4-hour timeframe

Amplitude of the last 5 days (high-low): 138p - 65p - 66p - 50p - 82p.

Average volatility over the past 5 days: 81p (average).

The GBP/USD currency pair resumed the upward movement today, although yesterday it went below the critical Kijun-sen line and gave hope for at least a slight correction against the upward trend, within which the pair has been in recent weeks. Today, no matter how trivial it may sound, British pound traders have completely ignored the US inflation report and are likely to ignore the conclusion of the Fed Open Market Committee meeting. But traders cheered on the information from the sociological company Yougov, which conducted another latest opinion poll, in which more than 100,000 people took part. According to this study, the Conservative Party can count on 339 mandates out of 650 possible. Thus, if the forecast from Yougov comes true, Boris Johnson's party will succeed in forming a ruling majority in the government. However, the Conservative Party's results have deteriorated compared to a previous similar study by Yougov. Earlier, Conservatives predicted victory with 359 parliamentary seats in the British Parliament. However, the most important assumption that the sociological company itself notes is that, given the margin of error, Conservatives can gain from 311 to 367 seats in Parliament. Accordingly, if the number of Conservatives in the Parliament is equal to 311, then there will be no ruling majority in the party of Boris Johnson. Accordingly, the probability of forming a ruling majority is about 70-75%. Polling stations will open tomorrow at 7:00 local time and will close at 22:00. Counting will take place all night, and on the morning of Friday the 13th (very symbolic), it will be finally known whether the Brexit issue will be resolved by the end of January 2020, or whether the Parliament will continue its work in a "hung" state, and Brexit will be delayed for another for long months and years.

But still, if you start from Yougov's research, as from completely reliable information, it's hard to imagine a situation in which even the minimum number of members of the Conservative Party in Parliament (311) could not accept the deal between Boris Johnson and the European Union and complete Brexit. In such a situation, Boris Johnson will need only 15 outside votes, which can easily be obtained, for example, from Nigel Faraj's Brexit Party. Thus, we believe that if the Conservatives do not "put a spoke on the wheel" on their own (meaning the situation in which some Conservatives refuse to vote "for" Boris Johnson's deal, as was already the case in September and October), then Brexit, most likely, will still be implemented in January 2020. Boris Johnson, of course, tried to play it safe and collected the signatures of all Conservatives who promise to vote "for" the exit from the EU, but this still does not guarantee that there is no situation in which at least a few Conservatives reject the deal with the EU. The UK will move into a new era for itself under the name of "establishing trade relations", since London will not have any trade agreements after leaving the EU. A long period of negotiations will begin. We believe that after the results of the elections to the Parliament are summed up, or maybe after the Parliament accepts a "divorce" agreement with the EU, the pound will again be prone to fall. Now it is very difficult to imagine a situation in which the pound continues to rise in price, despite the disastrous macroeconomic statistics from the UK in the last two months. Also, do not forget that in itself absolutely any Brexit is a negative for the UK economy and for the pound. Therefore, even if a "soft" Brexit scenario is implemented with a deal, this does not mean that the UK economy, which is even experiencing serious problems before it officially leaves the EU, will suddenly "blossom". Macroeconomic indicators are likely to continue to slow down, which will sooner or later provoke a fall in the British currency. Thus, we believe that in any case, the strengthening of the pound will end soon as soon as the wave of optimism about the victory of the Conservatives in the elections subsides.

From a technical point of view, the upward movement can and should continue, at least until Friday morning, when the results of the vote will be announced. At the same time, consolidating the pound/dollar pair below the Kijun-sen line will again cast doubt on the further upward movement.

Trading recommendations:

GBP/USD resumed a slight upward movement. Thus, it is now recommended to trade for an increase with the target of 1.3232. It is not advised that you consider selling the pound now, traders continue to ignore any macroeconomic data, and the pound rises in price solely on expectations of the Conservative party winning the election. Thus, it is recommended to wait for the election results, and then explore new opportunities for entering the market.

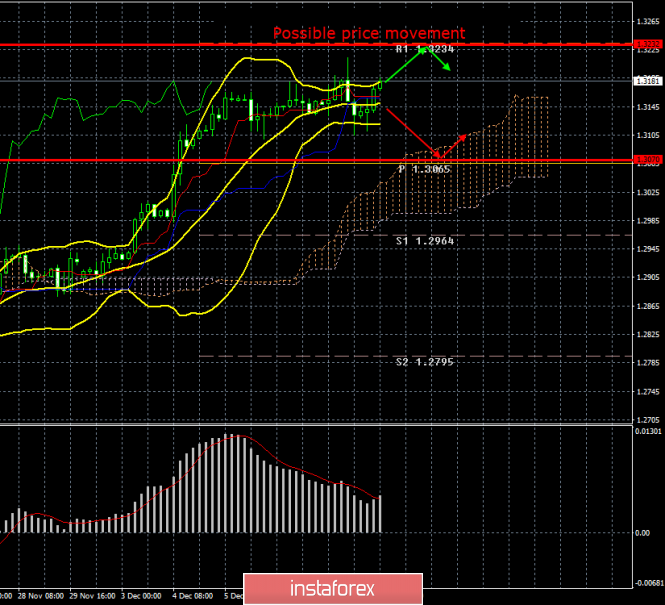

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com