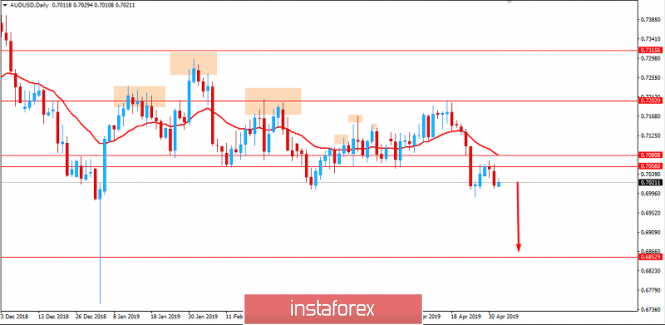

AUD/USD broke below 0.7050 area and is set to decline further with target towards 0.6850.

Australia released a positive employment change report but a negative unemployment rate report. As a result, the Australian currency weakened. Other econmic reports reinforsed the downward pressure. Thus, home prices declined again in April amid lackluster demand and tight credit, though the pace of losses eased as auction clearance rates stabilized in the major cities. The Reserve Bank of Australia may be forsed to cut the interest rate at its next policy meeting in the coming days. Consequently, the Australian dollar may take a nosedive against the US dollar.

Tomorrow, Australia's Building Permits report is going to be published which is expected to decrease significantly to -12.5% from the previous positive value of 19.1%. Additionally, the AIG Services Index report is also going to be published which previously was at 44.8. Recently, the AIG Manufacturing Index was published with an increase to 54.8 from the previous figure of 51.0, so the AIG Services Index is also expected to have a positive reading.

On the other hand, the Federal Reserve kept the interest rate unchanged at 2.50% and presented a dovish statement. Some analysts expected that the Fed might somehow signal they are shifting or perhaps biased toward a rate cut. The focus is still on the fact that the inflation is below the Fed's target, so the Fed officials may be reluctant to make any dramatic changes to its policy in the coming months.

The non-farm employment change report which is expected to show a decrease 181k from the previous figure of 196k. At the same time, the average hourly earnings report is expected to increase to 0.3% from the previous value of 0.1% and the unemployment rate is expected to be unchanged at 3.8%. Amid a deluge of economic data, the US dollar will come under the spotlight. On the back of the upbeat GDP report, the American currency has all the chances to extend gains.

As of the current scenario, USD is expected to sustain the bearish momentum as AUD may struggle further with downbeat economic reports to be published in the coming days. Though the Fed has been quite dovish in the recent meeting, any positive outcome on the employment reports may result in impulsive gains on the USD side.

Now let us look at the technical view. The price has recently retested the 0.7050 area after the impulsive bearish break which is expected to lead the price to the next important support area at 0.6850 in the coming days. The price broke below the 4-months lows with a strong bearish daily close which is expected to result in more downward pressure. As the price remains below 0.71 area with a daily close, the bearish bias is expected to continue.