Dear colleagues.

For the Euro / Dollar currency pair, the potential for a downward movement is limited by the level of 1.1414. In general, we expect a rollback to the top. For the currency pair Pound / Dollar, we are following the downward structure from September 20. At the moment, we are expecting a movement towards 1.2908. The currency pair Dollar / Franc, we are following the development of the ascending cycle of September 21 and we expect further uptrend after the breakdown of 0.9925. For the Dollar / Yen currency pair, the subsequent targets for the top were determined from the local structure on September 27. For the Euro / Yen currency pair, the continuation of the development of the downward structure of September 25 is expected after the breakdown of 130.94. The currency pair Pound / Yen, the situation is in equilibrium from October 1. The potential for downward movement is formed and the level of 149.00 is the key resistance for the top.

Forecast for October 4:

Analytical review of H1-scale currency pairs:

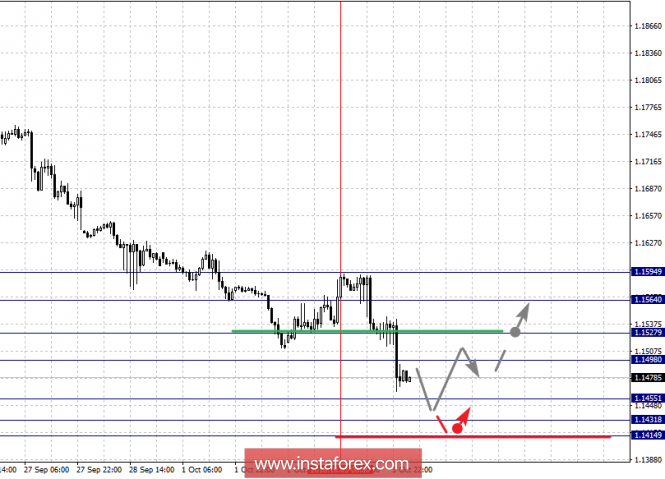

For the Euro / Dollar currency pair, the key levels on the scale of H1 are: 1.1594, 1.1564, 1.1527, 1.1498, 1.1455, 1.1431 and 1.1414. Here, the price forms a local potential for the downward movement of October 3. The short-term downward movement is possible in the range of 1.1455 - 1.1431, from here we expect a key upward reversal. The range of 1.1431 - 1.1414.

The short-term uptrend is possible in the range of 1.1498 - 1.1527 and breaking the last value will lead to an in-depth correction. Here, the goal is 1.1564 and this level is the key support for the downward structure of October 3. Its breakdown will have to form the initial conditions for the upward cycle 1.1594.

The main trend is the local structure for the bottom of October 3.

Trading recommendations:

Buy 1.1498 Take profit: 1.1525

Buy 1.1530 Take profit: 1.1562

Sell: 1.1455 Take profit: 1.1433

Sell: Take profit:

