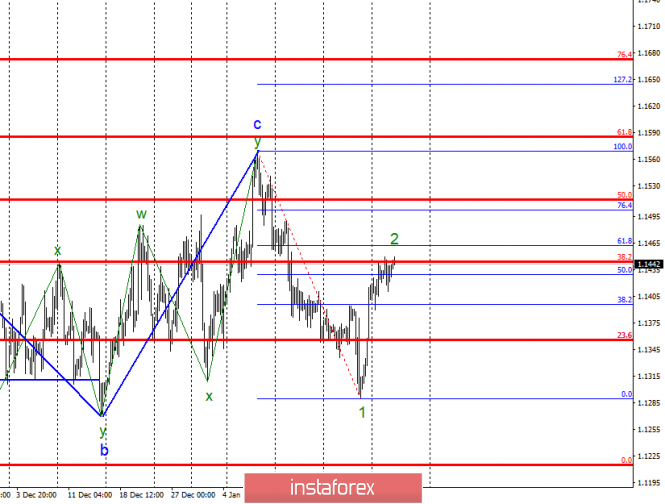

Wave counting analysis:

On Tuesday, January 29, bidding ended with a minimal increase for the pair EUR / USD. Thus, the wave marking has not changed and still assumes the construction of wave 2 as part of a new downtrend of the trend. An unsuccessful attempt to break through the level of 38.2% on the older grid or the reserve level of 61.8% on the youngest will induce the instrument to be ready for the completion of the correction wave. In the performance of this option, we are waiting for a new decrease in the instrument. Tonight, the Fed will announce its decisions during its meeting, and we'll figure out if this information can significantly affect the movement of the instrument. In accordance with the current wave counting, the US dollar is in great need of support from the Fed, otherwise wave 2 may become more complicated.

Sales targets:

1,1289 - 0.0% Fibonacci

1.1215 - 0.0% Fibonacci

Shopping goals:

1.1444 - 38.2% Fibonacci

1.1462 - 61.8% Fibonacci

General conclusions and trading recommendations:

The pair remains in the stage of building a correctional wave 2. Thus, its completion should lead to a resumption of the instrument's decline with targets located near the marks of 1,1289 and 1.1215, which equates to 0.0% and 0.0% Fibonacci. Now I recommend cautious sales of a pair with orders limiting losses above the levels of 38.2% and 61.8%.

The material has been provided by InstaForex Company - www.instaforex.com