To open long positions on EURUSD you need:

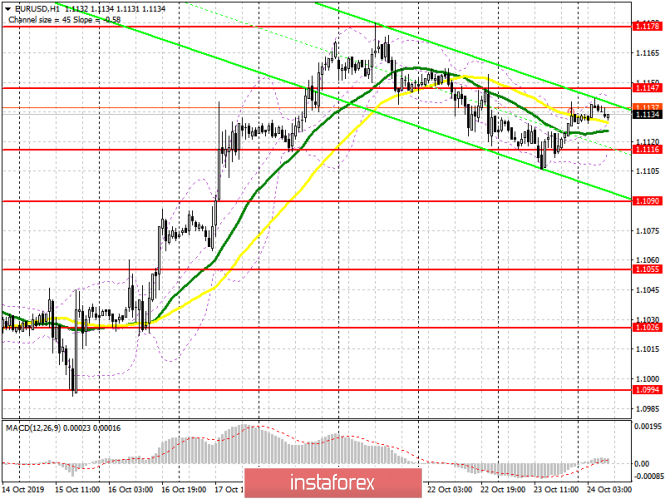

From a technical point of view, nothing has changed due to the lack of important statistics. The European Central Bank meeting will take place today, at which Mario Draghi will announce his retirement and, quite possibly, will signal a further easing of monetary policy. The whole emphasis in the first half of the day will be at the level of 1.1116, the formation of a false breakout will be an additional signal for opening long positions. However, the main task of the bulls will be the resistance test at 1.1147, as well as consolidation on it, which will resume demand for EUR/USD and lead to a weekly high of 1.1178, and to update it in the area of 1.1226, where I recommend profit taking. However, this would be almost impossible without good Brexit news. In case the pair returns to a support of 1.1116, against the background of Mario Draghi's comments, it is best to return to long positions from the lows of 1.1090 and 1.1055.

To open short positions on EURUSD you need:

Pressure on the euro will remain as long as trading is below the resistance of1.1147. The formation of a false breakout in this range in the first half of the day will be a direct signal to open short positions with the main goal of breaking through and consolidating below the support of 1.1116. If the bears manage to break below this range, most likely, the demolition of a number of bull stop orders will bring EUR/USD to a new support of 1.1090 and 1.1055, where I recommend profit taking. In a growth scenario above the resistance of 1.1147, which can be realized only in case of good news regarding the Brexit deal, it is best to return to short positions only after updating the weekly high near 1.1178, or immediately to rebound from resistance of 1.1226.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving averages, which indicates market uncertainty.

Bollinger bands

In case the euro grows in the morning, a breakthrough of the upper boundary of the indicator in the region of 1.1147 will strengthen demand. A break of the lower boundary at 1.1116 will put new pressure on the pair.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20