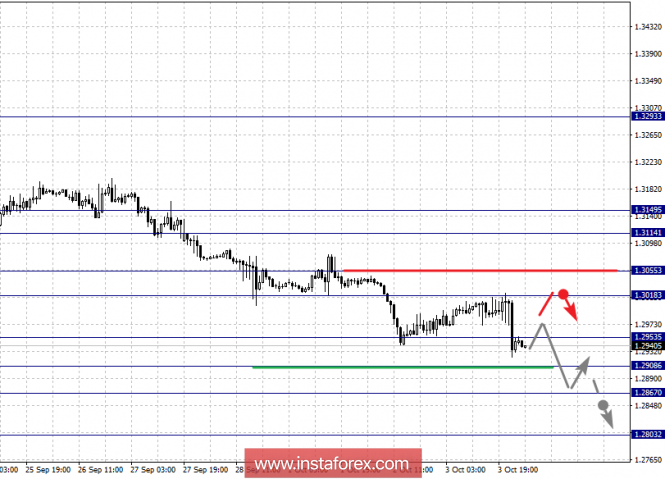

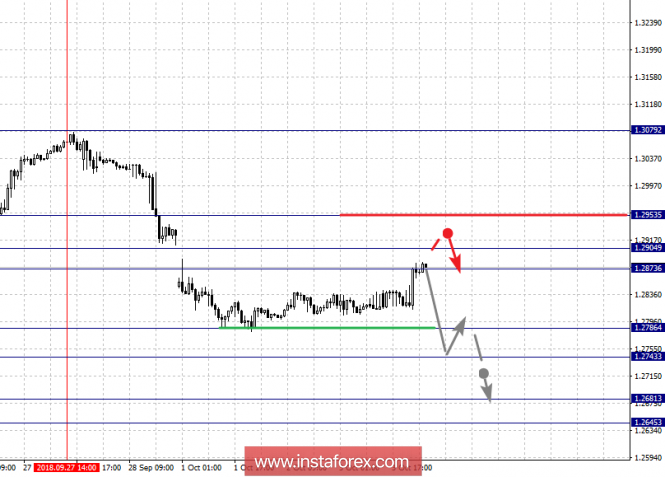

For the Pound / Dollar currency pair, the key levels on the scale of H1 are: 1.3114, 1.3055, 1.3018, 1.2953, 1.2908, 1.2867 and 1.2803. Here, we are following the downward structure of September 20th. At the moment, we expect to reach the level of 1.2908 and in the range of 1.2908 - 1.2867 is the short-term downward movement, as well as the consolidation. The potential value for the bottom is considered the level of 1.2803 and the movement to which is expected after the breakdown of 1.2865.

The short-term upward movement is possible in the range of 1.3018 - 1.3055 and the breakdown of the latter value will lead to a prolonged movement. Here, the target is 1.3114. The range of 1.3114 - 1.3149, before it we expect clearance of the expressed initial conditions for the ascending cycle.

The main trend is the downward structure of September 20.

Trading recommendations:

Buy: 1.3018 Take profit: 1.3053

Buy: 1.3057 Take profit: 1.3114

Sell: 1.2906 Take profit: 1.2868

Sell: 1.2865 Take profit: 1.2805

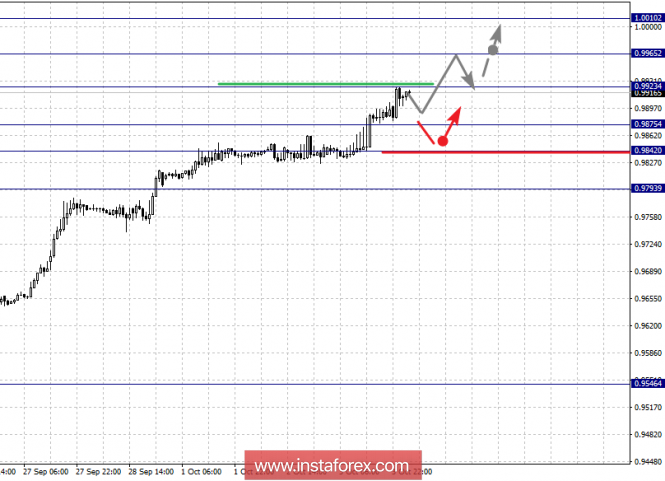

For the Dollar / Franc currency pair, the key levels on the scale of H1 are: 1.0010, 0.9965, 0.9923, 0.9875, 0.9842 and 0.9793. Here, we continue to follow the development of the ascending cycle of September 21. The short-term upward movement is possible in the range of 0.9923 - 0.9965 and the breakdown of the latter value will lead to movement to the potential target of 1.0010, from this level we expect a rollback downwards.

The short-term downward movement is possible in the range of 0.9875 - 0.9842 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.9793 and this level is the key support for the upward structure.

The main trend is the rising structure of September 21.

Trading recommendations:

