So, after standing still, the single European currency can demonstrate good movement today. And it's down.

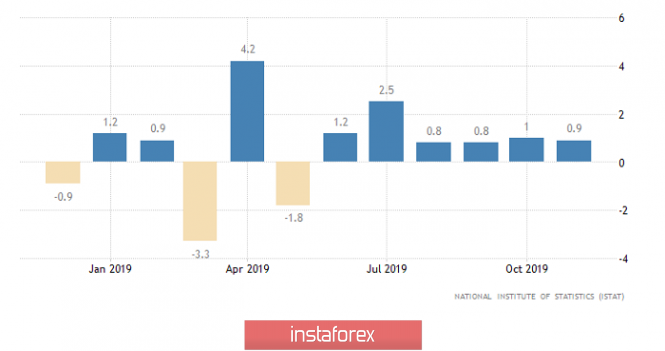

Stomping on the spot is largely due to the banal lack of reasons for at least some meaningful movement. Of course, in Germany, the decline in wholesale prices slowed down from -2.5% to -1.3%, and in Italy, the growth rate of retail sales decreased from 1.0% to 0.9%. But all these facts are of little interest, since they affect only individual countries, and not the entire eurozone. The indicators themselves are not so significant. Although retail sales are quite a significant indicator. However, with all due respect to Italy, the scale of its economy fades against Germany and France. Thus, Italian retail has an extremely insignificant effect on the whole of Europe as a whole.

Retail Sales (Italy):

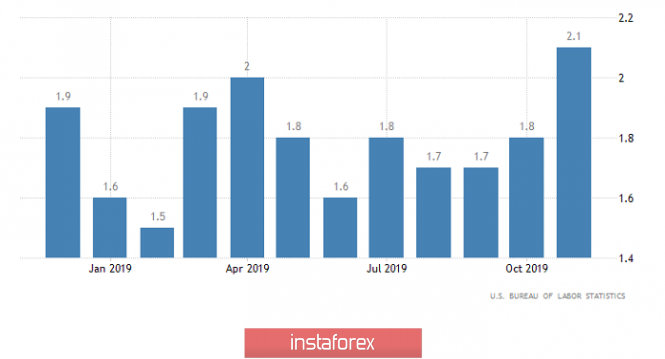

Today will be much more interesting and more fun, although only one single indicator is published. But what? Inflation in the United States is probably the most important macroeconomic indicator for the financial world. Indeed, the monetary policy of the Federal Reserve, which directly affects the financial situation of various banks, investment and pension funds, and other respected organizations, depends on inflationary dynamics. So, this same inflation should accelerate from 2.1% to 2.3%. Rising inflation, in itself, will have a beneficial effect. But if we take into account that if the forecasts come true, it will mean inflation for four consecutive months, then we can confidently conclude that the Fed will definitely not be naughty anymore and lower the refinancing rate. Moreover, the fact that inflation is confidently above the target level of 2.0% will obviously lead to talk that the Fed may well think about raising the refinancing rate. And all this will contribute to the growth of interest in the dollar. Only one thing can change this situation - an unexpected decline in inflation. But also take into account the fact that not long before the publication of inflation data, a single European currency is likely to grow somewhat. As they say - buy on rumors, sell on facts.

Inflation (United States):

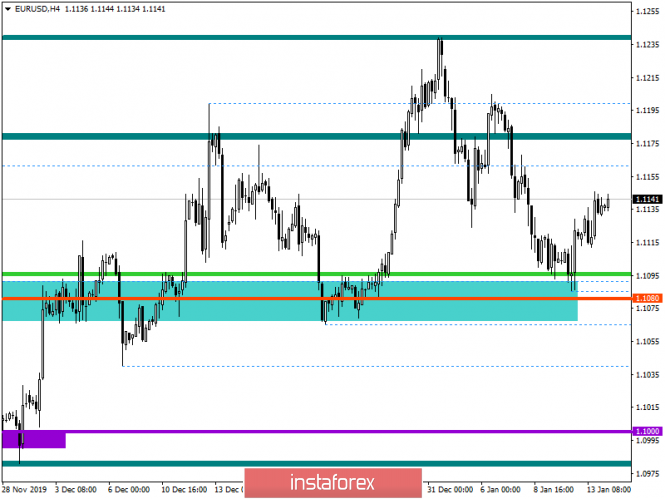

From the point of view of technical analysis, we see a kind of correctional move from the range of 1.1080, where the quote managed to locally achieve a periodic value of 1.1145, forming a slowdown there. In fact, having a correction was formed in the overall downward flow, thereby not violating the clock component of the market.

In terms of a general review of the trading chart, we see an attempt to restore the initial trend, where the quotation is still at its peak in the stage of elongated correction.

It is likely to assume that the quote will still try to complete the existing tact, returning sellers to the market. It is not worth rushing with actions, since we could encounter a time lag within the value of 1.1145 in the beginning, having local bursts in the form of breakout by shadows. The main position will be closer to the US trading session, where it is worth identifying a downward surge in the form of inertia, where the market entry will be made.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical indicators in the minute and intraday areas are focused on the upward tact, which cannot be said about the daily periods that still work to lower.