Dear colleagues.

For the Euro / Dollar currency pair, the development of the downward structure of October 3 is expected after the price passes the range of 1.1431 - 1.1414. For the Pound / Dollar currency pair, the upward structure of October 4 is considered as a medium-term structure. For the currency pair Dollar / Franc, we are following the development of the upward cycle from September 21 and we expect further uptrend after the breakdown of 0.9925. At the moment, the price is in the correction. For the currency pair Dollar / Yen, we are following the downward cycle of October 3 and the continuation of which we are expecting after the breakdown 112.70. For the currency pair Euro / Yen, we are following the development of the downward structure of September 25. For the currency pair Pound / Yen, we continue to follow the formation of the downward structure from October 8 and the level of 149.00 is the key support.

Forecast for October 10:

Analytical review of H1-scale currency pairs:

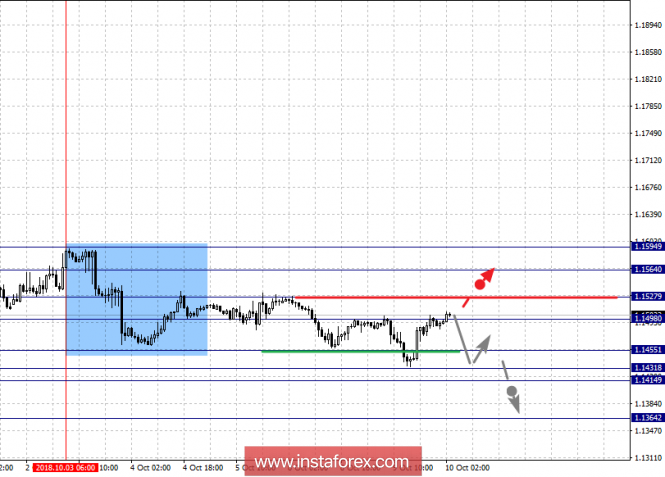

For the Euro / Dollar currency pair, the key levels on the scale of H1 are: 1.1594, 1.1564, 1.1527, 1.1498, 1.1455, 1.1431, 1.1414 and 1.1364. Here, we continue to monitor the downward structure of October 3. The short-term downward movement is possible in the range of 1.1455 - 1.1431, where we expect a key upward reversal. The range of 1.1431 - 1.1414 and the passage of its price will allow to count on a pronounced movement to the level of 1.1364.

The consolidated movement is expected in the range of 1.1498 - 1.1527 and the breakdown of the last value will lead to a deep correction. Here, the target is 1.1564 and this level is the key support for the downward structure of October 3. Its breakdown will have to form the initial conditions for the upward cycle. Here, the target is 1.1594 .

The main trend is the local structure for the bottom of October 3.

Trading recommendations:

