USDCAD has been quite impulsive amid the bearish bias recently whereas the bearish gap is not filled by the bulls yet. This indicates the strength of bears in the process. Despite a rate hike to 2.25% from the previous value of 2.00%, USD failed to gain over CAD and also could not sustain the previous pressure it had.

A series of macroeconomic reports is due on Friday, including Non-Farm Employment Change which is expected to decrease to 185k from the previous figure of 201k, Average Hourly Earnings to decrease to 0.3% from the previous value of 0.4%, and Unemployment Rate to decrease to 3.8% from the previous value of 3.9%. Ahead of these reports, USD is still quite indecisive that might trigger higher volatility. Today US ADP Non-Farm Employment Change report was published with an increase to 230k from the previous figure of 168k which was expected to be at 185 and ISM Non-Manufacturing PMI report was also published with an increase to 61.6 from the previous figure of 58.5 which was expected to decrease to 58.0. Despite positive results even today, USD failed to gain ground against CAD.

On the CAD side, ahead of the high impact economic reports from the US on Friday, CAD is quite very optimistic with the upcoming results. There is no impactful news or event on the CAD side today but on Friday CAD Employment Change is expected to show a significant increase to 25.0k from the previous figure of -51.6k, Unemployment Rate is expected to decrease to 5.9% from the previous value of 6.0% but Trade Balance is expected to decrease to -0.5B from the previous figure of -0.1B.

Meanwhile, CAD is expected to assert its strength because of the upcoming high impact reports in comparison to USD. As CAD is the dominant currency in the pair, any positive CAD report is expected to provide a further push to the bearish pressure in the coming days. On the other hand, if USD also shows better results, the pair may get extremely volatile for the coming days without any definite pressure and increased corrective price action.

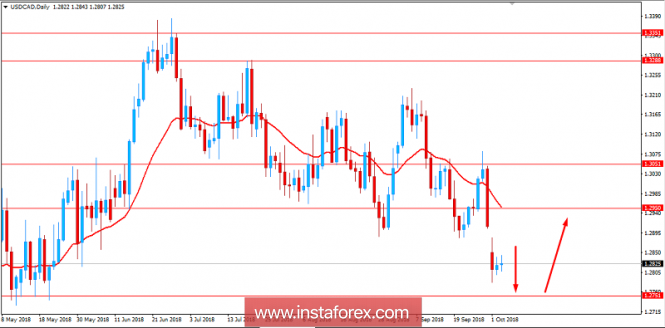

Now let us look at the technical view. The price has been quite indecisive and low on liquidity throughout this week but as per current fundamental position, CAD is expected to lead the price lower towards 1.2750 area before USD makes it move to push the price higher again. Despite the bearish gap in the price this week, CAD is expected to push lower towards 1.2750 area before bouncing up higher with target towards 1.2950 area in the future. As the price remains below 1.3050 area, the bearish bias is expected to continue.

SUPPORT: 1.2750

RESISTANCE: 1.2950, 1.3050

BIAS: BEARISH

MOMENTUM: VOLATILE