The euro and the pound continue to strengthen their position against the weakening US dollar at the end of the year amid growing optimism about the prospects for the US-China trade agreement. Given that there are no other important fundamental statistics during the pre-holiday period, traders are mainly focused on any news related to the agreement. Some pressure on the US dollar is also exerted by the Federal Reserve's ongoing repos through which banks are provided with the necessary liquidity.

From the data released, one can note a report on the number of contracts for the sale of homes in the United States. According to information from the National Association of Realtors, the index of signed home sales contracts rose by 1.2% in November, while economists had expected the index to grow by 1%. Sales rose by 7.4% compared to the same period of the previous year. Even despite the limited supply on the market, sales grew due to lower Fed interest rates this year. The start of the next year should take place on a positive note, but the proposal still does not keep pace with significant demand, which will only increase as the Fed returns to the average level of interest rates, which will lead to more expensive financing.

The PMI data for Chicago and Dallas supported the US dollar in the afternoon of Tuesday, but this did not lead to a more serious strengthening against the euro and the pound.

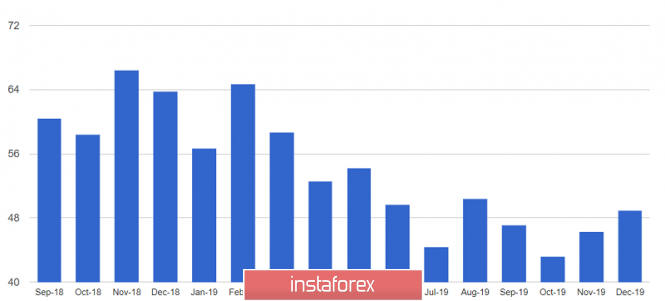

According to the report, Chicago Purchasing Managers PMI Index in December this year was 48.9 points, almost returning to around 50 points. However, its stay below the level of 50 points indicates a continuing decline in business activity. Economists had expected the business barometer to be 47.4 points.

Production activity in the area of responsibility of the Federal Reserve Bank of Dallas also recovered in December. According to the report, the production index calculated by the Fed-Dallas in December 2019 was 3.6 points, after falling to -2.4 points in November. Business activity in December fell to -3.2 points from -1.3 points in November, but the indicator of expectations of companies rose to 1.3 points.

As for the technical picture of the EURUSD pair, it should be noted the efforts of buyers of risky assets, who, at the end of the year, seizing the moment, are strengthening their positions against the US dollar. The problem for the bulls is resistance at 1.1215, which has already been tested several times. Only a breakout of this level will increase the demand for a trading instrument, which will lead to new highs in the region of 1.1240 and 1.1270. If the pressure on risky assets returns, and this can happen quite easily in a thin market, then only 1.1170 area will provide support.

GBPUSD

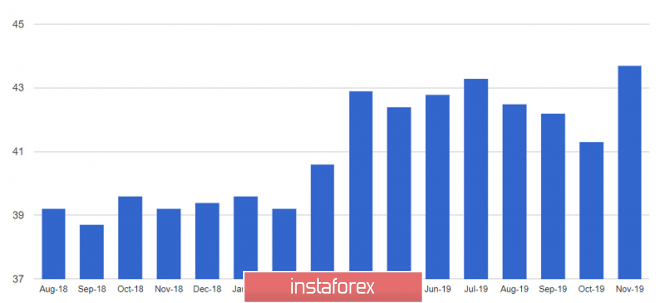

The British pound continues to regain its position against the US dollar. Yesterday's evidence that the number of mortgages in the UK has increased indicated a growing indifference to residents' Brexit problems. According to Octane Capital and UK Finance, the number of mortgages approved increased by 6.8% in November 2019 compared to the same period last year, to 43,589. The number of approved repeat collateral agreements also increased by 13% to 34,653 .

The main demand is associated with a gradual recovery in housing prices after a period of uncertainty with Brexit and sluggish economic growth, which constrained the housing market. Now that the situation seems to have partially cleared up, the prospect of price recovery worries people buying housing for the first time, which fuels market demand.

The material has been provided by InstaForex Company - www.instaforex.com