EUR / USD

Friday, October 26, ended for the EUR / USD pair with a decline of another 25 basis points. Thus, the construction of the proposed wave b as part of a rising set of waves, originating on October 1, continues. If this is true, then the quotation of the instrument will continue to decline, however, an unsuccessful attempt to break through the 38.2% mark may lead to the completion of the construction of the proposed wave b. After that, I will expect an increase in quotes with goals located above the 12th figure.

Fundamental component:

The news background for the EUR / USD pair became absent again after Thursday last week. The consumer confidence index from the University of Michigan came out on Friday in America, which showed a slight decrease compared to September (95.5 - 96). However, this event did not have a particular impact on the activity of the currency exchange market and its dynamics. More so, nothing more interesting happened on Friday and about the same applies to Monday, October 28. Throughout the day - not a single economic report was released, only a speech by Mario Draghi late in the evening, who said a lot at the ECB press conference last week. At least, the markets clearly realized the mood of the head of the Central Bank of Europe for the three days that he had to spend at his post. Thus, it is unlikely that Draghi will make "loud" statements today.

Purchase goals:

1.1208 - 61.8% Fibonacci

1.1286 - 76.4% Fibonacci

Sales goals:

1.0879 - 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a new upward set of waves and completed the construction of wave a. I recommend buying the instrument after the completion of building wave b with targets located about 12 figures and above. An unsuccessful attempt to break through the level of 1.1082 may indicate the readiness of the markets for a new increase.

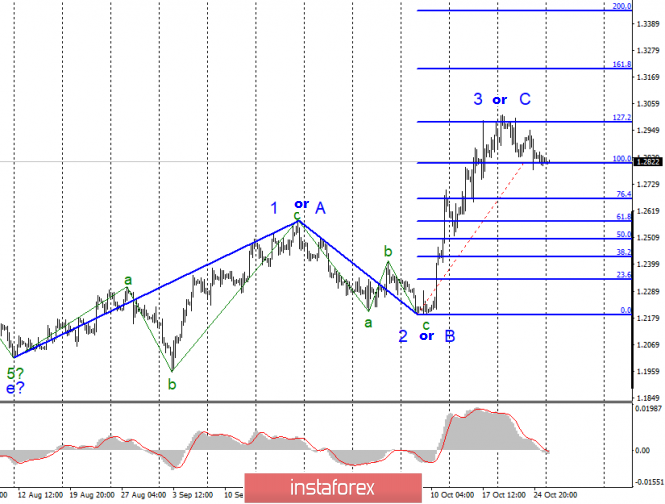

GBP / USD

On October 25, the GBP / USD pair lost about 30 basis points and fell to the level of 100.0% Fibonacci. Wave 3 or C is currently considered complete. If this is true, then the instrument will continue to decline from its current positions within either wave 4 or a new downward trend section. One way or another, we are waiting for the decline of the pound. An alternative option involves the complication of the alleged wave 3 or C, which can be identified by a successful attempt to break through the 127.2% Fibonacci level, which equates to 1.2986.

Fundamental component:

There will be an early parliamentary elections. At least, this is what the British Prime Minister Boris Johnson believes, which once again does not take too much into account the opinion of the majority of MPs who have already twice rejected his proposal for dissolution and re-election. In addition, according to Johnson, it is the deputies who are to blame for the fact that Britain will not leave the EU before October 31 and, most likely, it is unlikely to do so. The EU is discussing with might and main the terms for which Brexit will be extended, that is, it will be extended anyway. Boris Johnson proposes to hold elections on December 12, which has already puzzled by the Labor Party, who, it seems, are not against re-elections, but are clearly not in a hurry to approve this initiative. Thus, perplexity lies in the proximity to Christmas and New Year's holidays. Labor leader Jeremy Corbyn believes that the Prime Minister himself "got into a puddle" with his policy, which led to the next postponement of Brexit, and is also not going to support the idea of re-election, while the tough Brexit can still be implemented. Corbyn and his party members will be ready to discuss the re-election only after Brussels officially approves the postponement

Sales goals:

1.2191 - 0.0% Fibonacci

Purchase goals:

1.2986 - 127.2% Fibonacci

1.3202 - 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. An unsuccessful attempt to break the level of 1.2986 indicates that the instrument is ready to decline. Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of the alleged wave 3 or C and become the basis for new purchases of the instrument. Thus, now, I recommend looking in the direction of sales.

The material has been provided by InstaForex Company - www.instaforex.com