USD is struggling for gains due to mixed economic reports. USD traders are focused on the trade deal with China. Nevertheless, USD managed to gain momentum over JPY that is expected to be sustained further in the coming days with a retracement and correction along the way.

Japan is currently pursuing ultra-loose monetary policy. Recently BOJ Governor Kuroda said that the Bank of Japan does not have a specific exit strategy yet because it would take significant time to achieve its 2% target of inflation. According to Kuroda, exit from ultra-loose monetary policy would require an interest rate hike and measures to shrink the BOJ's balance sheet like the Federal Reserve is doing now. Though the economy has been responding quite well, sudden changes might be required if needed. Recently Japan's Monetary Base report was published with a decrease to 4.6% from the previous value of 4.7% which was expected to decrease further to 4.5%. Ahead of high impact economic reports like Final GDP to be published this week, mixed expectations on the reports may lead to further weakness in JPY while the BOJ is revising plans to spur economic growth plans.

On the other hand, the current focus of traders and investors is the US-China trade deal which is currently going through "Cautious Optimism" as political and practical hurdles are still going on. The tariffs are yet to be settled. Besides, the US economy may get some negative hit from the trade deal. Additionally, the US Treasury is taking extraordinary measures to avoid violating the government debt limit which is turning critical.

Ahead of NFP reports this week, which are expected to have mixed prints, recently the US Construction Spending report was published with a decrease to -0.6% from the previous value of 0.8%. Today US ISM Manufacturing PMI report is going to be published which is expected to increase to 57.4 from the previous figure of 56.7 and New Home Sales is expected to decrease to 597k from the previous figure of 657k. Moreover, today FOMC Member Rosengren is due to speak about the upcoming monetary policy and interest rate decisions. His speech are likely to be quite neutral in nature.

Meanwhile, USD is expected to sustain the bullish momentum as JPY is trading lower amid BoJ economic growth plans. Any positive report from Japan may lead to certain corrections along the way. To cap USD gains would require strong positive economic reports and developments in Japan.

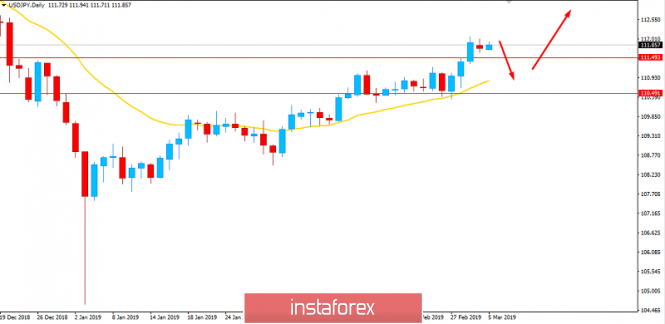

Now let us look at the technical view. The price is currently at the edge of 112.00 area from where having a bearish daily close with an inside bar indicates indecision which may lead to a retracement towards 110.50 support area before pushing higher in the coming days. As 112.00 is an event area, certain bearish pressure with correction is expected along the way. The price being above 110.00 with a daily close is expected to lead to continuation of the bullish momentum in the pair.