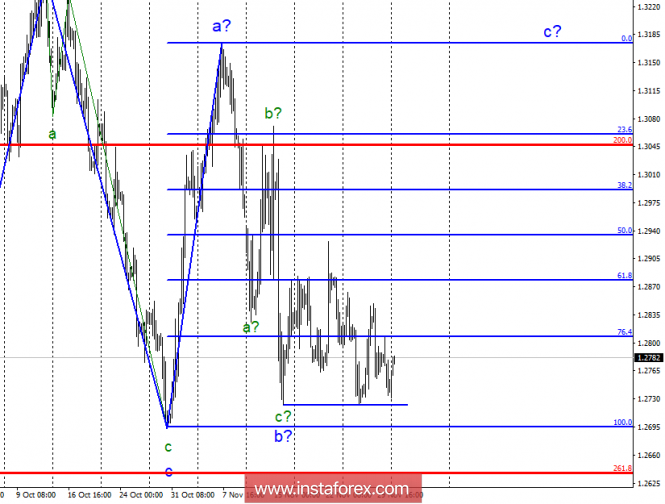

Wave counting analysis:

During the November 30 trading session, the GBP / USD currency pair lost about 30 basis points, but the minimum of the expected wave b did not break through, therefore, the chances of building an upward wave c remain. Until this breakthrough is reached, the pound sterling has quite good chances of rising to 32 and 33 figures within wave C. If the British Parliament accepts Theresa May on Brexit, this will be a strong support for the pound sterling, and the chances of building not only waves C, but a longer uptrend of the trend will increase significantly.

The objectives for the option with purchases:

1.2935 - 50.0% of Fibonacci

1.2991 - 38.2% of Fibonacci

1.3175 - 0.0% of Fibonacci

The objectives for the option with sales:

1.2695 - 100.0% of Fibonacci

1.2637 - 261.8% of Fibonacci (senior grid)

General conclusions and trading recommendations:

For the GBP / USD currency pair, the key level is 1.2721. A successful attempt to break through this mark will complicate the downward trend. Now, I still recommend cautious purchases of the pair, based on building an upward wave C with targets located between 1.2935 and 1.3175, which equates to 50.0% and 0.0% of Fibonacci. However, the negative news background from the UK, if it will, can "help" the tool to break through the mark of 1.2721.

The material has been provided by InstaForex Company - www.instaforex.com