Buy: 0.9924 Take profit: 0.9963

Buy: 0.9967 Take profit: 1.0010

Sell: 0.9875 Take profit: 0.9844

Sell: 0.9840 Take profit: 0.9796

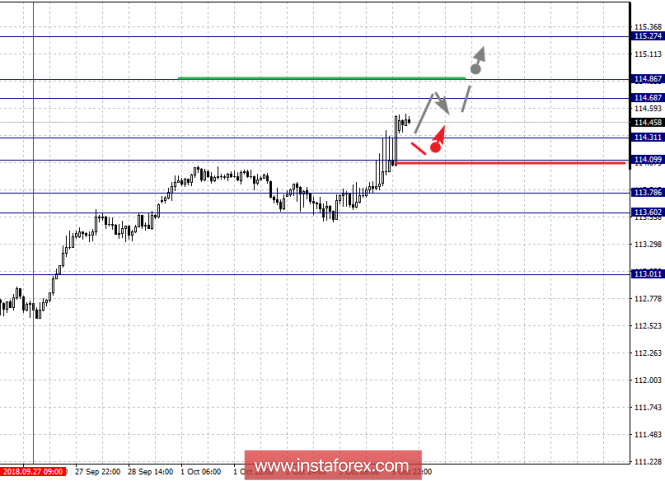

For the Dollar / Yen currency pair, the key levels on the scale of H1 are: 115.27, 114.86, 114.68, 114.31, 114.09, 113.78 and 113.60. Here, the subsequent goals for the top, we have determined from the ascending structure of September 27. The short-term uptrend is possible in the range of 114.68 - 114.86 and the breakdown of the last value will lead to the movement to the potential target of 115.27, upon reaching this level we expect a rollback downwards.

The short-term downward movement is possible in the range of 114.31 - 114.09 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 113.78 and the range of 113.78 - 113.60 is the key support for the upward structure.

The main trend: a local rising structure of September 27.

Trading recommendations:

Buy: 114.68 Take profit: 114.84

Buy: 114.87 Take profit: 115.25

Sell: 114.30 Take profit: 114.12

Sell: 114.06 Take profit: 113.80

For the Canadian dollar / Dollar currency pair, the key levels on the scale of H1 are: 1.2953, 1.2904, 1.2873, 1.2846, 1.2786, 1.2743, 1.2681 and 1.2645. Here, we are following the downward structure of September 27. At the moment, the price is in the correction zone. The short-term downward movement is possible in the range of 1.2786 - 1.2743 and the breakdown of the latter value will lead to a pronounced movement. Here, the target is 1.2681. The potential value for the bottom is considered the level of 1.2645, upon reaching which we expect consolidation in the range of 1.2645 - 1.2681, as well as a rollback to the top.

The short-term uptrend is possible in the range of 1.2846 - 1.2873 and the breakdown of the last value will lead to a prolonged correction. Here, the goal is 1.2904 and this level is the key support for the downward structure of September 27. Its price will have the formation of the initial conditions for the upward cycle. In this case, the target is 1.2953.

The main trend is the downward structure of September 27, the stage of correction.

Trading recommendations:

Buy: 1.2846 Take profit: 1.2871

Buy: 1.2874 Take profit: 1.2902

Sell: 1.2784 Take profit: 1.2746

Sell: 1.2740 Take profit: 1.2684

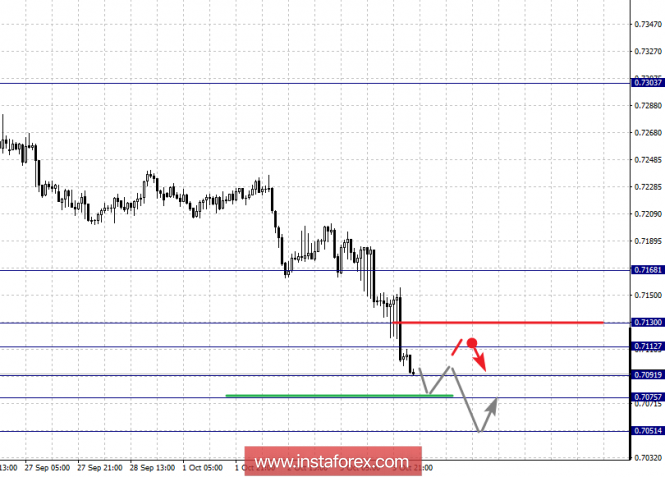

For the Australian dollar / dollar currency pair, the key levels on the scale of H1 are: 0.7168, 0.7130, 0.7112, 0.7091, 0.7075 and 0.7051. Here, we are following the downward structure of September 21. The short-term downward movement is possible in the range of 0.7091 - 0.7075 and the breakdown of the latter value will lead to movement to the potential target of 0.7051, upon reaching this level we expect a rollback to the top.

The short-term uptrend is expected in the range of 0.7112 - 0.7130 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.7168 and this level is the key support.

The main trend is the downward structure of September 21.

