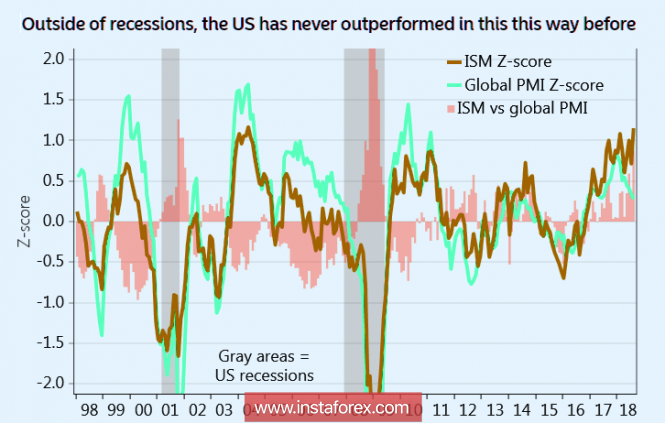

The US dollar is finished the week with an unconditional favorite. While the global PMI is declining due to the financial crisis in the number of developing countries and is at the lowest level since November 2016, ISM has got established itself above 60p, the production ISM has been at its maximum since 2004.

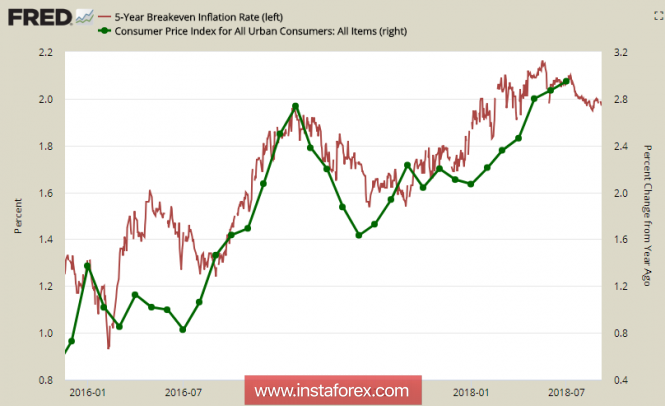

The employment report for August showed a sharp increase in average wages to 2.9% 2.7% a month earlier. Markets reacted poorly to the data output, considering that the Congressional elections and trade wars are now in the foreground, but from the point of view of the FRS's long-term plans, a strong increase in wages removes a number of concerns. It is no coincidence that the probability of a fourth increase this year reached 75% in the CME futures market, after which 50% at the beginning of the week can be regarded as a sharp change of mood.

This reaction is primarily due to the fact that the Fed is guided by the so-called "Phillips formula", according to which high growth rates of wages inevitably lead to an increase in consumer demand, and hence, to an increase in inflation. Accordingly, the Fed receives confirmation that the US economy is in a phase of growth, which gives it the right not to slow the pace of normalization of monetary policy.

Thus, all the concerns of the market were lifted after the speech of Powell in Jackson Hole. The dollar is again a favorite, as confirmed by the Friday report of the CFTC, which confirmed a strong preponderance of the cumulative bullish speculative position on the dollar in the futures market. Bonds TIPS has had not yet managed to react to the growth of inflationary expectations.

On Friday, Trump again confirmed his tough position regarding the intention to rewrite the rules of US foreign trade. According to him, the duties on the import of Chinese products will be raised soon, moreover, the next step is also being developed with a total volume of $ 267 billion. In addition, Trump announced the imminent start of negotiations with Japan on the development of a new bilateral agreement, as well as the intention to achieve a result with Canada within NAFTA, although Canada has so far refused to sign the document without concessions on the dispute resolution mechanism.

The dollar has every chance to spend a week in the green zone.

EUR/USD pair

On September 13, the ECB meeting on monetary policy will take place. Markets are calm and surprises are not expected. The main focus will be on the rhetoric of Draghi, as well as, the possible change in macroeconomic forecasts.

The Eurozone GDP growth slowed by only 0.4% in both quarters this year, which is below 0.7% on average for the quarter in 2017. The ECB is still quite far from the first rate hike, but the asset repurchase program is unlikely to be extended and will end by the end of this year.

Today, trade negotiations between the EU and the US begin in Brussels, hence, the euro's nervous reaction to any public statements is possible, but more likely it is still a quiet expectation of Thursday. The euro will be traded with a decrease with the nearest support at 1.1509. On Tuesday, the decline may accelerate to 1.1430.

GBP/USD pair

The pound plays out a leak about the EU's willingness to make some concessions in Brexit negotiations. The head of the EU delegation Michel Barnier warned that the two main provisions of the UK trade plan are unacceptable, accordingly, the concession on the part of the EU can mean the readiness to work out an interim document without specifying details, on which, at the moment the discrepancy is most severe. This is the approach proposed by the ruling coalition of Germany, and if it is adopted, the chances of developing an agreement will increase.

On Thursday, there will be a meeting of the Bank of England, which will be a passing event, surprises are not expected. The pound's reaction is predicted to be calm. The week, as a whole, will be quite tense. A report on industrial production and trade balance in July will be published today, a little later NIESR will give an estimate of GDP growth rates. It could significantly change the position of the pound if the data on average wages will be significantly different from the forecasts.

Today, GBP/USD pair is under the threat of increased volatility. There is no direction and the price will fluctuate in a wide range of 1.2786-1.3050.

The material has been provided by InstaForex Company - www.instaforex.com