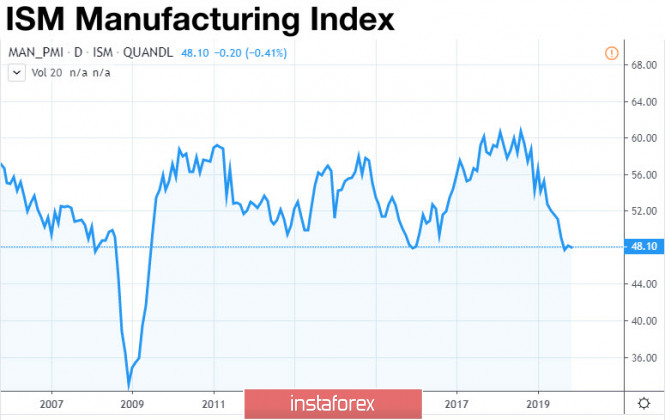

ISM's production report in November turned out to be worse than a month earlier. Contrary to forecasts, the decline has been observed for the fourth consecutive month in most sub-indices, including new orders and sector employment.

Moreover, ISM's index is at its lowest levels over the past 10 years, returning to the situation that preceded the election of D. Trump to the presidency of the United States. Dynamics, in turn, actually indicates that Trump's election program is losing including the development of the US manufacturing base.

On Monday, the US Administration announced the restoration of the level of import duties for Argentina and Brazil on steel and aluminum. The formal reason for canceling the exceptions made earlier is "a substantial devaluation of their national currencies," but the matter is obviously more serious. On the other hand, Foreign Ministry spokesman Hua Chunying said Beijing imposes sanctions on a number of US non-governmental organizations, which is seen by the markets as a response to two US laws that China sees as interference in domestic affairs.

Due to the worsening of relations, the probability of concluding the first phase of a trade deal between the United States and China declined by the end of the year. Stock indices in the United States closed in the red zone and Asian indices lose an average of about 0.5%, although in general, the reaction of the markets is still restrained. At the same time, demand for gold is limited while the yen strengthened within the correction range. Nevertheless, the demand for bonds is also not observed, therefore, the demand for protective assets in the coming days will most likely remain weak.

EUR/USD

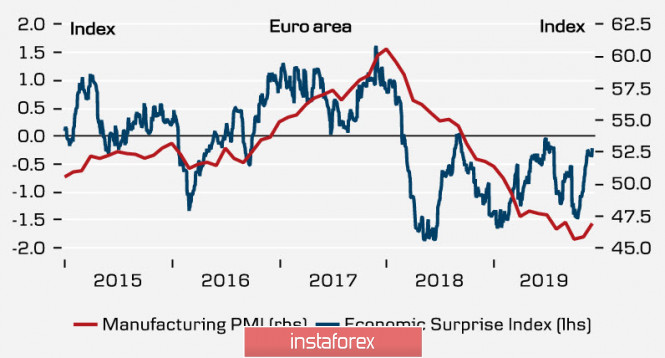

The euro zone's PMI in the manufacturing sector rose in November from 46.6p to 46.9p, which gives reasons for cautious optimism. Despite the fact that the index is still below the 50p border, the negative trend has ended, which may indicate a decrease in the risk of recession. On the other hand, the surprise index has risen, which indicates that published data is coming out in line with expectations or even better, which is a good sign of improving the business climate.

On Monday, ECB's President Christine Lagarde spoke in the European Parliament and commented on the economic situation in the eurozone, explaining the weak growth by global factors that impede the growth of investor confidence. Now, a number of important indicators are coming out this week. In particular, Markit will present the PMI index in the services sector on Wednesday, and there will also be reports on retail sales and GDP for the 3rd quarter on December 5.

The euro rose significantly at the beginning of the week, responding to a number of factors, and the main of which was the decline of the dollar index to a weekly low after a series of Trump's posts on Twitter, and it is not only the return of duties on steel and aluminum, but also the Fed's demand to lower "overvalued" dollar, which affects the American farmers. Thus, it is clear that the Fed has reserves for lowering the rate, unlike the ECB, which will have to head deep into the negative territory for symmetrical measures. As a result, the euro may continue to grow if Fed's officials leave Trump's attack without comment.

Support is 1.1040/50 and with its decline, it is logical to buy in order to test the recent high of 1.1096 and the subsequent movement to 1.123.

GBP/USD

The PMI in United Kingdom also rose slightly in November, but the pound reacts much more modestly. The upcoming elections will remain the most important driver for the pound, according to YouGov's MRP model, the conservative party will receive an absolute majority, which will allow the UK to leave the EU on January 31, 2020.

Such an outcome would be supported by the pound if it weren't for one "but" - the Bank of England in November hinted at the possibility of lowering the rate, and now, the market assumes that this decline will occur at the meeting in January while another decline in the second half of 2020 is excluded.

Now, the pound remains in the range, but the probability of an exit above the resistance of 1.2975 / 85 with a subsequent breakthrough of 1.30 is increasing.

The material has been provided by InstaForex Company - www.instaforex.com