4-hour timeframe

Amplitude of the last 5 days (high-low): 111p - 118p - 89p - 111p - 55p.

Average volatility over the past 5 days: 97p (high).

The British pound continued its downward movement on Monday, January 13, and also worked out the first support level of 1.2975, as well as the lower level of volatility that we gave in the morning, 1.2956. Thus, now the pound/dollar pair is ready for an upward correction, which is unlikely to be strong or even tangible. As we have repeatedly said, the overall fundamental background remains unambiguously in favor of the British pound, so traders have no choice but to continue to sell the British currency, despite the proximity of Brexit, which was identified with almost solving all the problems of the United Kingdom. However, we see that Brexit is approaching, it is no longer possible to cancel it, and there are only more problems. We will not dwell on geopolitical problems, which we have also talked about more than once. It will be exclusively about the problems in Great Britain's economy. Recall that for several consecutive months the Bank of England has been walking around the decision to lower the key rate, and only fears for the consequences of Brexit, which starts on January 31, prevented most members of the monetary committee from taking this step. The central bank is simply reinsured in this regard, trying to postpone lowering the rate as a last resort. In his last speech, the head of the BoE, Mark Carney, almost openly stated that the regulator could go on easing monetary policy. And it sounded "maybe" as "sure to go," because there are simply no other options. The economy will not suddenly begin to grow for no reason at all. Brexit, which, we repeat, has not even started yet (that is, the last three years can not even be called Brexit procedure, these were just preparations), already has a very negative impact on the British economy. The economy is losing around $70 billion annually. We can also add failed macroeconomic statistics in the last 3-4 months to these financial losses, which was supplemented today with new excellent reports.

Industrial production data showed how weak the UK economy is at this time. The total indicator decreased by 1.6% in annual terms instead of the forecasted 1.4%. On a monthly basis, there was a decrease of 1.2% in November instead of the projected 0.1%. The manufacturing industry lost about 2.0% y/y. Furthermore, data on GDP for November were published, according to which the indicator fell (!!!) by 0.3%. If in recent months we have observed body movements of the indicator about 0%, now now in one fell swoop for one month the loss amounted to 0.3%. This is a lot. Such data were quite enough so traders again rushed to sell the British currency. An absolutely logical solution and now there is only one question. What will the BoE do at the next meeting, which will take place on January 30, that is, in two weeks? We believe that, firstly, the number of voting members of the monetary committee will increase from two to at least three or four, and, secondly, the British regulator should finally begin to prepare markets for a possible easing of monetary policy, because there is simply no other way. In general, we believe that the central bank will in any case be with dovish rhetoric, which will then be transformed into the bearish mood of currency traders. Consequently, the pound now has no reason to strengthen, and in two weeks these bases may become even less.

Tomorrow, the British pound may be slightly helped by the consumer price index in the United States, which is projected to rise to 2.3% y/y. The forecast is high, respectively, the real value may be slightly lower. However, on Wednesday, January 15, inflation for December will be published in Britain, which has recently managed to accelerate and reach the level of 1.5% y/y. However, given today's macroeconomic statistics, it can be assumed that inflation may fail in December.

The technical picture now presupposes a corrective movement, however, given the nature of macroeconomic statistics and in case of overcoming the level of 1.2975, we can expect continued movement down and without a pullback.

Trading recommendations:

GBP/USD continues to move down. Thus, traders are advised to stay on the pound/dollar pair with the target of a support level of 1.2894 until a rebound from the level of 1.2975 (or 1.2956). It is recommended that purchases of the British currency be returned no earlier than the price consolidation above the Kijun-sen and Senkou Span B lines with the first goals of 1.3150 and 1.3175.

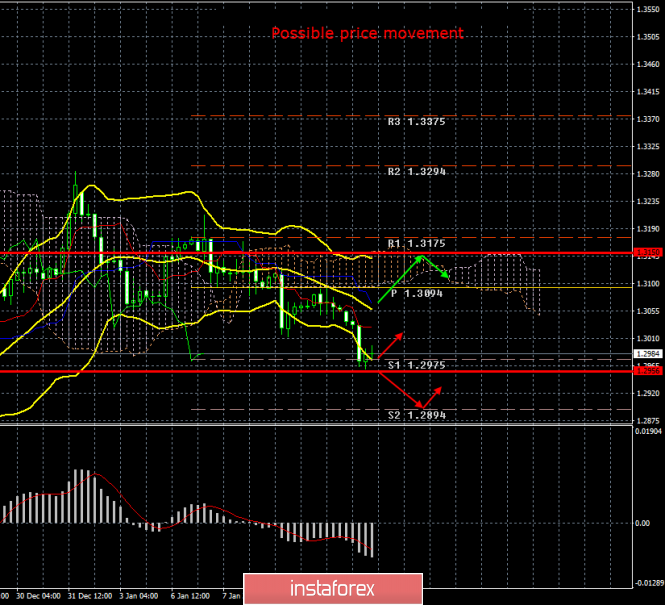

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com