4-hour timeframe

Technical data:

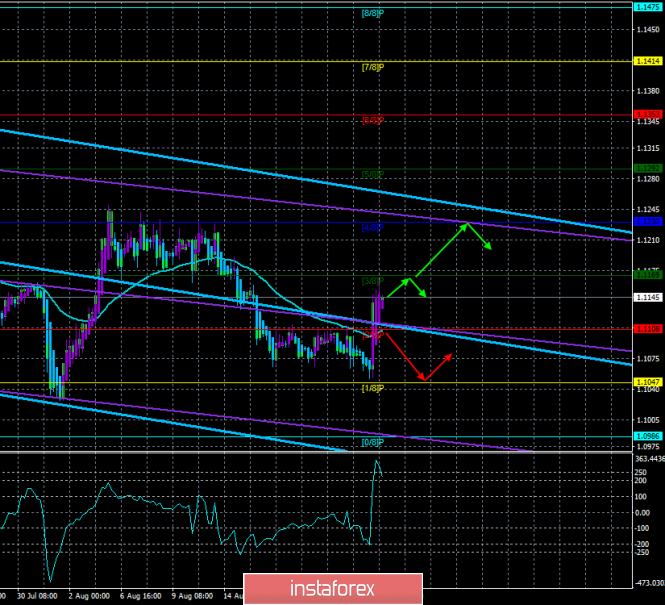

The upper channel of linear regression: direction – down.

The lower channel of linear regression: downward direction.

The moving average (20; smoothed) – sideways.

CCI: 219.4245

On August 26, the EUR/USD currency pair is above the moving average line, which gives hope for the formation of an upward trend. Friday's neutral performance of Jerome Powell in Jackson Hole caused a strong reaction from traders. Whether market participants have seen something dangerous to the US dollar, or they simply lost their nerves at the bears, or there are no more sellers below the level of 1.1050 and the euro/dollar pair broke large pending buy orders. In any case, we would like to note one important fact: if we take the period from May 27, 2018, to the present moment, that is, 15 months, then the euro fell for it by only 5 cents. That is, the loss of the euro is not so big and secondly, the euro, though cheaper, does not fall under the strong and long-term sales. The advantage of the US dollar is not so undeniable because the strengthening of the euro by 5 cents for 15 months occurred at a time when the Fed rate increased, and the US economy felt great. Now, when the Fed intends to reduce the rate in the long term, the downward trend should either weaken even more or even complete. The fulcrum can now be considered 1.1027 – the minimum of August 1. Thus, the main thing is that the fundamental background does not interfere with the planned strengthening of the euro. Because if macroeconomic statistics from overseas gain strength again, and things get worse in Europe, it will return the bears to the market. In the current situation, we would say that the probability of an upward trend beginning is 60/40.

On Monday, August 26, important reports on durable goods orders will be released in America. The technical picture involves the purchase of the euro currency until the pair returns to the area below the moving.

Nearest support levels:

S1 – 1.1108

S2 – 1.1047

S3 – 1.0986

Resistance levels:

R1 – 1.1169

R2 – 1.1230

R3 – 1.1292

Trading recommendations:

The euro/dollar pair is fixed above the moving average. Thus, we can consider the purchase of euro currency with the targets of the Murray levels of 1.1169 and 1.1230. Local adjustments – by turning the Heiken Ashi indicator down. It is recommended to return to sales not earlier than the reverse consolidation of the price below the moving average line.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of illustrations:

The upper linear regression channel – blue line unidirectional movement.

The lower linear regression channel – purple line unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) – blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

The material has been provided by InstaForex Company - www.instaforex.com