Forecast for September 6:

Analytical review of currency pairs on the scale of H1:

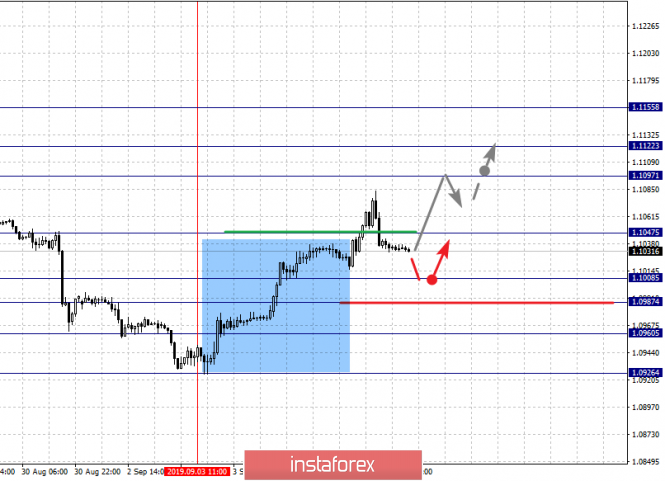

For the euro / dollar pair, the key levels on the H1 scale are: 1.1155, 1.1122, 1.1097, 1.1047, 1.1008, 1.0987, 1.0960 and 1.0926. Here, we follow the development of the ascending structure of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 1.1047. In this case, the target is 1.1097. Short-term upward movement, as well as consolidation is in the range of 1.1097 - 1.1122. For the potential value for the upward trend, we consider the level of 1.1155. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is expected in the range of 1.1008 - 1.0987. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.0960. This level is a key support for the upward structure. Its passage at the price will lead to the formation of a local downward structure. In this case, the first goal is 1.0926 .

The main trend is the upward structure of September 3.

Trading recommendations:

Buy: 1.1047 Take profit: 1.1095

Buy 1.1098 Take profit: 1.1120

Sell: 1.1008 Take profit: 1.0988

Sell: 1.0985 Take profit: 1.0960

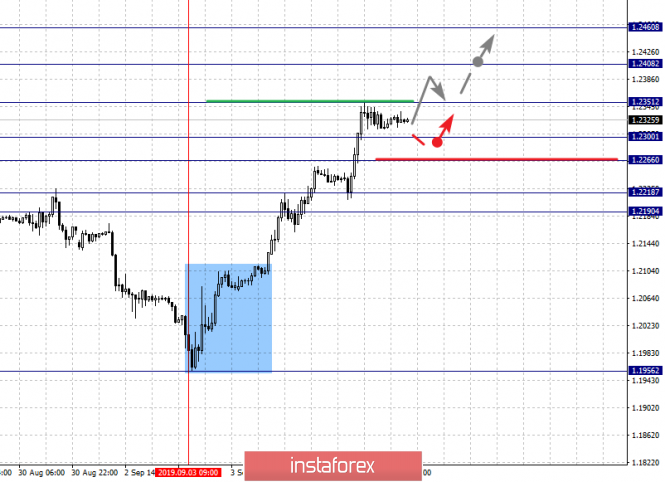

For the pound / dollar pair, the key levels on the H1 scale are: 1.2460, 1.2408, 1.2351, 1.2300, 1.2266, 1.2218 and 1.2190. Here, we follow the development of the upward cycle of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 1.2351. In this case, the target is 1.2408. The breakdown of which, in turn, will allow us to count on the movement to the potential target - 1.2460. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is expected in the range of 1.2300 - 1.2266. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2218. The range of 1.2218 - 1.2190 is the key support for the upward cycle.

The main trend is the upward cycle of September 3.

Trading recommendations:

Buy: 1.2351 Take profit: 1.2406

Buy: 1.2409 Take profit: 1.2460

Sell: 1.2300 Take profit: 1.2268

Sell: 1.2264 Take profit: 1.2220

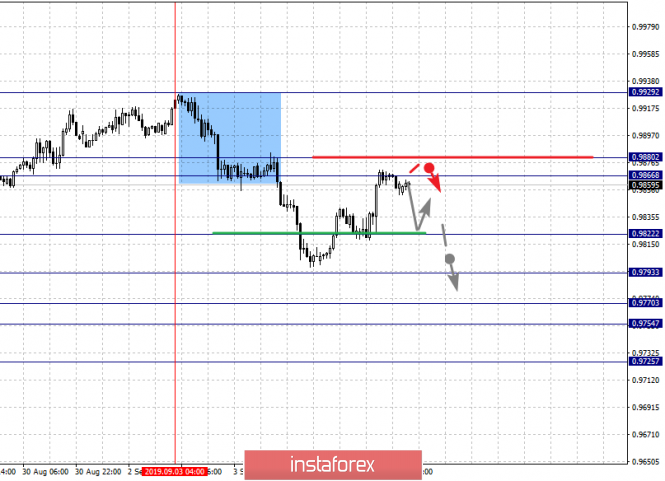

For the dollar / franc pair, the key levels on the H1 scale are: 0.9880, 0.9866, 0.9822, 0.9793, 0.9770, 0.9754 and 0.9725. Here, we are following the development of the downward structure of September 3. At the moment, the price is close to the cancellation of this structure, which requires the passage of the noise range of 0.9866 - 0.9880. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9822. In this case, the first target 0.9793. The breakdown of which, in turn, will allow you to count on moving to the level of 0.9770. Price consolidation is in the range of 0.9770 - 0.9754. For the potential value for the bottom, we consider the level of 0.9725. The movement to which is expected after the breakdown of the level of 0.9754.

