Global markets continue to balance on the wave of continuing uncertainty regarding Britain's exit from the EU and the result of trade negotiations between the US and China

If the American stock market found some outlet for itself in the form of quarterly corporate reporting, which generally shows that companies are not yet experiencing problems from the US-China trade crisis, then the foreign exchange and commodity markets are completely dependent on Brexit's problems and trade negotiations.

In addition, quotations of gold have simply been driven by these two factors into a very narrow range for the past two weeks. And where they will go, spatially up or down, is not clear, since Brexit's outcome is very vague, and the result of trade negotiations is also unclear until the end. Thus, we expect that this uncertainty will continue at least until the end of this month.

The oil market and other commodities are also in limbo. On the one hand, they receive support on the basis of OPEC + measures aimed at supporting prices, and on the other, the reality of reducing global economic growth, and with it the demand for "black gold", keeps prices sideways.

Due to this, the currency market has become extremely "boring." It practically does not respond to published economic statistics and is under severe pressure from the soft monetary policies of the world's largest Central Banks, primarily the Fed, the ECB, the Bank of England and the Central Bank of Japan. In addition, Brexit's negative factors in its uncertainty and trade negotiations between America and China hamper investor activity.

Today, the attention of the market will be drawn to the decision of the ECB on monetary policy, as well as to the last press conference of the President of the Bank M. Draghi as head of the regulator. It is assumed that the key interest rate will remain at the previous zero level and the deposit rate at minus 0.5%. It can be recalled that the bank is also launching a large-scale program to stimulate the European economy, which is supposed to weaken the single currency. However, it is not so simple. If only the ECB carried out these measures then, of course, the euro would have failed and quite noticeably against the major currencies, but the continuation of stimulation by the Fed. The continuation of it by the Bank of England and the Central Bank of Japan, as well as lower interest rates by other central banks that are influential in the world, will offset this effect. Therefore, we do not expect any noticeable exchange rate changes in the market, although local speculative moves will be.

In addition to the ECB meeting, data on orders for durable goods in the United States that will be published today will be interesting. With their negativity, they can exert local pressure on the dollar, but nothing more.

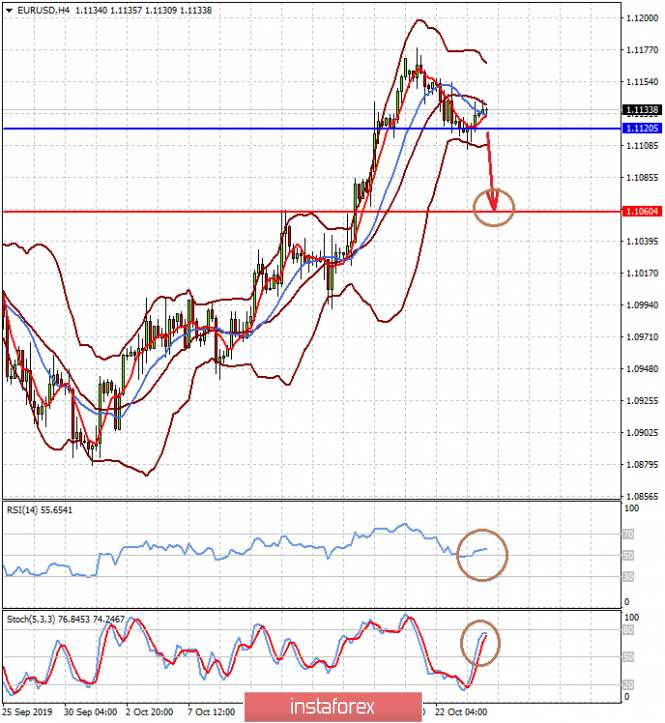

Forecast of the day:

The EUR/USD pair is trading at the support level of 1.1120. If new unexpected details of incentive measures will appear following the results of the ECB meeting and the press conference of M. Draghi - this may lead to a local decline of the pair to 1.1060.

The USD/CAD pair is consolidating above 1.3070. If oil prices continued to rise, and the pair overcomes this level, there is a high probability of its decline to 1.3015.