The single European currency steadily fell for three consecutive days. This is largely due to the general situation, which lies in the clear intention of the European Central Bank to find new ways to mitigate its monetary policy. At the same time, the Federal Reserve almost directly tells investors that there is no reason to lower the refinancing rate. Moreover, the banal disparity in interest rates also favors the dollar's growth. Like it or not, but the rate is 0.00% in Europe, and it is 2.25% in the United States. Well, this means that the yield on US government debt securities is significantly higher than in Europe. So it is not surprising that investors prefer the dollar rather than the single European currency.

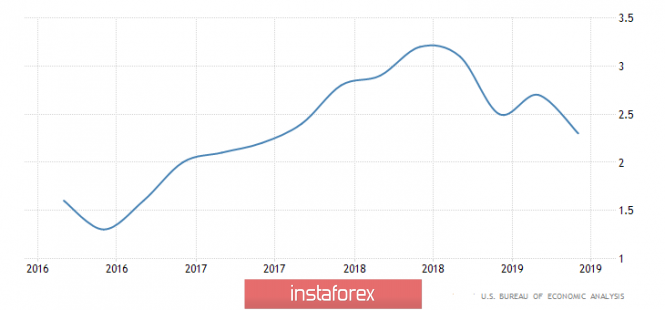

However, this fascinating process is not so monotonous, and from time to time there are jumps in one direction or the other on the market, which at least temporarily brings some kind of variety to the life of traders. Today there is a turn of deviations from the given scenario, and the second short-term panic will be caused by the second estimate of the United States GDP for the second quarter. The first estimate showed a slowdown in economic growth from 2.7% to 2.3%, while the second could show a slightly larger decrease, to 2.2%. Naturally, this will instantly lead to renewed discussion of an impending recession in the United States, with calls for the Federal Reserve to immediately lower the refinancing rate. So today we can safely expect the growth of the single European currency, especially since in recent days it has appeared to be somewhat oversold.

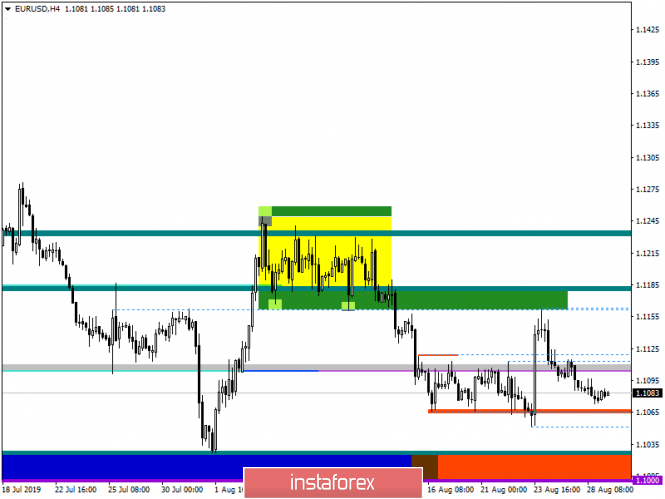

The EUR/USD pair has been stubbornly recovering quotes since the beginning of the trading week after the impulsive jump from Friday, working out more than 80% of at the moment. The sluggish movement has returned us to the framework of the recent flat formation of 1.1066/1.1100, where the quote is now located. Considering everything that happens in general terms, we see that the recent leap has not changed the overall picture of the trend, the pair continues to run in a downward trend, having all the same points of support 1.1060 ---> 1.1000.

It is likely to assume that the movement within the specified limits of 1.1066/1.1100 will still remain for some time in the market, where, against the background of the news flow, we can expect the quotation to return to the upper limit of 1.1100-1.1115. The main move is considered after the breakdown of the given framework.

We concretize all of the above into trading signals:

• We consider long positions in terms of temporary corruption in the direction of 1.1100-1.1115, from the current coordinates.

• We consider short positions in case of price consolidation lower than 1.1060, with the prospect of a move to 1.1030-1.1000.

From the point of view of a comprehensive indicator analysis, we see that indicators relative to all the main time periods signal a further decline. At the same time, indicators in short-term temporary areas signal stagnation, varying interest.