The publication of the US labor market report for November was a real disaster for gold. An increase in employment by 266 thousand, a fall in unemployment to 3.5%, the lowest mark for half a century, and an acceleration of average wages to 3.1% YOY led to an increase in the S&P 500 of more than 1%, to a strengthening of the US dollar and an increase in profitability treasury bonds. This created an extremely unfavorable environment for the precious metal, which could not gain a foothold within the previous consolidation range of $1475-1515 per ounce.

The value of gold increased by 12% in 2019. This is the best result since 2010. The precious metal is ahead of the Bloomberg commodity market index and is poised to end in the positive for the third year out of the last four. The reasons should be sought in the uncertainty associated with the trade war and Brexit, as well as in the three acts of monetary expansion of the Fed. However, the picture could seriously change in 2020. Washington and Beijing are close to a deal, and Britain is about to leave the EU. The recovery of the economies of China, the eurozone and Great Britain improves the prospects for equity markets, real estate and industrial metals. However, not everyone thinks so.

Dynamics of gold and commodity index

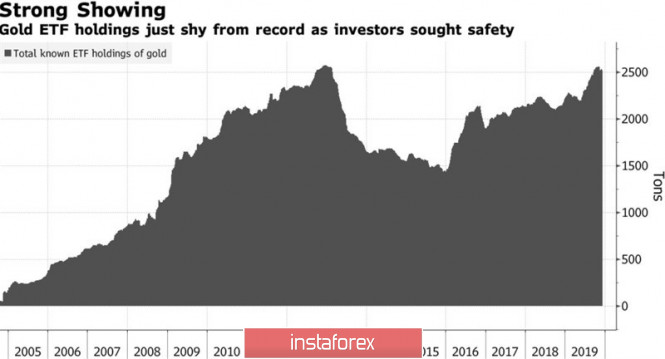

Goldman Sachs and UBS forecast a gold rally to the level of $1,600 per ounce, which was last seen in 2013. BlackRock calls the precious metal the best option for hedging the risks associated with the correction in the stock markets. Bulls on XAU/USD expect that the period of low inflation, which falls short of the targets, will continue for a very long time, and under such conditions, central banks will remain prone to ultra-soft monetary policy. An increase in geopolitical and political risks, including those associated with the US presidential election, will lead to pullbacks in the S&P 500, which is usually perceived by investors as a deterioration in global risk appetite and is fraught with increased demand for safe haven assets. No wonder ETF fans are in no hurry to get rid of their products, even in the face of falling XAU/USD quotes.

Gold ETF Stock Dynamics

Investment demand for gold is quite large. Along with interest in specialized exchange-traded funds, central banks show increased activity, which, according to Goldman Sachs, bought up about 20% of the global precious metals supply in the de-dollarization process. Assets like US Treasury bonds are not well suited to implement the idea of reducing dependence on the protectionist states of the United States. Gold is another matter.

There is no clarity on the outcome of the trade war. Both sides claim that they are moving towards an agreement, but the White House has repeatedly surprised investors with unexpected escalations in the conflict with China. Who can guarantee that the same will not happen in mid-December?

Technically, the bulls for gold leave no hope to return quotes within the previous consolidation range of $1475-1515 per ounce. It will turn out - it will be possible to count on the activation of the Expanding Wedge pattern and on implementing the target by 161.8% according to the Crab pattern. No - risks of the precious metal falling to $1435-1440 will increase.

The material has been provided by InstaForex Company - www.instaforex.com