AUD/JPY has been quite volatile and indecisive after breaking below 80.50 with a daily close. JPY failed to sustain its bearish momentum in the pair as of recent positive AUD results published with positive results.

Mixed economic data from Australia, released ealier this week, caused indecision about AUD among investors and added more volatility to the market. However, AUD is still able to extend its advance against JPY. Today Australia's Employment Change report was published with a decrease to 5.6k from the previous figure of 44.6k which was expected to be at 15.2k and Unemployment Rate dropped to 5.0%, defying expectations for the flat reading at 5.3%. Moreover, NAB Quarterly Business Confidence report was published with a decrease to 3 from the previous figure of 7.

On the other hand, JPY has been quite positive today which helped the currency to gain certain momentum for a while. Today, Japan's Trade Balance report was published with an increase to -0.24T from the previous figure of -0.19T which was expected to be at -0.34T. Though the figure decreased from the previous figure but it was not as gloomy as expected which encouraged gains for JPY today.

Meanhwile, AUD has been trading without a certain trend, whereas positive outcome of Japan's Trade Balance is expected to strengthen JPY pressure in the long run. To sum up, despite certain AUD bullish pressure being observed in this pair, the price is expected to fall deeper amid impulsive bearish pressure with the long-term bearish trend in the future.

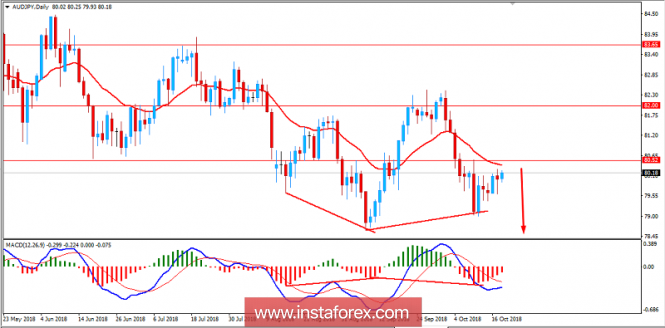

Now let us look at the technical view. The price is currently residing just below 80.50 and dynamic resistance of 20 EMA amid the bullish pressure. Recently the price has formed Bearish Convergence as well which is expected to push the price lower towards 78.50 area in the coming days. As the price remains below 82.00 with a daily close, the bearish bias is expected to continue.

SUPPORT: 78.50

RESISTANCE: 80.50, 82.00

BIAS: BEARISH

MOMENTUM: VOLATILE