To open long positions on GBP/USD you need:

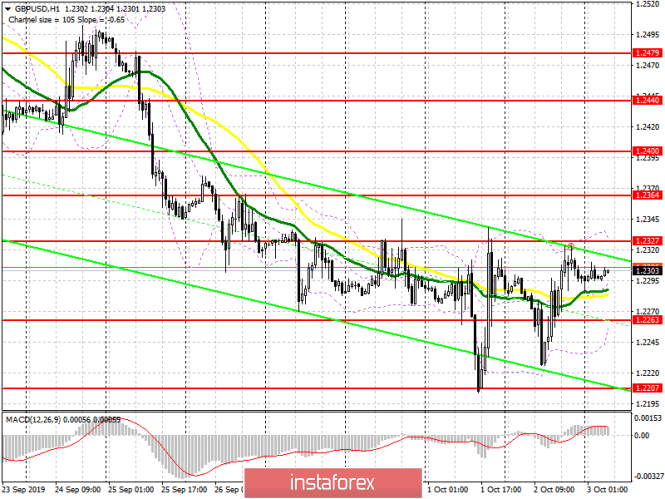

Yesterday, the UK government announced a new Brexit plan and said that this is the final proposal, and if it is not accepted by the EU, then the UK will leave the EU without an agreement. In a nutshell, the essence of the proposal does not provide for customs points on the border between Ireland, which the EU representatives so sought. However, there are a number of nuances, because of which the demand for the pound remained quite weak. The next formation of a false breakdown in the region of 1.2263 this morning will be a signal to buy the pound, which will lead to an upward correction of the pair to the area of the upper boundary of the side channel at 1.2327, consolidating above which will strengthen demand for GBP/USD, which will update the resistance at 1.2364, where I recommend take profits. However, in the event of a weak report on the UK services sector, which is scheduled to be released today in the morning, the level of 1.2263 may be broken. In this scenario, it is best to consider purchases in GBP/USD after updating the lows in the areas of 1.2207 and 1.2165.

To open short positions on GBP/USD you need:

Once again, the bears managed to protect the level of 1.2327, to which I repeatedly paid attention. It will be possible to talk about the continuation of the bearish trend only after the breakout of support at 1.2263, which may coincide with the release of weak PMI data for the UK services sector. This will lead to a decrease in GBP/USD to the low of this month to the level of 1.2207, the breakdown of which will only increase the pressure on the pair, allowing sellers to reach the support of 1.2165, where I recommend taking profits. If the pressure on the pair weakens, in case of good PMI data or a positive decision from the EU according to the proposed Brexit plan, it is best to sell the pound after an upward correction to the upper boundary of the side channel at 1.2327, subject to the formation of a false breakdown, or immediately to rebound from a high of 1.2364 and 1.2400.

Signals of indicators:

Moving averages

Trade is carried out in the region of 30 and 50 moving average, which indicates some market uncertainty.

Bollinger bands

In case the pound declines, support will be provided by the lower boundary of the indicator in the region of 1.2263, while the upper boundary of the indicator in the region of 1.2327 will act as resistance.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20