To open long positions on EURUSD you need:

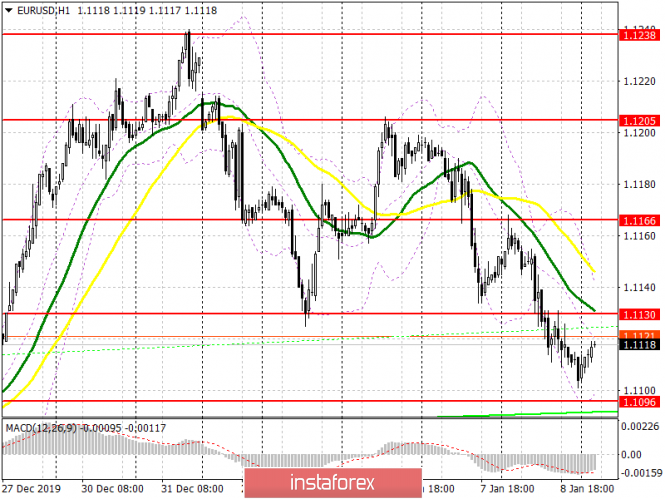

A good report from ADP on the growth in the number of employees in the US private sector led to the strengthening of the US dollar against the euro at the US session yesterday. Today, the entire focus in the morning will be shifted to the report on industrial production in Germany and in case of weak indicators, pressure on the euro will continue. However, with a good report, which is unlikely, euro buyers will attempt to return to the level of 1.1130, which will be a signal to open long positions, counting on updating highs 1.1166 and 1.1205, where I recommend taking profits. You should also pay attention to the support of 1.1096, the update of which, together with the divergence on the MACD indicator, which may form after a test of this level, will also indicate a possible euro growth in the short term. Otherwise, it is best to open long positions in EUR/USD by rebounding from the lows of 1.1069 and 1.1041.

To open short positions on EURUSD you need:

Sellers continue to control the market and now their main task in the first half of the day will be the formation of a false breakout in the resistance area of 1.1130. This scenario may come true after a weak report on German industrial production, which is expected in the morning. An equally important task for the bears will be to break through and consolidate below the support of 1.1096, which will increase pressure on EUR/USD and will lead to an update of the lows of 1.1069 and 1.1041, where I recommend taking profits. However, before opening new short positions on the breakout of 1.1096, you should make sure that no divergence is formed on the MACD indicator. In case the euro grows above resistance at 1.1130 in the morning, short positions are best considered for a rebound from highs 1.1166 and 1.1205.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 moving averages, which indicates the advantage of euro sellers.

Bollinger bands

An unsuccessful breakout of the lower boundary of the indicator in the region of 1.1096 will be a signal to buy the euro. Growth will be limited by the upper level of the indicator in the area of 1.1140.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20