Trading recommendations:

Buy: 0.7112 Take profit: 0.7128

Buy: 0.7132 Take profit: 0.7165

Sell: 0.7090 Take profit: 0.7077

Sell: 0.7072 Take profit: 0.7053

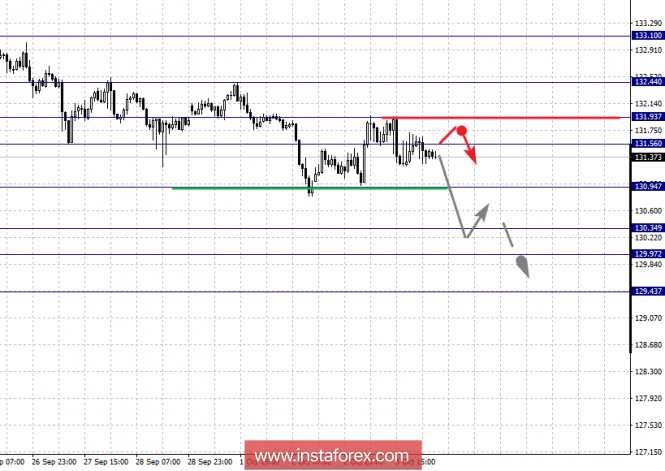

For the Euro / Yen currency pair, the key levels on the scale of H1 are: 132.44, 131.93, 131.56, 130.94, 130.34, 129.97 and 129.43. Here, we continue to monitor the downward structure of September 25. A downward movement is expected after breakdown of 130.94. In this case, the goal is 130.34 and in the range of 130.34 - 129.97 is the short-term movement, as well as the consolidation. The potential value for the bottom is considered the level of 129.43, after reaching which we expect a rollback to the top.

The short-term upward movement is possible in the range of 131.56 - 131.93 and the breakdown of the last value will lead to a prolonged correction. Here, the goal is 132.44 and this level is the key support for the downward structure. Its breakdown will have to develop the ascending structure. In this case, the potential target is 133.10.

The main trend is the downward structure of September 25.

Trading recommendations:

Buy: 131.56 Take profit: 131.90

Buy: 131.95 Take profit: 132.40

Sell: 130.90 Take profit: 130.40

Sell: 130.31 Take profit: 130.00

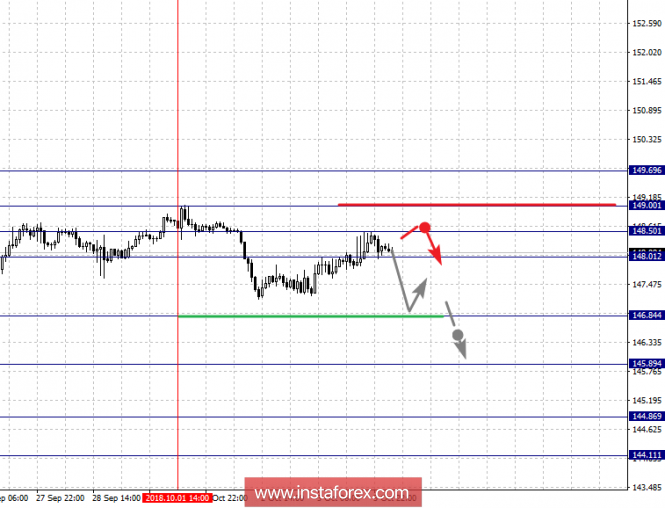

For the Pound / Yen currency pair, the key levels on the scale of H1 are: 149.00, 148.50, 148.01, 146.84, 145.89, 144.86 and 144.11. Here, the situation is in equilibrium from October 1 and the local potential is formed for the downward movement. The continuation of the downward movement is expected after the breakdown of 146.84. Here, the target is 145.89 and near this level is the consolidation. The break of 145.89 will lead to the development of a pronounced movement. Here, the goal is 144.86. The potential value for the bottom is considered the level of 144.11, upon reaching which we expect a rollback to the top.

The short-term uptrend is possible in the range of 148.01 - 148.50 and the breakdown of the last value will lead to an in-depth correction. Here, the goal is 149.00 and this level is the key support for the downward structure, and the breakdown will have to form the initial conditions for the upward cycle.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 148.01 Take profit: 148.50

Buy: 148.60 Take profit: 149.00

Sell: 146.80 Take profit: 146.00

Sell: 145.85 Take profit: 145.00

The material has been provided by InstaForex Company - www.instaforex.com