USD / JPY

At the oldest time intervals, the yen has been trying to stay above the lows of 2018 (104.65) and January 2019 (104.48) for the last couple of months. Consolidating below will allow you to consider quite impressive prospects for traders on the downside. For example, a bearish target for breaking through the monthly cloud (92.30). At the same time, the closest bearish reference in this case will be the accumulation of historical support in the region of 100-101, where the pair has already found a reliable support in 2016.

Among the main goals of the traders is to increase. At the moment, it is possible to note a reliable consolidation above the monthly short-term trend (108.44), elimination of the weekly dead cross, and also 100% fulfillment of the daily target for the breakdown of the cloud (109.32). Before the traders, a fairly wide resistance zone, formed by the accumulation of strong levels of different time intervals 109.34-60 - 109.80 - 110.21 - 110.80, hangs over the increase in the current conditions. Therefore, a possible continuation of the rise is unlikely to be active and large-scale. The support that will help traders to improve their prospects and opportunities for the coming week are 108.43 (monthly Tenkan + daily Tenkan) - 107.64-74 (daily Kijun + weekly cross) - 106.90 (lower border of the daily cloud).

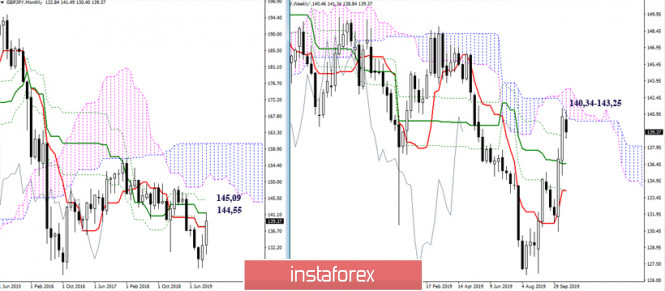

GBP / JPY

The active development of the upward correction has led the pair to important lines of resistance. The breakdown of the weekly cloud (140.34 - 143.25) and the elimination of the monthly dead cross will allow us to consider new large-scale upward prospects. To maintain the benefits and opportunities for the traders to increase next week, it is advisable to optimistically close October, holding current positions or forming a minimum upper shadow. In addition, it should be noted that at the moment, disparate levels of different time intervals form a fairly wide resistance zone. This circumstance makes it difficult for traders to actively increase in the zone, and can prevent the bears from returning, because the resistance levels that was passed by will act as support.

For the next working week, the most significant support levels can be seen at the lines of 137.82-138.01 (monthly short-term trend) and 135.30 (weekly cross + final levels of the daily gold cross). To preserve the advantages and prospects for the traders to increase, it is advisable not to go down to these levels.

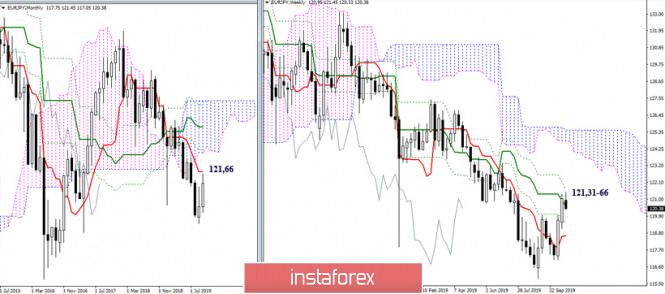

EUR / JPY

In the month of October, at the oldest time intervals, the euro / yen was mainly engaged in the development of an upward correction, which led it to important resistance lines 121.66-121.31 (monthly short-term trend + final boundaries of the weekly cross). Consolidating above will allow you to consider new opportunities and prospects - an increase in the resistance of the Ichimoku clouds (123.97 - 125.50) for weeks and a month. In addition to the upward prospects can now be attributed to the goal of a breakdown of the daily cloud (122.58 - 123.33).

The most significant supports for the upcoming working week are the area of 120 (weekly levels + daily short-term trend) and 118.65 (weekly Tenkan + daily cloud). Consolidating below will delay the implementation of traders' plans to increase and will contribute to the formation of rebound from the resistance met in the most senior times.

The material has been provided by InstaForex Company - www.instaforex.com