The main trend is the descending structure of September 3, the stage of deep correction.

Trading recommendations:

Buy : 0.9880 Take profit: 0.9915

Buy : Take profit:

Sell: 0.9820 Take profit: 0.9795

Sell: 0.9790 Take profit: 0.9770

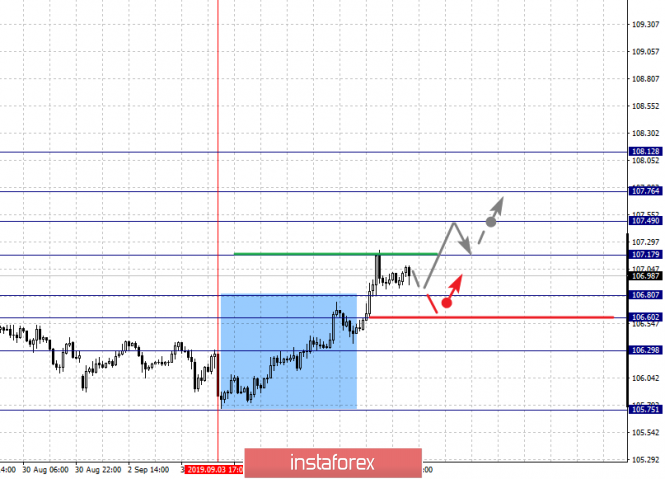

For the dollar / yen pair, the key levels on the scale are : 108.12, 107.76, 107.49, 107.17, 106.80, 106.60 and 106.29. Here, we determined the subsequent goals for the top from the local ascendant structure on September 3. The continuation of the movement to the top is expected after the breakdown of the level of 107.17. In this case, the target is 107.49. Short-term upward movement, as well as consolidation is in the range of 107.49 - 107.76. For the potential value for the top, we consider the level of 108.12. Upon reaching which, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 106.80 - 106.60. The breakdown of the last value will lead to a long correction. Here, the goal is 106.29. This level is a key support for the top.

Main trend: local upward structure from September 3.

Trading recommendations:

Buy: 107.17 Take profit: 107.46

Buy : 107.50 Take profit: 107.74

Sell: 106.80 Take profit: 106.62

Sell: 106.58 Take profit: 106.30

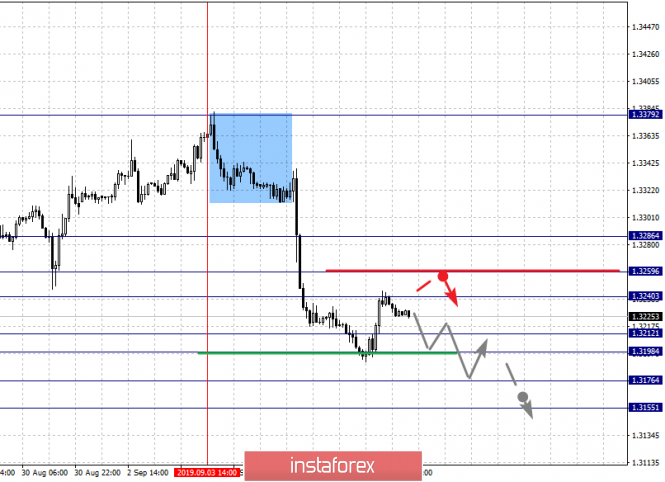

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3286, 1.3259, 1.3240, 1.3212, 1.3176 and 1.3155. Here, the price forms a pronounced medium-term downward structure from September 3. The continuation of the movement to the bottom is expected after the price passes the noise range 1.3212 - 1.3198. In this case, the target is 1.3176. For the potential value for the bottom, we consider the level of 1.3155. Before this value, we expect a pronounced structure of the initial conditions.

Short-term upward movement is possibly in the range of 1.3240 - 1.3259. The breakdown of the last value will lead to a long correction. Here, the target is 1.3286. This level is a key support for the upward structure.

The main trend is the formation of a medium-term downward structure from September 3.

