Forecast for May 29:

Analytical review of H1-scale currency pairs:

For the euro / dollar pair, the key levels on the H1 scale are: 1.1269, 1.1248, 1.1217, 1.1206, 1.1191, 1.1167, 1.1154 and 1.1136. Here, the price forms the potential initial conditions for the upward movement of May 23 and is currently in a correction zone from this structure. Continuation of the movement to the top is expected after the breakdown of 1.1191. In this case, the goal is 1.1206, wherein consolidation isn near this level. The price passage of the noise range 1.1206 - 1.1217 must be accompanied by a pronounced upward movement. In this case, the target is 1.1248. For the potential value for the top, we consider the level of 1.1269. After reaching which, we expect a rollback to the bottom.

Short-term downward movement is possible in the range of 1.1167 - 1.1154. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 1.1136. This level is a key support for the top.

The main trend is the formation of initial conditions for the top of May 23.

Trading recommendations:

Buy 1.1191 Take profit: 1.1206

Buy 1.1218 Take profit: 1.1246

Sell: 1.1167 Take profit: 1.1155

Sell: 1.1153 Take profit: 1.1136

For the pound / dollar pair, the key levels on the H1 scale are: 1.2811, 1.2737, 1.2693, 1.2612, 1.2553, 1.2478 and 1.2428. Here, the price is still in equilibrium: a downward structure of May 21, as well as the formation of a potential of May 23. Continuation of the movement to the bottom is expected after the breakdown of 1.2612. Here, the target is the level of 1.2553. The breakdown of which must be accompanied by a pronounced downward movement. In this case, the target is 1.2478. We consider the level of 1.2428 to be a potential value for the bottom. Upon reaching this level, we expect a consolidation in the range of 1.2478 - 1.2428, as well as a departure to a correction.

Short-term upward movement is possible in the range of 1.2693 - 1.2737. The breakdown of the latter value will have to form an upward movement. Here, the target is the level of 1.2811.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.2693 Take profit: 1.2735

Buy: 1.2738 Take profit: 1.2810

Sell: 1.2612 Take profit: 1.2555

Sell: 1.2550 Take profit: 1.2478

For the dollar / franc pair, the key levels on the H1 scale are: 1.0137, 1.0118, 1.0094, 1.0082, 1.0057, 1.0048 and 1.0034. Here, we are following the development of the ascending structure of May 24. Short-term upward movement is expected in the range of 1.0082 - 1.0094. The breakdown of the last value should be accompanied by a pronounced upward movement. In this case, the target is 1.0118. For the potential value for the top, we consider the level of 1.0137. The movement to which is expected after the breakdown of 1.0120.

Short-term downward movement is possible in the range of 1.0057 - 1.0048. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 1.0034. This level is a key support for the upward structure.

The main trend is the ascending structure of May 24.

Trading recommendations:

Buy : 1.0082 Take profit: 1.0094

Buy : 1.0096 Take profit: 1.0118

Sell: 1.0057 Take profit: 1.0048

Sell: 1.0046 Take profit: 1.0036

For the dollar / yen pair, the key levels on the scale are : 110.21, 109.94, 109.73, 109.36, 109.14, 108.98 and 108.51. Here, the price forms the medium-term initial conditions for the downward cycle of May 21. Continuation of the movement to the bottom is expected after the breakdown of 109.36. In this case, the goal is 109.14, wherein consolidation is near this level. The price pass of the noise range of 109.14 - 108.98 should be accompanied by a pronounced downward movement. Here, the goal is 108.51. Near this level, we expect a consolidation and a possible rollback to the correction.

Short-term upward movement is possible in the range of 109.73 - 109.94. The breakdown of the latter value will lead to in-depth correction. Here, the goal is 110.21. This level is a key support for the downward cycle.

The main trend: the formation of medium-term initial conditions for the downward cycle of May 21.

