EUR/USD has been quite impulsive inside the bearish bias recently, residing below 1.1430-1.1500 resistance area with a daily close. Despite mixed economic reports from the US, USD managed to gain momentum as EUR has worse fundamentals leading to severe weakness in the pair.

A series of worse Manufacturing and Services PMI reports and the budget crisis in Italy made the single European currency lose momentum against USD recently. Amid the recent meeting between Italy's Prime Minister and European Commission President at Brussels, Italy and the European Commission will work in the nearest days to come to a common denominator on Italy's 2019 draft budget. Nevertheless, the budget still breaches some EU rules. The European Commission took the first step on Wednesday after Rome refused to change it which increased uncertainty in the whole eurozone and could eventually lead to certain fines. Though the meeting did not ended with a significant decision, it provided certain hints about what measures should be taken to solve the issue. ECB President Draghi's speech and the EU Economic summit today are the market-moving events which could make a significant impact on a further dynamic of EUR. Moreover, German Ifo Business Climate report is going to be published which is expected to have a slight decrease to 102.3 from the previous figure of 102.8.

On the other hand, USD is struggling with mixed economic reports. So, USD might lose some momentum ahead of the ECB event today due to high volatility in the market. Notably, EUR gains are likely to be quite short-lived. Tomorrow US Consumer Confidence report is going to be published which is expected to decrease to 136.2 from the previous figure of 137.9, which might lead to certain weakness on the USD if the forecast comes true or the report is worse than expected. Besides, FOMC Meeting Minutes on Thursday are expected to disclose the upcoming interest rate decision which is expected to be quite positive and may lead to impulsive gains on the USD side by the end of this week.

In the meantime, this week the pair is expected to be quite volatile and corrective on the back of important events from the eurozone and the US. EUR is expected to struggle for gains in the long term. Nevertheless, ahead of a rate hike by the Federal Reserve next month, USD is likely to hold the upper hand.

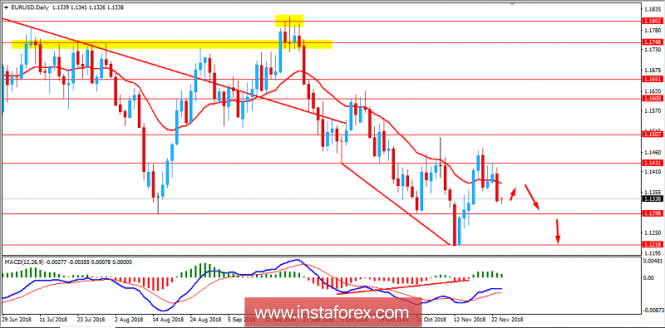

Now let us look at the technical view. The price has been quite impulsive amid the bearish bias recently that lead the price to breach below the dynamic level of 20 EMA with a daily close while residing below 1.1430-1.1500 resistance area. Amid such momentum, the price may correct itself for a certain period before it starts to push lower towards 1.1300 and later towards 1.1200 support area in the coming days. As the price remains below 1.1500 with a daily close, the bearish bias is expected to continue.

SUPPORT: 1.1200, 1.1300

RESISTANCE: 1.1430, 1.1500

BIAS: BEARISH

MOMENTUM: VOLATILE