Buy 1.1530 Take profit: 1.1562

Buy 1.1565 Take profit: 1.1592

Sell: 1.1455 Take profit: 1.1433

Sell: 1.1414 Take profit: 1.1366

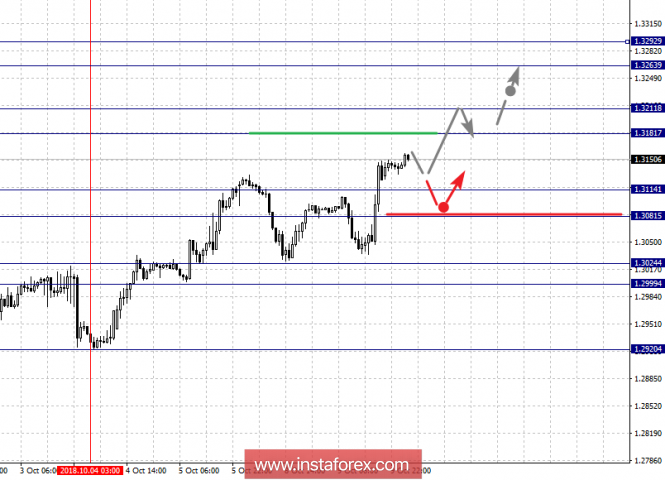

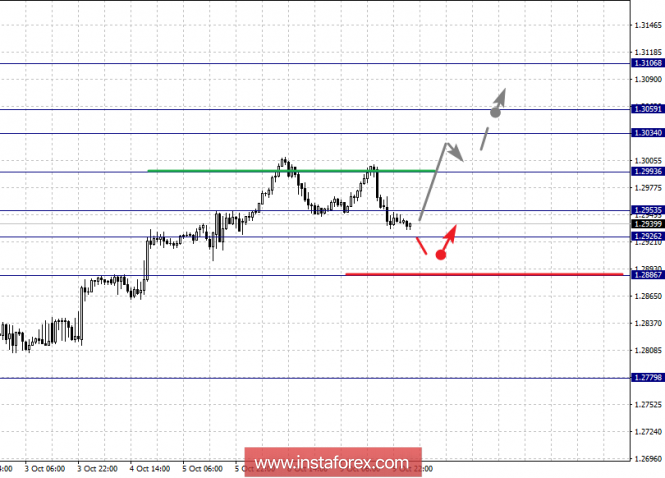

For the pound / dollar currency pair, the key levels on the scale of H1 are: 1.3292, 1.3263, 1.3211, 1.3181, 1.3114, 1.3081, 1.3024 and 1.2999. Here, we consider the ascending structure of October 4 as a medium-term structure. The short-term upward movement is possible in the range of 1.3181 - 1.3211 and the breakdown of the latter value will lead to the development of a pronounced movement. Here, the target is 1.3263. The potential value for the top is considered the level of 1.3292, upon reaching which we expect consolidation, as well as a rollback to the top.

The short-term downward movement is possible in the range of 1.3114 - 1.3081 and the breakdown of the latter value will lead to a prolonged movement. Here, the target is 1.3024 and the range of 1.3024 - 1.2999 is the key support for the upward structure.

The main trend is the upward cycle of October 4.

Trading recommendations:

Buy: 1.3181 Take profit: 1.3210

Buy: 1.3214 Take profit: 1.3260

Sell: 1.3114 Take profit: 1.3084

Sell: 1.3079 Take profit: 1.3030

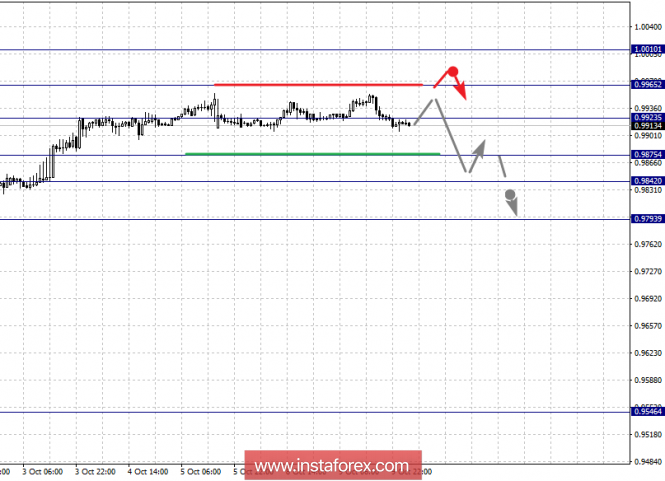

For the Dollar / Franc currency pair, the key levels on the scale of H1 are: 1.0010, 0.9965, 0.9923, 0.9875, 0.9842 and 0.9793. Here, we continue to follow the development of the ascending cycle of September 21. The short-term upward movement is possible in the range of 0.9923 - 0.9965 and the breakdown of the latter value will lead to movement to the potential target of 1.0010, from this level we expect a rollback downwards.

The short-term downward movement is possible in the range of 0.9875 - 0.9842 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.9793 and this level is the key support for the upward structure.

The main trend is the upward structure of September 21.

