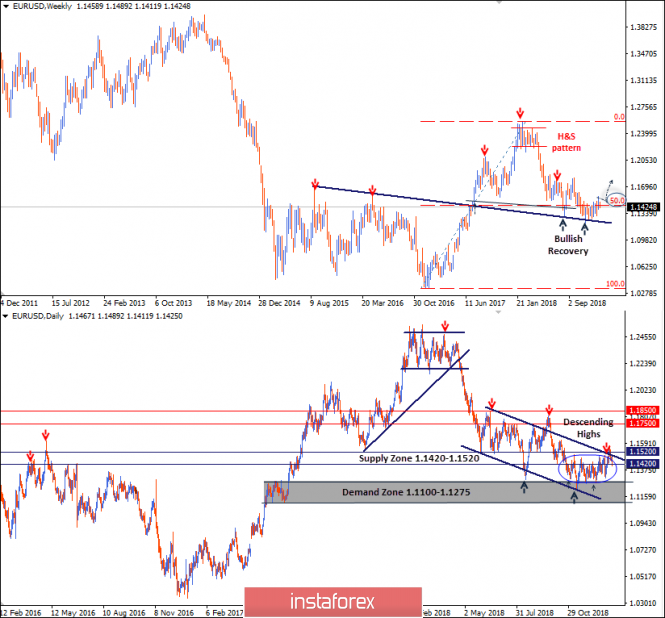

On the weekly chart, the EUR/USD pair is demonstrating a long-term Head and Shoulders reversal pattern where the right shoulder is currently in progress.

On the Daily chart, the pair has been moving sideways with slight bearish tendency. Narrow sideway consolidations have been maintained within the depicted daily movement channel since June 2018.

On November 13, the EUR/USD demonstrated recent bullish recovery around 1.1220-1.1250 where the lower limit of the channel as well as the depicted demand zone came to meet the pair.

Bullish fixation above 1.1420 was needed to enhance further bullish movement towards 1.1520. However, the market has demonstrated significant bearish rejection around 1.1420 few times so far.

Last week, a recent attempt of bullish breakout above 1.1520 (upper limit of the depicted movement channel) was executed. However, early signs of bearish rejection are being expressed on the H4 and daily charts.

Bullish persistence above 1.1520 enables further bullish advancement towards 1.1600 (October's High) and probably 1.1720 if enough bullish momentum is maintained.

On the other hand, any bearish decline below the key-levels of 1.1520 & 1.1420 brings more sideway consolidations down to 1.1260 again.

The material has been provided by InstaForex Company - www.instaforex.com