The storm continues to rage in the gold market. Despite the fact that only two weeks have passed since the beginning of the year, the precious metal has already managed to go to 7-year highs, collapse like a stone, and then begin to recover thanks to bad news about the trade war. Bloomberg is actively spreading rumors that tariffs on $360 billion of Chinese imports will remain in force, at least until the US presidential election, because the White House needs to assess how Beijing is fulfilling its obligation to increase purchases of American agricultural and other products. The trade war, which has lasted just under two years, does not seem to be going to stop, which means that demand for safe-haven assets will remain high.

The conflict in the Middle East is gradually fading. The market is dominated by the view that the current XAU/USD correction is due to the mass closure of long speculative positions. Hedge funds in the week of January 7 increased them to the highest level since the end of September, probably hoping that the confrontation between US and Iran will be long-lasting. Some are still hoping for it. The Standard Chartered Bank notes that the price movement due to geopolitics was stronger than previously expected. HSBC raised its forecast for gold for 2020 from $1560 to $1613 per ounce.

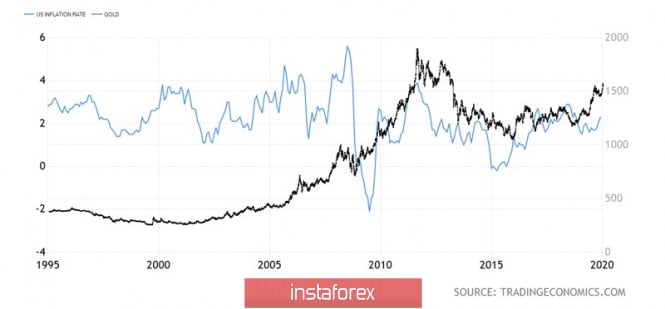

In my opinion, the reasons for the strengthening of the precious metal should not be found in geopolitics, but in the activities of central banks, in politics and in trade disputes instead. The Fed has made it clear that even exceeding the 2% inflation target will not force it to abandon passive behavior. The regulator is ready to endure the acceleration of consumer prices during the period of economic expansion, which is good news for the "bulls" on XAU/USD. The precious metal is traditionally perceived as a tool for hedging inflation risks, asits dynamics have a lot in common with the changes in the US CPI.

The dynamics of gold and American inflation:

The dog is buried in the increased sensitivity of gold to the real yield of US Treasury bonds. In December, inflation in the United States grew by 2.3%. This is the second best indicator for a calendar year since 2011, when its growth rate was at 3%. In 2018, consumer prices rose by 1.9%, and by 1.6% on average for 10 years.

Another factor supporting XAU / USD is the propensity of the world's leading central banks to ultra-soft monetary policy, which keeps global debt market rates close to historical lows. At the same time, a large-scale monetary stimulus contributes to the devaluation of currencies, which increases the attractiveness of gold. If global GDP does not recover as quickly as expected, regulators will further weaken monetary policy. With tariffs on $360 billion of Chinese imports still in place, this is more than likely.

Technically, after reaching the target of 113% for the "Shark pattern", a natural pullback to the 38.2% Fibonacci correction level followed. Important Pivot levels are also located here. The fact that the "bulls" managed to hold support at $1545-1548 per ounce, the hopes of restoring the upward trend remains.

Gold, daily chart