Trading recommendations:

Buy: 0.9924 Take profit: 0.9963

Buy: 0.9967 Take profit: 1.0010

Sell: 0.9875 Take profit: 0.9844

Sell: 0.9840 Take profit: 0.9796

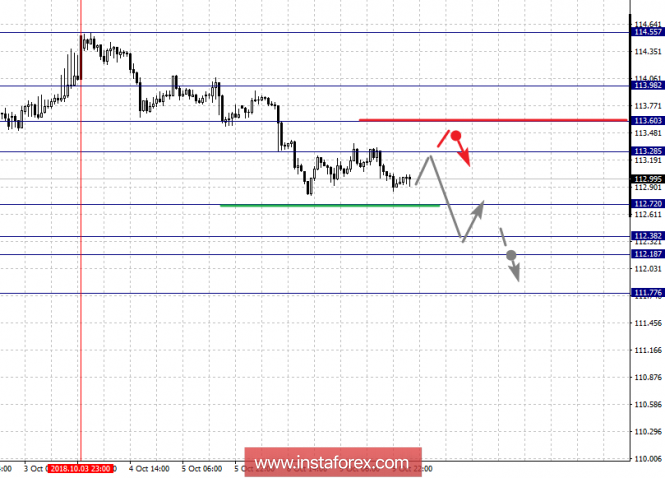

For the Dollar / Yen currency pair, the key levels on the scale of H1 are: 113.98, 113.60, 113.28, 112.27, 112.38, 112.18 and 111.77. Here, we are following the downward cycle of October 3rd. The downward movement is expected after breakdown of 112.72. In this case, the goal is 112.38 and in the range of 112.38 - 112.18 is the price consolidation. The potential value for the bottom is considered the level of 111.77, after reaching which we expect a rollback to the top.

The short-term upward movement is possible in the range of 113.28 - 113.60 and the breakdown of the latter value will lead to a prolonged correction. Here, the goal is 113.98 and this level is the key support for the downward structure.

The main trend: the downward cycle of October 3.

Trading recommendations:

Buy: 113.28 Take profit: 113.60

Buy: 113.63 Take profit: 113.98

Sell: 112.70 Take profit: 112.40

Sell: 112.16 Take profit: 111.80

For the Canadian dollar / Dollar currency pair, the key levels on the scale of H1 are: 1.3106, 1.3059, 1.3034, 1.2993, 1.2953, 1.2926 and 1.2886. Here, we are following the ascending structure of October 1. The upward movement is expected after the breakdown of 1.2993. In this case, the target is 1.3034 and in the range of 1.3034 - 1.3059 is the consolidation. The potential value for the top is considered the level of 1.3106, upon reaching which we expect consolidation and rollback downwards.

The consolidated movement is possible in the range of 1.2953 - 1.2926 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.2886 and this level is the key support for the upward structure from October 1.

The main trend is the ascending structure of October 1.

Trading recommendations:

Buy: 1.2995 Take profit: 1.3034

Buy: 1.3060 Take profit: 1.3104

Sell: 1.2953 Take profit: 1.2928

Sell: 1.2924 Take profit: 1.2887

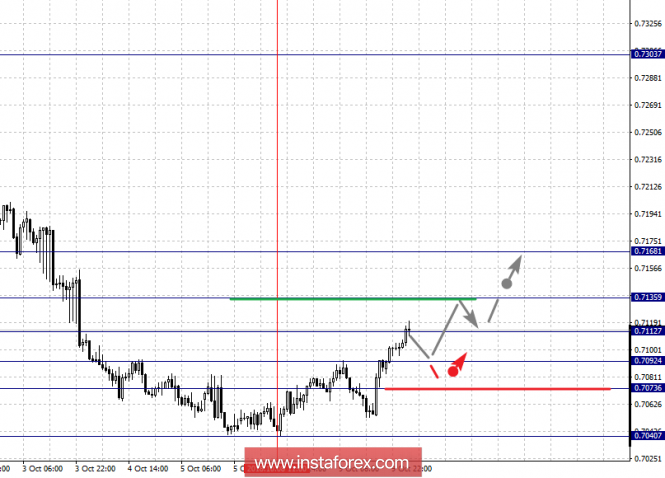

For the Australian dollar / dollar currency pair, the key levels on the scale of H1 are: 0.7168, 0.7135, 0.7112, 0.7092, 0.7073 and 0.7040. Here, we are following the formation of the ascending structure of October 8. The continuation of the movement upward is expected after the breakdown of 0.7135. In this case, the goal is 0.7168 and up to this level, we expect the registration of the expressed initial conditions for the top.

The short-term downward movement is expected in the range of 0.7092 - 0.7073 and the breakdown of the latter value will have to the development of a downward structure. In this case, the goal is 0.7040.

