To open long positions on EURUSD you need:

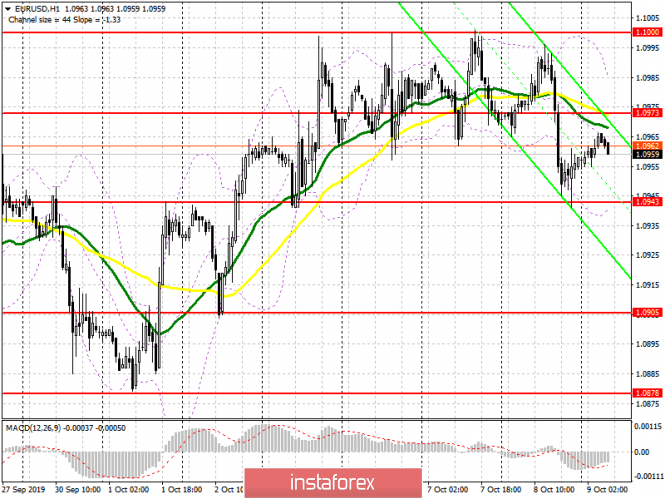

Fed Chairman Jerome Powell's speech yesterday in which he emphasized the likelihood of launching the asset-purchase program and an increase in bank reserves, all this weakened the position of the US dollar and led to a slight upward correction. However, the bulls, in order to pull the market to their side, need a return to the resistance of 1.0973, where the moving averages are located. Only such a scenario will lead to a larger upward correction to the area of this week's high - 1.1000, where I recommend taking profits. The entire focus in the morning will be shifted to the Eurogroup meeting, which may put additional pressure on the pair. In this case, it is best to look for new long positions after the formation of a false breakdown from the support of 1.0943, or buy the euro for a rebound from a low of 1.0905.

To open short positions on EURUSD you need:

Bears will try to maintain a downward trend, and the formation of a false breakdown in the resistance area of 1.0973 will be the first signal to open short positions, which will lead to the return of EUR/USD to the area of yesterday's low of 1.0943. However, a more important task for sellers will be to break through this range, which will bring the pair to support at 1.0905 and 1.0878, where I recommend taking profits. In case the euro grows above the resistance of 1.0973, amid important fundamental data on the eurozone, it is best to consider selling only after updating the high of the week - 1.1000.

Signals of indicators:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates the possibility that the euro might further fall.

Bollinger bands

In case the EUR/USD declines in the morning, support will be provided by the lower boundary of the indicator around 1.0940. Growth will be limited by the upper limit in the area of 1.0990, from where you can immediately sell the euro for a rebound.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20