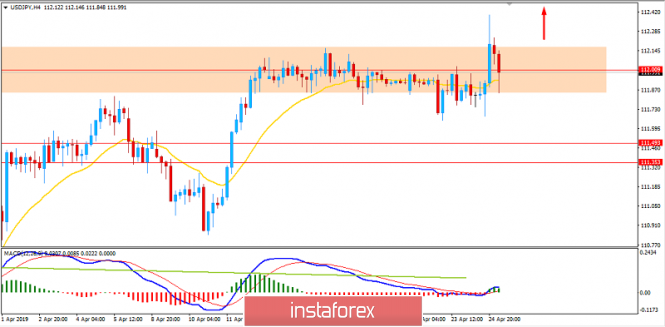

The USD/JPY pair is being quite volatile at the edge of the 112.00 resistance area, after the previous sharp upward move that indicates the upcoming bullish bias.

The Fed keeps its rates unchanged as well after the last hike to 2.5% in December, while traders are worried about the possibility of its decline. However, encouraging economic reports can help the situation. In the meantime, declining inflation actually constitutes a tightening because it pushes up the so-called real rate. It is likely to slow the economy and even put more pressure on inflation.

Moreover, regarding the trade talks with China, the US is pretty optimistic about the outcome expecting further negotiations to go in the US favor. The next round of talks is scheduled to begin on April 30 in Beijing followed by further discussions starting May 8 in Washington. The US Core Durable Goods Orders report is due today. The reading is forecast to inch up to 0.2% from the previous value of -0.1%, while the Durable Goods Orders report is expected to increase as well to 0.7% from the previous value of -1.6%.

The Advance GDP report is the main attraction for USD buyers this week. It is anticipated to be neutral at 2.2%. If the expectations are met, then USD is likely to weaken against JPY triggering the further correction and volatility in the market.

On the yen side, today's Bank of Japan's Policy Statement and Policy Rate were published unchanged at -0.10%. This ultra-loose value is expected to weigh down the Japanese currency. The Bank of Japan maintained its short-term interest rate target at minus 0.1% and a pledge to guide 10-year government bond yields around 0%. So far, Japan's regulator has not hinted how long it is going to keep the interest rate at such a low position. Hopefully, today's Press Conference will give a clue to the upcoming JPY movement.

Tomorrow's JPY Tokyo Core CPI is anticipated to remain unchanged at 1.1%, while the Unemployment Rate is forecast to increase to 2.4% from the previous value of 2.3%, the Retail Sales index is to rise to 0.8% from the previous value of 0.6%, and the Housing Starts data is also expected to grow to 5.6% from the previous value of 4.2%.

As of the current scenario, both USD and JPY have optimistic expectations from the upcoming economic reports. Therefore, the market is likely to be volatile. Notably, the greenback may gain further momentum over the yen as it has been attracting market sentiment lately.

Now, let us look at the technical view. The pair is currently trading at the edge of the 112.00 area after the previous impulsive bullish move. If the price remains above 111.50 or completely breaks above 112.00 with a daily close or even an H4 close, then the price is expected to push higher towards 114.50 and the 115.00 resistance area in the coming days.