On Monday, optimism reigned in the markets. This was supported by rising expectations that the Fed would pause raising interests by next year. Furthermore, investors are hoping that Washington and Beijing will be having an agreement on customs duties which might be discussed at the G20 summit.

Shares of retailers, which rose in the wake of sales last week, was supported by stock markets. However, the main beneficiaries were securities of companies in the financial sector, which grew quite well on a wave of increased hopes in which the Fed could pause at an unhurried rate of interest rates. On the other hand, the local growth in demand for risky assets can be explained by the trivial closure of short positions. There are warming expectations that the USA and China will be able to agree on customs duties at the G20 summit.

The US dollar on Monday rose against major currencies, with the exception of the New Zealand, supported by the demand for dollar assets.The single European currency also came under pressure against the background of the ECB President's comment, M. Draghi, who, despite the statement that the regulator would stop the quantitative easing program by the end of the year, was traditionally careful, making it clear that further actions by the bank would depend from the situation in the economy. These words, as well as problems with the adoption of the budget of Italy, put pressure on the euro.

The British pound has been stabilized in Brexit. It seems that the situation remains extremely uncertain , which does not allow investors to be active, since the result can both play in favor of sterling and, on the contrary, have a negative impact on it. While the markets are hoping that a decision will be made. In this case, certainty can support the local exchange rate of the British currency.

Today, consumer confidence index data from the Conference Board will be published. A decline is expected to 135.9 points against 137.9 points. If the decline is more noticeable, this may cause a new wave of "optimism" in the US stock market and strengthen investors in the thought that the Fed will necessarily pause in raising interest rates next year. On this wave, the dollar may again get support due to the growing demand for dollar assets.

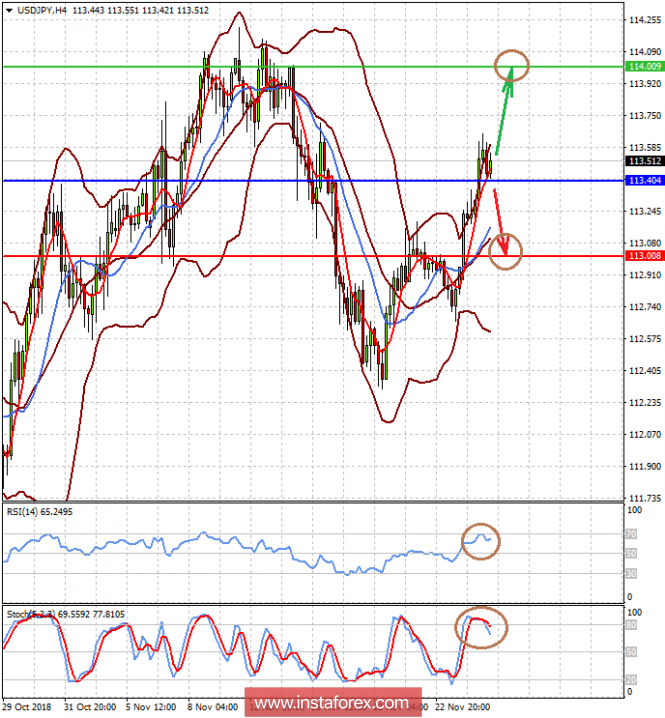

Forecast of the day:

The USDJPY pair is trading above the 113.30 mark, continuing to remain in the local side, but at the same time in a short-term uptrend. It can be assumed that there will not be any specific dynamics before the G20 summit results. From a technical point of view, the pair continues to balance. If the price holds above the level of 113.40, it may rise to 114.00, but a decline below this mark will lead to its fall to 113.00.

The pair USDCAD is trading below 1.3260. It is also influenced by the USDJPY pair. In addition, it should be borne in mind that if oil prices resume falling, it will push the pair up and after breaking through 1.3260 it may rise to 1.3300. The continuation of a local increase in oil prices will put pressure on the pair, and it may fall to 1.3200-10.