4-hour timeframe

Amplitude of the last 5 days (high-low): 42p - 59p - 55p - 49p - 64p.

Average volatility over the past 5 days: 54p (average).

The EUR/USD pair ends the third trading day of the week with a downward movement, which was resumed this morning after a minimal correction. Traders rightly reasoned that there is no reason to buy the European currency and continue to work out our hypothesis, which we have repeatedly voiced in recent weeks. For those who do not remember. We believe that the euro currency does not have sufficient reasons to show a long-term strengthening against the US currency, since the general fundamental background remains in favor of the dollar. The United States has a stronger economy, stronger monetary policy, not so pronounced signs of a slowdown, and the Federal Reserve has far more options for stimulating the economy than the ECB. All this leads to increased demand for the US currency as a whole. Of course, there are global corrections, kickbacks and corrections that take several months, but in general, the US dollar tends to grow. Even despite all the political troubles in the United States connected with the impeachment of Donald Trump, even despite the trade war with China, which is unknown when it will end, even despite the open hostilities that began a few days ago in Iran.

Meanwhile, Iran's supreme leader Ali Khamenei said rocket attacks on two US bases in Iraq are just a "slap in the face" to Washington. The Iranian leader has put forward demands on the US government to withdraw troops from the region. "It is important to end America's corrupt presence in the West Asian region," Khamenei said. "The US has caused wars, destruction and destruction of infrastructure in this region. They do it all over the world. However, this region will not accept the presence of America. The people of the region and the government will not accept it," the head of Iran summed up. However, the Iranian leader also reports that this attack on US facilities in Iraq was not the "tough retaliation" for the assassination of General Soleimani. Thus, firstly, it is quite possible to expect new attacks by the Iranian armed forces on US facilities in the region, and secondly, hardly anyone doubts that now there will be no retaliatory strike from America. Unfortunately, an even greater escalation of the military conflict in the Middle East is almost inevitable. Iranian television claimed "at least 80 dead American terrorists" and "heavily damaged equipment and helicopters at the bases." It is unlikely that Trump will leave this blow unanswered.

It's good that so far all the events in the Middle East do not particularly affect the forex currency market. Although in the future, as we have already noted, they can have a significant impact. The ADP report on changes in the number of employees in the US private sector, which showed an increase of 202,000 workers, was much more influenced by the course of today's trading, while only 160,000 were forecasted to increase, while the previous value was at the level of 67,000. Thus, after the failure ISM business activity index for manufacturing in the US, statistics are starting to prove again that they are in excellent condition, like the entire American economy. Traders praised this report, since it is the state of the labor market that is considered one of the most important engines of the economy of the whole country. The euro fell by 40 points against the dollar during the day, which fully fits into the current average volatility for five and 30 of the last trading days.

But macroeconomic statistics from the European Union today was secondary and did not have any impact on traders, but it turned out to be very interesting. Recall that the latest publication of business activity indexes in the manufacturing sectors of the EU countries showed a slight improvement in things. However, most of the indices still remained below the level of 50.0, which means the continued decline in European industry. Today, a report on production orders was published in Germany, which showed a decrease of 6.5% (!!!) YOY in November. Despite the fact that in October a decrease of 5.5% YOY was recorded. Data on industrial production in Germany for November will be published tomorrow, and it is likely that the real numbers will be much lower than the forecast, which predicts a decrease of 3.8% YOY.

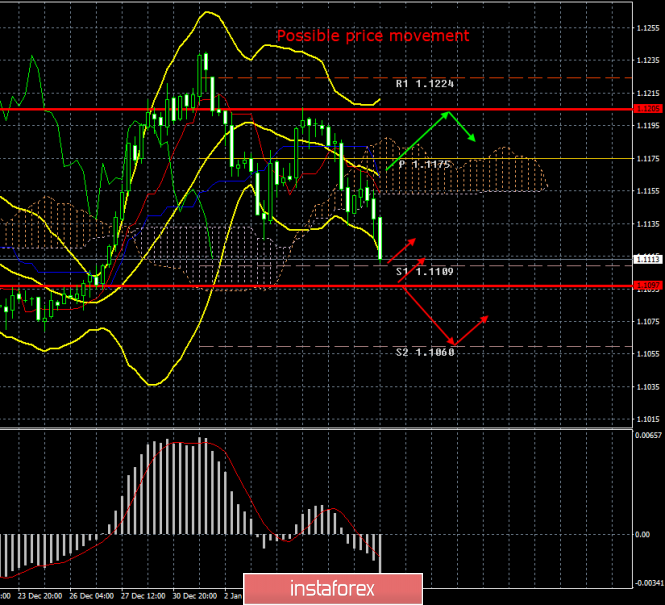

Thus, we expect the downward movement to continue this week. A few more critical macroeconomic publications will take place on Friday. We are talking about NonFarm Payrolls in the United States, about changing the average hourly wage and unemployment rate. All three reports are critical to the US economy. The technical picture is now absolutely clear. The price consolidated below the Ichimoku cloud, so the current signal for selling the Dead Cross has strengthened. The pair has almost reached the first support level of 1.1109 and may rebound from it or the lower boundary of the volatility channel on January 8 - 1.1097. Thus, a new round of upward correction may begin today or tomorrow.

Trading recommendations:

The EUR/USD pair resumed its downward movement. Thus, now it is recommended for traders to trade lower with targets 1.1109 and 1.1097 and reduce shorts in case of a rebound from any of these levels. It will be possible to consider purchases of the euro/dollar pair no earlier than when the price is consolidated above the critical Kijun-sen line with the first goals of 1.1205 and 1.1224.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com