the Treasury has excluded China from the list of countries manipulating its national currency. Technically, this means that all sorts of transactions and cash transactions between the United States and China are simplified and cheapened. It's just that if a country falls into the list of countries that manipulate the national currency, then all trade and financial transactions with that country automatically impose a number of restrictions. In other words, The United States Treasury Department's actions overlooked in the first phase of the agreement offset China's potential increase in imports from the United States. In relation to, Chinese companies instantly gained additional advantages in the American market, which means they will increase their exports. As a result, this alignment was the reason for the weakening dollar. Let it be purely symbolic. Since in any case, the signing of this agreement at least reduces the tension and uncertainty of international trade issues. Thus, the dollar becomes cheaper when the world becomes calmer.

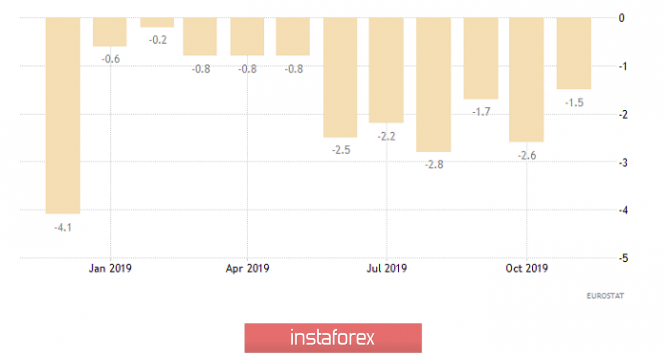

Meanwhile, the single European currency was waiting until the last, and ignored data on industrial production in Europe. The decline of which slowed down from -2.6% to -1.5%, which turned out to be slightly worse than forecasts that predicted a slowdown in recession to -1.4%, or even to -1.1%. But in any case, European industry has been declining for more than a year.

Industrial Production (Europe):

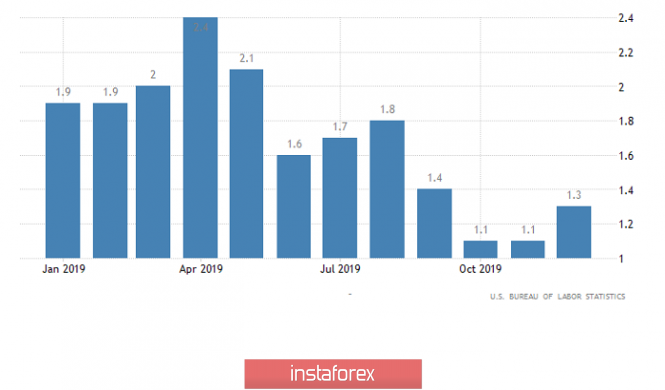

In addition, data on producer prices in the United States, whose growth rate accelerated from 1.1% to 1.3%, remained almost unaddressed. But, in this case, the data turned out to be worse than forecasts, since they expected acceleration to 1.4%. However, this indicates that inflation does not have a potential for decline, and is likely to continue to grow. Consequently, the Federal Reserve will soon think about the possibility of raising the refinancing rate.

Manufacturer Prices (United States):

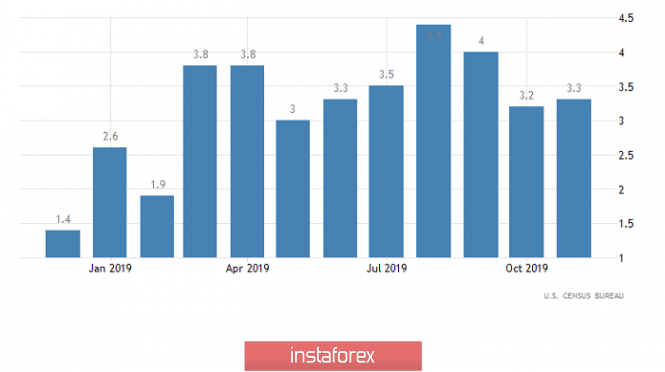

Today, the situation will be quite quiet and calm before the opening of the American session. The United States only publishes at least some significant macroeconomic data. However, they will not bring the dollar anything good. Of course, on the one hand, a decrease in the number of applications for unemployment benefits is expected, but only by 6 thousand. And even then, the number of which should be reduced by 11 thousand thanks to repeated applications and then the number of primary ones may increase by 5 thousand. However, data on retail sales are also published. The growth rate of which should slow down from 3.3% to 2.9%. A marked decline in consumer activity is offsetting the recent rise in inflation, and the dollar is losing its advantages.

Retail Sales (United States):

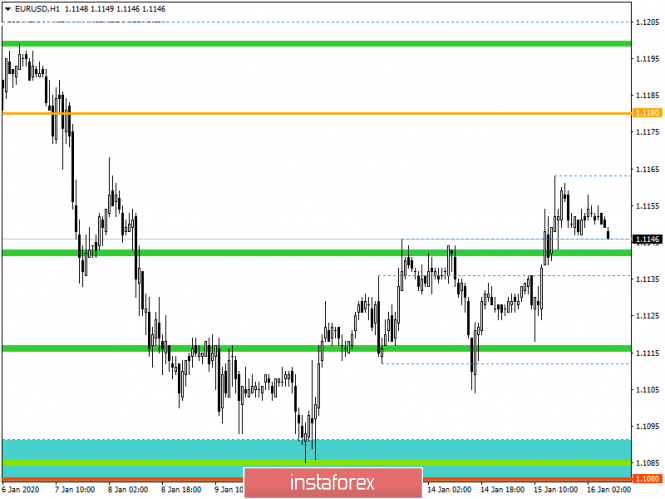

From the point of view of technical analysis, we saw that the quotes still managed to locally break through the periodic level of 1.1145, drawing out impulse candles in the market, but the joy of the market was temporary, and a deceleration process almost immediately occurred. In fact, quotes remained at a value of 1.1145, with an amplitude of just under 20 points.

In terms of a general review of the trading chart, we see a preserving correction phase in the structure of the two-week downward movement, where the pivot point is the range level of 1.1080.

It is likely to assume that the quotes will not linger above the level of 1.1145 for a long time and will already go down under it today, having an amplitude fluctuation with average volatility.

Concretizing all of the above into trading signals:

- Long positions are considered in the case of keeping the rising mood and fixing the price higher than 1.1165, which is in the direction of 1.1180.

- Short positions are considered in the case of a clear fixation of prices lower than 1.1145.

From the point of view of a comprehensive indicator analysis, we see a variable downward interest, where only intraday sections restraint keep a buy signal, displaying the same correction.