EUR / USD

Tuesday, October 8, ended for the EUR / USD pair with a decrease of another 15 basis points, and the instrument managed to complete the fourth unsuccessful attempt to break through the Fibonacci level of 61.8% during the day. Thus, we can say that at the moment, the markets are inclined towards sales of the euro currency again, although the news background in recent days is absolutely empty or, at least, is not negative for the euro currency. I would expect a new increase in the euro-dollar pair only after a successful attempt to break through the level of 61.8%. Up to this point, rather high chances remain to complicate the downward trend section and its internal wave 5.

Fundamental component:

The news background for the euro / dollar pair now comes down only to the daily speeches of Fed President Jerome Powell. At first glance, his speech yesterday could cause strong sales of the US dollar and, as a result, the euro increase, which is what the current wave count suggests. However, in practice, the words that the Federal Reserve is planning to start purchasing short-term securities (bills), that is, to increase its balance again, did not cause much resonance in the foreign exchange market. In addition, Powell immediately explained to the markets that this was not a new phase of the QE program, but only a temporary repurchase of assets in order to "maintain a normal level of reserves." Thus, there was no panic in the market, and the American currency remained in the same place it was before Powell's speech.

Purchase goals:

1.1109 - 0.0% Fibonacci

Sales goals:

1.0876 - 127.2% Fibonacci

1.0814 - 161.8% Fibonacci

General conclusions and recommendations:

The euro-dollar pair has allegedly completed the construction of a downward set of waves. At the same time, until a successful attempt to break through the 61.8% Fibonacci level, certain chances remain for complicating wave 5 of the downward trend section with targets located around 1.0876 and 1.0814. Therefore, with instrument purchases, I recommend being careful for now.

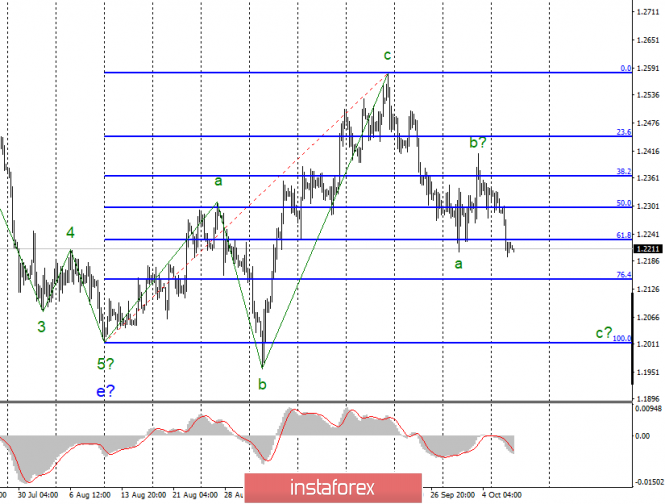

GBP / USD

On October 8, GBP / USD lost another 75 base points and thus, confirmed its readiness to build a bearish wave c. If this assumption is true, then the decline will continue with targets located below 22 figures again, and with a favorable news background (for the dollar), much lower than 22 figures. Currently, I expect to build at least a 3-wave descending structure, but we can see a full-fledged 5-wave trend section in the future.

Fundamental component:

The next round of talks between Boris Johnson and his European colleagues did not bring any results. Moreover, Angela Merkel said yesterday that Northern Ireland should remain in the Customs Union and only in this case London should count on an agreement with Brussels. All proposals by Boris Johnson are rejected. Also yesterday, the head of the European Parliament, David Sassoli, announced the absence of any progress in negotiations with Johnson, as well as about alternative options for Brexit. According to Sassoli, it is possible now to either extend the terms of Brexit, or the absence of a deal and the exit of the United Kingdom without an agreement on October 31. Thus, almost all the officials directly involved in the Brexit negotiation process recognized that it is almost impossible to conclude an agreement at the current stage. In this case, there really are only two options: either move Brexit to a later date, or disagree without agreement. It remains only to understand which of the options will be implemented. For the pound, by the way, both options are negative, but the first still leaves hope for the favor of the market for the British currency.

Sales goals:

1.2147 - 76.4% Fibonacci

1.2013 - 100.0% Fibonacci

Purchase goals:

1.2582 - 0.0% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly continues to build a new bearish trend section. Thus, now, I expect the continuation of the decline of the instrument in the direction of the levels 1.2147 and 1.2013, which corresponds to 76.4% and 100.0% Fibonacci in the construction of wave 3 or c. The MACD signal "down" indicated the transition of the instrument to the construction of a new bearish wave.

The material has been provided by InstaForex Company - www.instaforex.com