Trading recommendations:

Buy: 109.73 Take profit: 109.92

Buy: 109.95 Take profit: 110.20

Sell: 109.36 Take profit: 109.15

Sell: 108.98 Take profit: 108.51

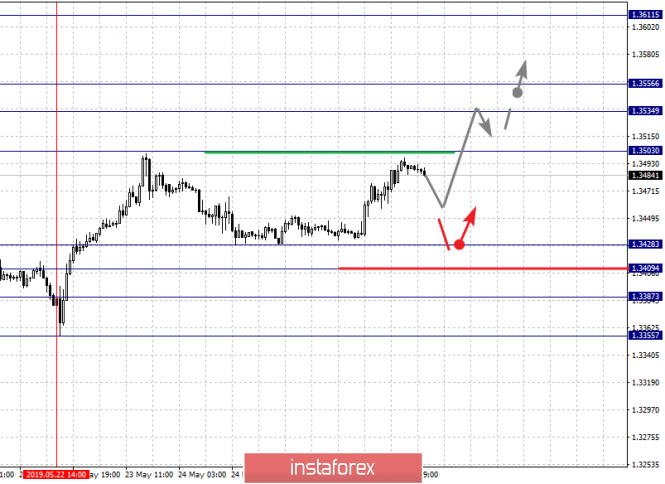

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3611, 1.3556, 1.3534, 1.3503, 1.3474, 1.3428, 1.3409, 1.3387 and 1.3355. Here, the price forms the medium-term initial conditions for the upward cycle of May 22. Continuation of the development of this structure is expected after the breakdown of the level of 1.3503. In this case, the first target is 1.3534, wherein consolidation is near this level. The price passage of the noise range 1.3534 - 1.3556 should be accompanied by a pronounced upward movement. Here, the potential target is the level of 1.3611.

Short-term downward movement is possible in the range of 1.3428 - 1.3409. The breakdown of the latter value will lead to a prolonged correction. Here, the target is the level of 1.3388. This level is a key support for the top.

The main trend is the formation of medium-term initial conditions for the upward cycle of May 22.

Trading recommendations:

Buy: 1.3474 Take profit: 1.3501

Buy : 1.3503 Take profit: 1.3534

Sell: 1.3426 Take profit: 1.3410

Sell: 1.3408 Take profit: 1.3388

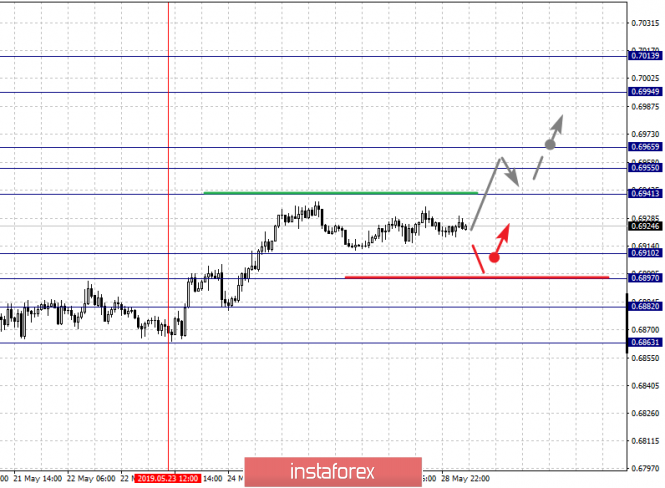

For the pair Australian dollar / US dollar, the key levels on the H1 scale are : 0.7013, 0.6994, 0.6965, 0.6955, 0.6941, 0.6910, 0.6897, 0.6882 and 0.6863. Here, the price forms the expressed initial conditions for the top of May 23. Continuation of the movement to the top is expected after the breakdown 0.6941. Here, the first goal is 0.6955, near this level is a price consolidation. The price passage of the noise range of 0.6955 - 0.6965 should be accompanied by a pronounced upward movement. In this case, the target is the level of 0.6994. For the potential value for the top, we consider the level of 0.7013. After reaching which, we expect a rollback to the bottom.

Short-term downward movement is possible in the range of 0.6910 - 0.6897. The breakdown of the latter value will lead to a prolonged movement. Here, the target is the level of 0.6882. This level is a key support for the upward structure.

The main trend is the formation of initial conditions for the top of May 23.

