Friday's US labor market data do not change anything in assessing the Fed's outlook. Salary dynamics in line with forecasts and at the level of 2.8 y / y. The unemployment rate has been lowest for almost five decades. Powerful revisions of data for the previous two months (in total by over 85,000). All this cemented the conviction that weakness is temporary and dictated largely by hurricane Florence.

At the start of the week, volatility should be limited. After all, the macro calendar is practically empty, in the USA Columbus Day and in Japan, the Day of Sport was celebrated. Despite the loosening of the policy by the People's Bank of China (reduction in the reserve requirement), the sentiment is weak - after the Christmas break, Shanghai Composite is down 3.0%.

The day's event in the EM world will be the real reaction of the BOVESPA index (as well as sugar and coffee - raw materials heavily dependent on the BRL valuation) on the result of the presidential election in Brazil. Representing the extreme right, J. Bolsonaro almost won the first round. The polls indicated its growing advantage (which gave rise to a strong rebound), but such high support is not discounted and should prolong the rally.

Throughout the week, fiscal and monetary policy perspectives will remain in the foreground, alongside the assessment of the effects of trade wars. Europe will focus more than the data on the Italian budget and progress in Brexit negotiations. In the US, PPI and CPI inflation figures will be screened for whether they justify an aggressive rate of interest rate increases. In addition, attention is drawn to the trade balance from China in the face of tightened customs policy.

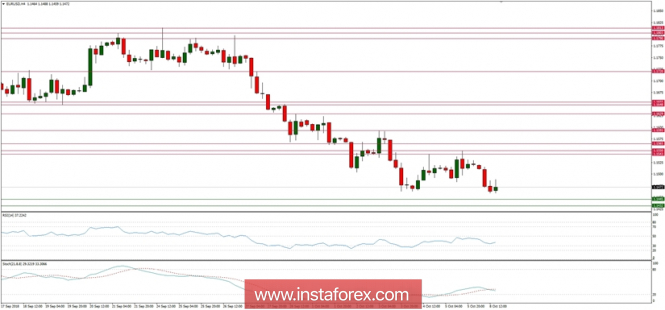

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The market tried to rally higher but was capped at the level of 1.1550 and then reversed. Currently, the price is trading around the level of 1.1470, just above the technical support at the level of 1.1445. Any violation of this level would likely extend the drop towards the level of 1.1432. Please notice the clear and visible bullish divergence between the price and the momentum oscillator, so the spike up might occur any time now.