GOLD prices pushed lower quite sharply after reaching the $1300 price area with a daily close as US positive economic reports helped the greenback to gain momentum. The price plummeted. The price resided below $1290. The price is currently correcting itself.

Recently, US Home Building Permits report showed an increase to 1.30M. The reading was expected to be unchanged at 1.29M. Housing started to climb to an annual rate of 1.24 million last month. Economists polled by MarketWatch has expected starts to rise at 1.21 million pace. The Philadelphia Fed manufacturing index in May rose to a four-month high of 16.6 after registering 8.5 in April.

Federal Reserve Gov. Lael Brainard made the case on Thursday that the "new normal" of low interest rates requires the central bank to let inflation run hotter than usual as well as to employ tools like increased capital requirements to check financial market exuberance. Separately, Minneapolis Fed President Neel Kashkari said the Fed in the current recovery treated the 2% inflation target as a ceiling instead of a target. Gold had found support earlier in the week from modest, haven-related demand as investors kept an eye on an escalating U.S.-China tariff battle and rising tensions in the Middle East. Stocks, however, had subsequently managed to claw back some lost ground as anxieties about tariffs receded for the moment.

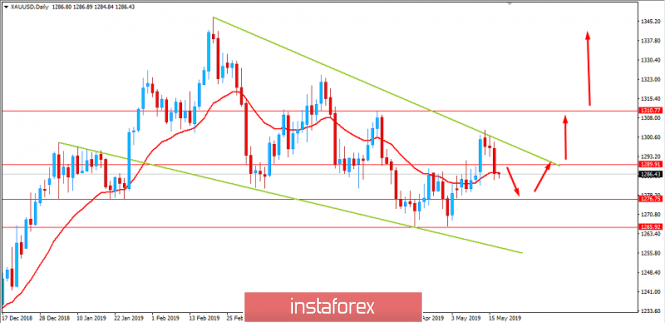

On the technical view. The price is held by the dynamic level of 20 EMA currently which might push a bit lower towards $1265-$1276 support area before pushing higher with a target towards breaking above $1290 and reaching $1300 area again. The price formed Bullish Flag in the trend whereas a break above the Flag is expected to lead to strong upward thrust in the coming days. As the price is currently inside a corrective range between $1265 to $1290 where volatility in the price was observed earlier.

SUPPORT: 1265, 1276

RESISTANCE: 1290, 1300

BIAS: BULLISH

MOMENTUM: VOLATILE