EUR/USD has been quite volatile while struggling at the edge of 1.1450-1.1500 resistance area recently which indicates certain downward pressure in the coming days. USD, having indecisive and mixed employment report published recently, managed to extend gains the euro struggled with the dovish outcome of the ECB meeting and worse economic reports in the process.

The European Union is currently quite concerned about the upcoming BREXIT deal. The no deal outcome is expected to leave a negative mark on the euro economy as per Bank of Italy's governor Visco. Today the Spanish Unemployment Change report is going to be published which is expected to increase to 60.3k from the previous figure of -50.6k. Such a significant increase in unemployment may lead to further weakness of the euro in the process. Along with it, the Sentix Investor Confidence is expected to increase to -1.1 from the previous figure of -1.5, PPI is expected to decrease to -0.7% from the previous value of -0.3%, and the Italian Prelim CPI is expected to increase to 0.1% from the previous value of -0.1%. As no high impact events or economic reports are going to be published this week on the euro side, certain weakness may be observed in this currency throughout the week.

On the other hand, US President Trump is going to speak on Tuesday about the US-Mexico Border issue whereas any positive outcome from the speech may lead to certain gains on the USD in the coming days. Moreover, a number of Fed speeches are going to be delivered this week which includes Fed Chair Powell, Bullard and Quarles. Last week, the US Central Bank left the interest rates unchanged which according to Fed President Kashkari is healthy for the US economy and indicates the growing behavior of the economy as well. He also stated that the Fed is working on their mistakes but external impact on the economy cannot be controlled. Recently, the Non-Farm Employment Change was published with an increase to 304k from the previous figure of 222k which was expected to decrease to 165k. At the same time, the Unemployment Rate increased to 4.0% which was expected to be unchanged at 3.9% and the Average Hourly Earnings also decreased to 0.1% from the previous value of 0.4% which was expected to be at 0.3%.

Today the US Factory Orders report is going to be published which is expected to increase to 0.3% from the previous value of -2.1% and tomorrow ISM Non-Manufacturing PMI will see the light of the day which is expected to have a slight decrease to 57.0 from the previous figure of 57.6.

As of the current scenario, USD is going to be rather volatile this week whereas the euro is expected to be quite silent and slow with no high impact economic reports or events this week. If the US economic reports and events show a positive outcome, further gains on the USD side is expected against the euro in the coming days.

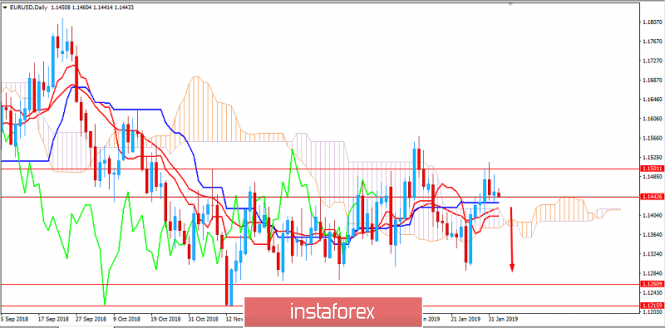

Now let us look at the technical view. The price is currently residing at the edge of 1.1450 area which is being pressurized by bears in the process. The dynamic levels such as 20 EMA, Tenkan and Kijun line are expected to act as support along with the Kumo Cloud which might slow down the bearish momentum. The price being below 1.1500 area with a daily close indicates that the bearish bias is expected to continue further in the future with target towards 1.1200-1.1300 support area.

SUPPORT: 1.1200-50, 1.1300

RESISTANCE: 1.1450, 1.1500

BIAS: BEARISH

MOMENTUM: VOLATILE