Trading recommendations:

Buy: 0.6941 Take profit: 0.6955

Buy: 0.6967 Take profit: 0.6992

Sell : 0.6910 Take profit : 0.6898

Sell: 0.6895 Take profit: 0.6884

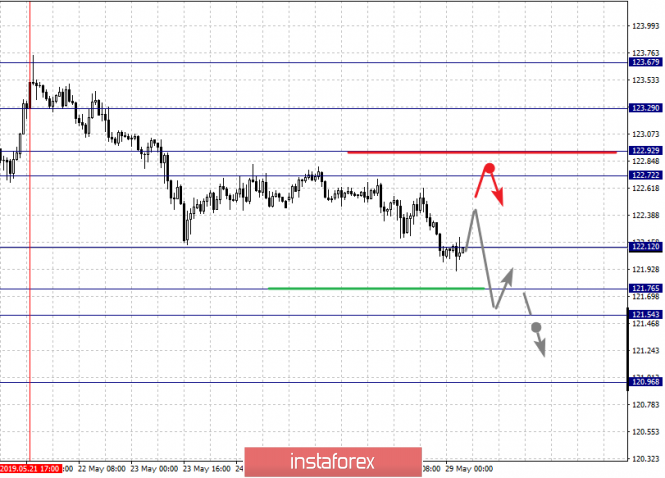

For the euro / yen pair, the key levels on the H1 scale are: 123.29, 122.92, 122.72, 122.12, 121.76, 121.54 and 120.96. Here, the price forms the expressed initial conditions for the downward cycle of May 21. Continuation of the movement to the bottom is expected after the breakdown of 122.12. In this case, the goal is 121.76, wherein consolidation is near this level. Meanwhile, in the range of 121.76 - 121.54, there is a short-term downward movement. The breakdown of the last value will allow to count on the movement towards a potential target - 120.96. From this level, we expect a rollback to the top.

Short-term upward movement is possible in the range of 122.72 - 122.92. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 123.29. This level is a key support for the downward structure.

The main trend is the formation of medium-term initial conditions for the downward cycle of May 21.

Trading recommendations:

Buy: 122.72 Take profit: 122.90

Buy: 122.93 Take profit: 123.25

Sell: 122.12 Take profit: 121.78

Sell: 121.74 Take profit: 121.55

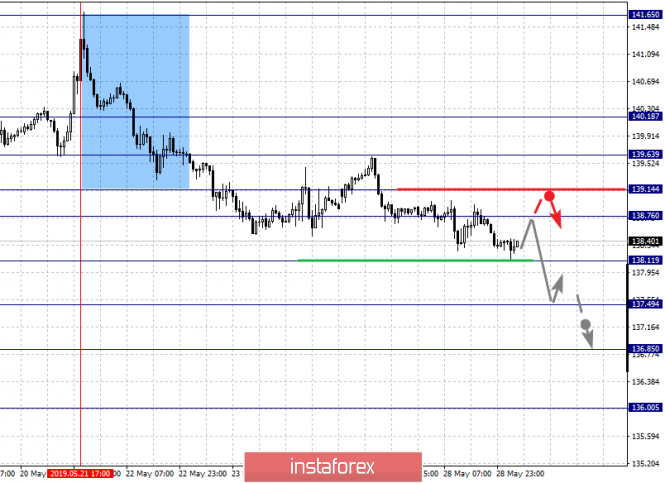

For the pound / yen pair, the key levels on the H1 scale are: 140.18, 139.63, 139.14, 138.76, 138.11, 137.49, 136.85 and 136.00. Here, we are following the development of the downward structure of May 21. Continuation of the movement to the bottom is expected after the breakdown of the level of 138.10. In this case, the goal is 137.49, wherein a price consolidation is possible near this level. The breakdown of 137.49 will allow us to count on a move to 136.85. From this level, there is a high probability of going into a correction. For the potential value for the bottom, we consider the level of 136.00.

Short-term upward movement, possibly in the corridor 138.76 - 139.14. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 139.63. This level is a key support for the downward structure. Its price will have the formation of the initial conditions for the upward movement. In this case, the potential target is 140.18.

The main trend is a local downward structure of May 21.

Trading recommendations:

Buy: 138.76 Take profit: 139.12

Buy: 139.16 Take profit: 139.60

Sell: 138.10 Take profit: 137.55

Sell: 137.46 Take profit: 136.90

The material has been provided by InstaForex Company - www.instaforex.com