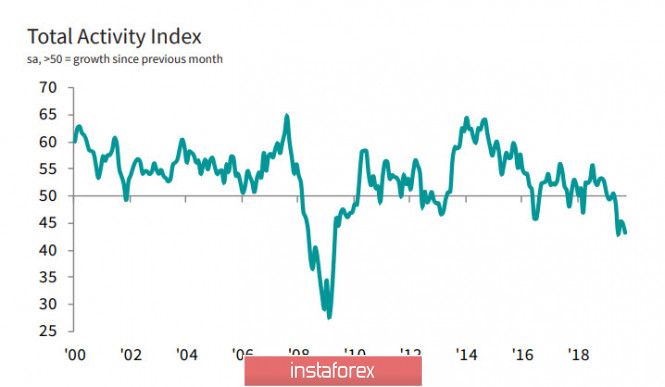

The effect of the unexpectedly weak ISM report in the manufacturing sector is played out, and the dollar will make an attempt to recover today from the fall a day earlier. At the same time, there is basically nothing to rely on the bulls - regional indices continue to decline. In particular, the reports of the Federal Reserve Bank of Chicago, Dallas and New York repeat each other like a blueprint and indicate a reduction in activity.

Moreover, the ADP report on employment in the private sector also does not give any reason for optimism. The September growth of 135 thousand below the average for 12 months, which before the publication of the report on the labor market on Friday is a negative signal.

At the same time, the focus of the market is directed, rather, towards the threat of total trade war, and not macroeconomic data. According to Mizuho Bank, China intends to refuse to cooperate with the United States on the terms of the American side. In addition, China is ready to conclude deals on short-term issues, but will not concede in a principled position - to gain a foothold in the status of the most powerful power of the 21st century.

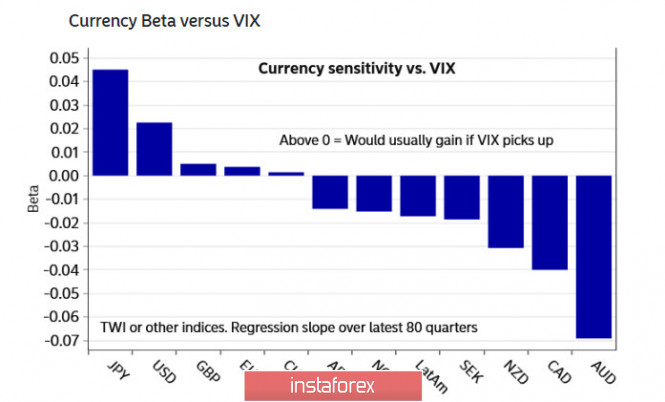

Also on Wednesday, Washington announced its intention to introduce increased duties on certain types of products from the EU. An attempt to draw Europe into a trade war raises the degree of general tension. Nordea Bank, on the other hand, expects a strong increase in volatility in commodity currencies and puts the yen and the dollar in the first place - they will be the market favorites in the coming weeks.

EURUSD

A weak report on the manufacturing sector, low inflation and the threat of being drawn into a trade war put pressure on the euro, which the European currency has little chance of dealing with. The nearest support is 1.0925, while further support is 1.0877. The motion vector is directed towards the lower boundary of the channel 1.0800 / 20.

GBPUSD

Behind the political battles, macroeconomic indicators fell into the background. Recent data indicate that the dynamics are negative, and the British economy has few chances to stay at the level "slightly above the market".

On Monday, reports for the 2nd quarter were published and despite the fact that they were slightly better than expected, there is no reason for optimism. GDP fell by 0.2%, annual growth of 1.3%, and investment in business continues to decline.

Activity in the manufacturing sector also indicates a decline. In September, the PMI was 48.3 p, slightly rebounding from the 6.5-year minimum in August, but the most significant is the rapid decline in construction at the fastest pace since April 2009.

While interpretation options are still possible in the manufacturing sector, since the sector is under pressure from the general global slowdown and, as a consequence, the decline in export orders, the construction sector reflects exclusively internal trends. The level of new orders is at a historic low, which clearly indicates deep doubts about the possibility of growth in consumer demand.

Furthermore, the trend indicates that rising inflation is at risk, as real incomes are expected to fall. In this regard, the possibility of a "Brexit without a deal" acquires a distinctly ominous prospect that will require an immediate response from both the Bank of England and the government.

As historical experience shows, the Bank of England has always followed in the wake of the Fed's policy and reduced rates within 9-12 months after the "big brother". The development of the situation probably requires a softening of tax policy, however, against the backdrop of the political crisis, the government cannot concentrate on economic tasks and, moreover, count on the support of the parliament. The danger of missing time is growing, and the pound will experience increasing pressure in the coming weeks.

On Wednesday, the FTSE100 stock index lost 3.23%, even against the backdrop of a weakening pound. This is a very strong signal, indicating the approach of panic. The pound is also preparing for the second wave of decline after the reversal last September 20. Now, we have the support of 1.2230 and 1.2203, the second of them is weak and unlikely to stand, after which the pound will form a way out of the growing channel down and go to 1.1957.

The material has been provided by InstaForex Company - www.instaforex.com