The publication of the minutes of the Fed and ECB meetings, the release of data on US inflation, or the consideration of the draft agreement between Britain and the EU submitted by Boris Johnson will not be the main event of the week by October 11. Investors' attention will be focused on the next round of US-China trade negotiations. Much depends on their outcome: will US stock indices rewrite record highs; whether the upward trend in yen, franc and gold will continue; will the global economy feel the low? Against this background, the AUD/JPY pair quite naturally attracts interest. It is traditionally perceived as the main indicator of investor risk appetite and is likely to show good movement as soon as the results of the visit of the Chinese delegation to Washington become known.

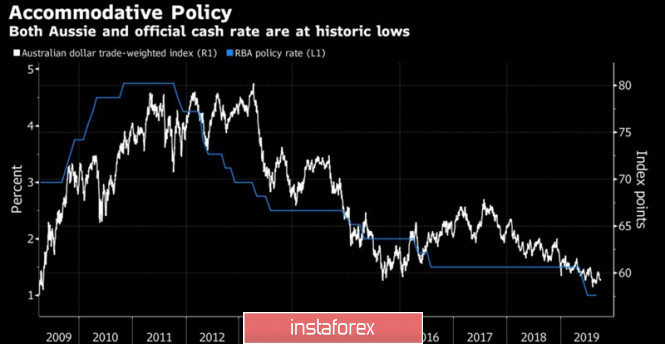

If the yen has consistently been among the best performers among the G10 currencies over the past three years, speculative rates on the Australian dollar are in the red zone for the 17th consecutive month. In the third quarter, the AUD/USD pair plunged by almost 4%, and reached a 10-year low in August. In an effort to protect Australia from adverse headwinds, primarily related to trade wars, the RBA does not get tired of easing monetary policy. It has already reduced the cash rate three times in the past few months, bringing the rate to a record low level of 0.75%. Goldman Sachs believes that this will not end there: for growth and stabilization of inflation within the targeted range of 2-3%, the Reserve Bank will have to lower the cost of borrowing to 0.25% and launch an asset purchase program for AU $ 200 billion.

Dynamics of cash rate and Australian dollar rate

Japan has a completely different mood. The Bank of Japan representatives are increasingly talking about the side effects of the negative interest rate program. They would like to get rid of it, but inflation stubbornly does not want to go to the target of 2%. Tokyo is not going to blindly follow Washington and Frankfurt, which is one of the important factors supporting the yen. Among its other trump cards is a favorable external background for safe haven assets. The uncertainty surrounding the US-China conflict, the impeachment of Donald Trump and Brexit, supports the demand for reliable currencies.

If trade wars put sticks in the wheels of one (AUD) and lend a helping hand to others (JPY), then their completion can turn everything upside down. If a breakthrough awaits us, the global economy will finally be able to find the ground under its feet, the global risk appetite will improve, and the RBA will abandon the idea of further easing monetary policy. The aussie will be one of the main beneficiaries of the thaw. On the contrary, another failure of negotiations and an increase in duties from mid-October will allow the bears to continue to move down the USD/JPY and AUD/JPY.

Technically, the situation in the last pair looks twofold. The growth of quotations above resistance by 72.9 with their subsequent exit beyond the descending trading channel will increase the risks of activating the "Ideal Butterfly" pattern with a target of 127.2%. On the contrary, a successful assault on support at 71.2 will allow the bears to count on an early recovery of the downward trend.

The material has been provided by InstaForex Company - www.instaforex.com