GBP/USD has been quite bearish at the edge of 1.2850 from where it is expected to sink much lower in the coming days. GBP has been weighed down due to recent Brexit developments. On the other hand, despite mixed economic reports from the US USD managed to gain certain momentum.

Recently, lack of progress in the Brexit deal has badly hurt GBP. Moreover, GBP suffered a blow from resignation of the Brexit minister in protest against Theresa May's version of the divorce deal. Nevertheless, the UK is going to quit the EU with a deal. Citing some senior British Ministers, if Theresa May's Brexit deal is rejected by the parliament, there is a scenario that the UK will join the European Free Trade Zone (EFTA) which may have a positive impact on the overall economic development of the UK in the future. Recently Bank of England's Governor Carney spoke about the upcoming economic challenges regarding the interest rate issues and monetary policy which might be affected by the Brexit decision. His speech contained a dovish tone which lead GBP to lose momentum. Moreover, today CBI Realized Sales report is going to be published which is expected to increase to 10 from the previous figure of 5.

On the USD side, ahead of the upcoming rate hike in December which is more probable despite certain arguments on it, USD is currently quite impulsive with the recent gains. Today FOMC Member Clarida is going to speak about the upcoming interest rate decision and monetary policies which is expected to be quite bullish for the currency leading to certain impulsive momentum in the nearest days. Additionally, today HPI report is going to be published which is expected to increase to 0.4% from the previous value of 0.3% and CB Consumer Confidence report is expected to decrease to 136.2 from the previous figure of 137.9. Expectations of FOMC Meeting Minutes this week have already aroused optimism in the market. Thus, USD is expected to hold the upper hand in the pair.

Meanwhile, GBP is expected to struggle further against USD due to weak fundamentals in the UK. Ahead of the highly probable rate hike, USD is expected to gain impulsive momentum, leading to non-volatile gains.

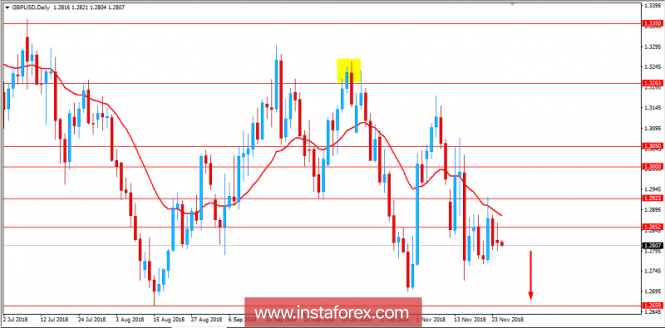

Now let us look at the technical view. The price is currently quite impulsive amid the bearish pressure while residing below 1.2850. The pair is expected to reach 1.2650 support area in the coming days. Despite ongoing volatility, the price is expected to trade lower amid the bearish pressure in volatile price momentum. As the price remains below 1.30 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 1.2550, 1.2650

RESISTANCE: 1.2850, 1.2920, 1.30

BIAS: BEARISH

MOMENTUM: VOLATILE