The New Zealand dollar receded from the shock after an unexpected decision by the RBNZ to cut the interest rate by 50 basis points at once. Impulsively, the pair updated the annual (and simultaneously three-year) minimum of 0.6373 but then corrected to the area of the 64th figure, where it drifts for the second week. Nevertheless, despite fading of the downward momentum, the bearish trend is still in force. Apparently, the Reserve Bank of New Zealand has not yet put an end to the process of lowering the interest rate. Therefore, "kiwi" cannot only make a retest of the annual minimum in the near future but can also reach the key support level of 0.6350 at the lower line of the Bollinger Bands indicator on the daily chart.

Until the end of this year, only two RBNZ meetings remained on September 25 and November 13. According to most experts, the regulator will reduce the interest rate by another 25 basis points by 0.75% at one of these meetings. The implementation of such a scenario does not exclude the head of the New Zealand Central Bank Adrian Orr. Moreover, immediately after the meeting, he announced that the regulator may very well have to deal with negative rates. In the event of a crisis, the regulator can reduce the key interest rate to -0.35%. At the same time, Orr is skeptical of asset purchase programs and in his opinion, such steps are "less attractive tool for easing monetary policy."

One noteworthy fact is worth mentioning here. Fairly strong data on labor market growth came out in New Zealand. The unemployment rate in the second quarter fell to a record low of 3.9% with a growth forecast of 4.3%. The employment growth rate increased significantly after a reduction to -0.2% and the indicator also jumped to 0.8% in quarterly terms. This is the best result since the third quarter of last year. Similarly, the wage dynamics index showed a positive trend after a three-month decline, it rose to 0.8% with a growth forecast of 0.7%. In other words, almost all indicators of the new Zealand labor market suddenly came out in the "green zone". However, the regulator actually ignored (though noted) this fact, taking the course on aggressive easing of monetary policy parameters.

All of these suggest that internal macroeconomic statistics play an important, but far from the decisive role of RBNZ members in the context of determining further steps. The focus is on the global trade conflict and the associated uncertainty. according to Adrian Orr, the trade war negatively affects consumer confidence, as well as the investment climate and the exports actually paralyze business activity in the country. The words of the head of the RBNZ are also confirmed by "dry numbers". In particular, the index of business activity in the manufacturing sector, amounted to 48.2 points, falling to a key mark of 50, which is the boundary of expansion. Previously, the figures were at 51.3 and 48.2 points in June and July, respectively. Consequently, business activity narrowed down in this area.

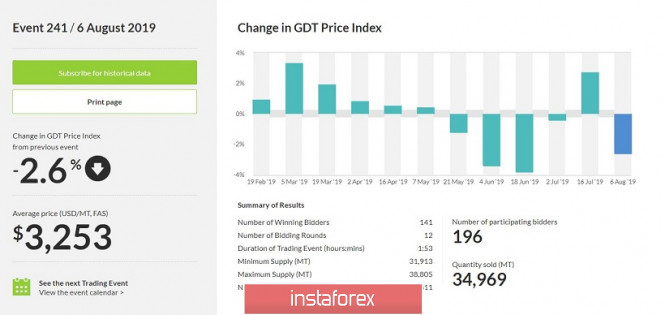

In addition, the New Zealander has recently lost another "trump card" in the form of an increase in the price index for dairy products. During the July GTD auction, trading closed in positive territory, although before that, the index showed a downward trend. At the first August auction on August 6, the indicator returned again to the negative area, reaching -2.6%. The second August auction will be held today and according to most experts, the index will show negative dynamics and will go down deeper into the negative area. For the economy of New Zealand, the cost of milk and the demand for it are extremely important. Thus, the current situation can put significant pressure on the national currency. The island nation exports powdered milk powder and other dairy products mainly to China and to European countries.

Thus, the results of today's GTD auction may put additional pressure on the NZD/USD pair, or provoke a correctional pullback. However, trusting today's price fluctuations is not worth it, considering the upcoming economic symposium in the American Jackson Hole. Adrian Orr has already announced his participation in this forum, which means that he will be able to comment on the latest trends in light of the future prospects of the RBNZ monetary policy. If he takes a "dovish" position, hinting at the likelihood of aggressive measures to ease monetary policy, the New Zealander will again update the annual minimum regardless of the results of today's GTD auction.

Technically, the pair is trading in a downtrend on the daily price chart, which is confirmed by the generated bearish signal of "Parade of Lines". All the lines of the Ichimoku Kinko Hyo indicator are above the price chart. The pair is also located between the lower and middle lines of the Bollinger Bands indicator, which act as support and resistance levels and correspond to 0.6350 and 0.6510 marks.

The material has been provided by InstaForex Company - www.instaforex.com