EUR/JPY has been quite volatile at the edge of the resistance area of 129.00-50 from where certain bearish pressure can be observed currently. Amid recent mixed economic data from Japan, certain gain on the EUR side has been observed that is expected to be short-lived as JPY is expected to lead the way again in the coming days.

Ahead of the ECB decision on the benchmark refinancing rate which is expected to be unchanged at 0.00% and ECB Press Conference later this week, EUR has been struggling to gain momentum as it was expected to be. Today French Final Private Payrolls report was published with a decrease to 0.1% which was expected to be unchanged at 0.2%, German ZEW Economic Sentiment increased to -10.6 from the previous figure of -13.7 which was expected to be at -13.5 and Employment Change report was published unchanged at 0.4%. Moreover, ZEW Economic Sentiment was published with an increase to -7.2 from the previous figure of -11.1 which was expected to be at -10.9.

On the other hand, JPY has been quite positive with the recent economic reports which is expected to impact the future gains in the pair against EUR. Today Japan's M2 Money Stock report was published unchanged at 2.9% which was expected to increase to 3.0%, Tertiary Industry Activity report was published as expected with an increase to 0.1% from the previous negative value of -0.6%, and Prelim Machine Tool Orders report was published with a decrease to 5.3% from the previous value of 13.1%.

At present, both currencies in the pair have been affected by mixed economic reports today which is expected to lead to further indecision and correction in the process. Having comparison of the both currencies via fundamentals, JPY is still quite stronger against EUR whereas ECB Press Conference and Main Refinancing Rate is expected to have a great impact on further momentum in the pair.

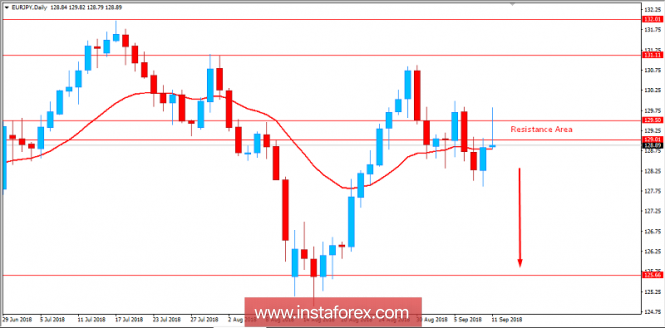

Now let us look at the technical chart. The price is currently residing below the resistance area of 129.00-50 area with a strong bullish rejection. Though the price has been volatile and corrective, a daily close below 129.00 is expected to provide the required confirmation for further bearish pressure in the pair with a target towards 125.50 support area in the coming days. As the price remains below 129.50 area, the bearish bias is expected to continue.

SUPPORT: 125.50

RESISTANCE: 129.00-50

BIAS: BEARISH

MOMENTUM: VOLATILE