The main trend is the formation of the ascending structure of October 8.

Trading recommendations:

Buy: 0.7135 Take profit: 0.7165

Buy: Take profit:

Sell: 0.7092 Take profit: 0.7075

Sell: 0.7070 Take profit: 0.7045

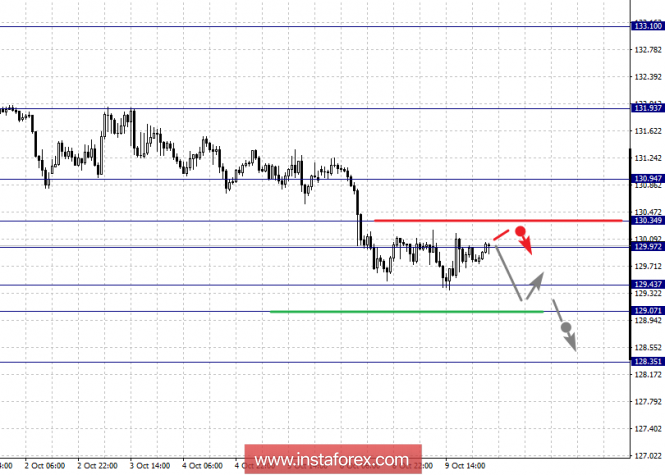

For the Euro / Yen currency pair, the key levels on the scale of H1 are: 130.94, 130.34, 129.97, 129.43, 129.07 and 128.35. Here, we continue to monitor the downward structure of September 25. The short-term downward movement is possible in the range of 129.43 - 129.07, hence the probability of a upward reversal. The breakdown of the level of 129.07 will allow us to count on the movement towards a potential target of 128.35, after reaching which we expect a rollback to the correction.

The short-term upward movement is possible in the range of 129.97 - 130.34 and the breakdown of the latter value will lead to a prolonged correction. Here, the goal is 130.94 and this level is the key support for the downward structure.

The main trend is the downward structure of September 25.

Trading recommendations:

Buy: 129.98 Take profit: 130.32

Buy: 130.37 Take profit: 130.90

Sell: 129.41 Take profit: 129.10

Sell: 129.03 Take profit: 128.40

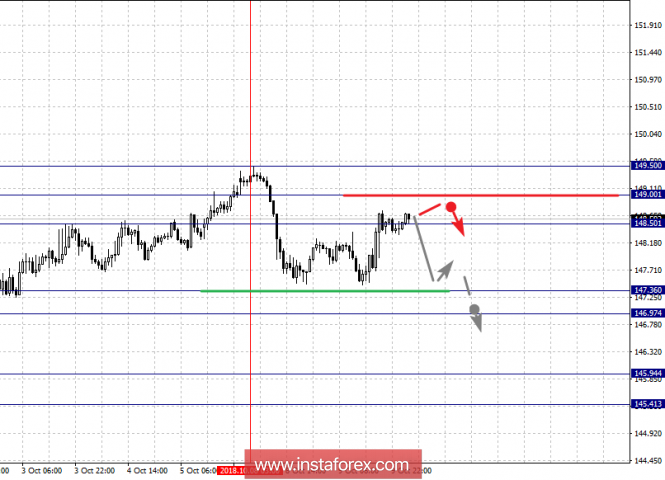

For the Pound / Yen currency pair, the key levels on the scale of H1 are: 149.50, 149.00, 148.50, 147.36, 146.97, 145.94 and 145.41. Here, we are following the formation of the downward structure of October 8. A downward movement is expected after the price passes the range of 147.36 - 146.97. In this case, the target is 145.94. The potential value for the downward structure is considered the level of 145.41, near which we expect consolidation, as well as a rollback to the top.

The short-term uptrend is possible in the range of 148.50 - 149.00. The breakdown of the latter value will have to form the initial conditions for the top. Here, the potential target is 149.50.

The main trend is the formation of the downward structure of October 8.

Trading recommendations:

Buy: 148.50 Take profit: 149.00

Buy: 149.05 Take profit: 149.50

Sell: 146.95 Take profit: 146.00

Sell: 145.90 Take profit: 145.44

The material has been provided by InstaForex Company - www.instaforex.com