Trading recommendations:

Buy: 1.3240 Take profit: 1.3257

Buy : 1.3261 Take profit: 1.3286

Sell: 1.3198 Take profit: 1.3176

Sell: 1.3174 Take profit: 1.3155

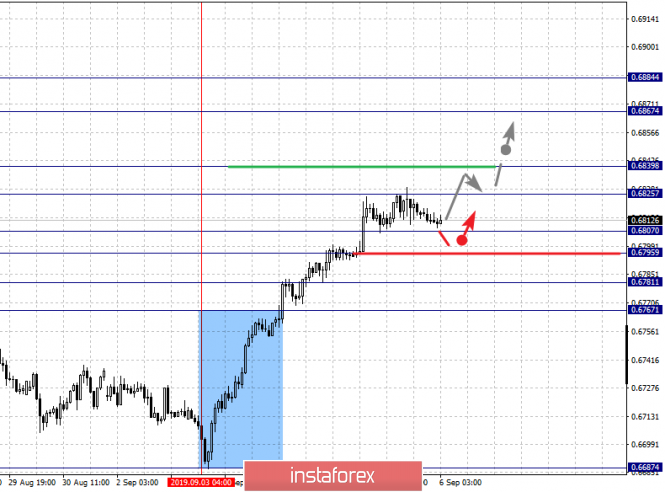

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6884, 0.6867, 0.6839, 0.6825, 0.6807, 0.6795, 0.6781 and 0.6767. Here, we follow the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 0.6825 - 0.6839. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 0.6867. For the potential value for the top, we consider the level of 0.6884. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.6807 - 0.6795. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6781. This level is a key support for the top. Its breakdown will lead to the formation of initial conditions for the downward cycle. In this case, the potential target will be 0.6767.

The main trend is the upward structure of September 3.

Trading recommendations:

Buy: 0.6840 Take profit: 0.6865

Buy: 0.6868 Take profit: 0.6882

Sell : 0.6807 Take profit : 0.6796

Sell: 0.6793 Take profit: 0.6783

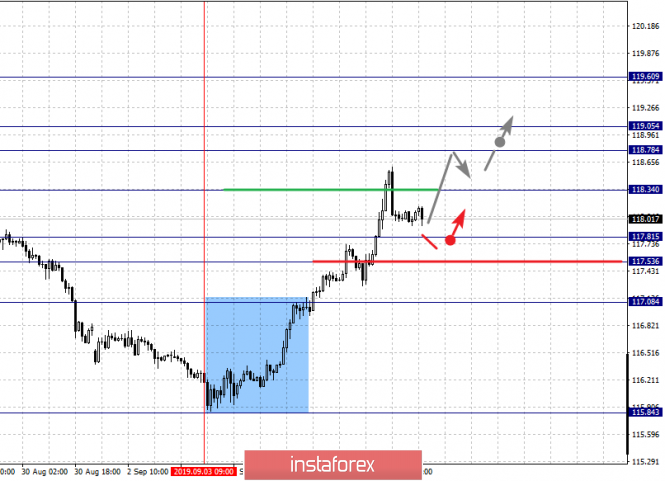

For the euro / yen pair, the key levels on the H1 scale are: 119.60, 119.05, 118.78, 118.34, 117.81, 117.53 and 117.08. Here, we follow the development of the ascending structure of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 118.34. In this case, the target is 118.78. Short-term upward movement, as well as consolidation is in the range of 118.78 - 119.05. The breakdown of the level of 119.05 should be accompanied by a pronounced upward movement towards a potential target - 119.60. We expect a pullback from this level to the bottom.

Short-term downward movement is expected in the range of 117.81 - 117.53. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 117.08. This level is a key support for the upward structure.

The main trend is the upward cycle of September 3.

Trading recommendations:

Buy: 118.36 Take profit: 118.76

Buy: 118.78 Take profit: 119.05

Sell: 117.80 Take profit: 117.55

Sell: 117.50 Take profit: 117.10

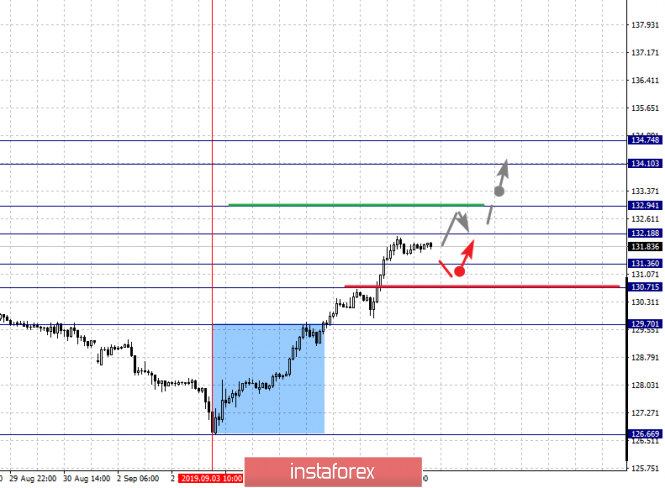

For the pound / yen pair, the key levels on the H1 scale are : 134.74, 134.10, 132.94, 132.18, 131.36, 130.71 and 129.70. Here, we continue to monitor the development of the upward cycle of September 3. Short-term upward movement is expected in the range of 132.18 - 132.94. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 134.10. For the potential value for the top, we consider the level of 134.74. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 131.36 - 130.71. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 129.70. This level is a key support for the upward structure.

The main trend is the upward structure of September 3.

Trading recommendations:

Buy: 132.20 Take profit: 132.90

Buy: 132.98 Take profit: 134.10

Sell: 131.36 Take profit: 130.74

Sell: 130.68 Take profit: 129.80

The material has been provided by InstaForex Company - www.instaforex.com