USD/CAD has been quite impulsive with the recent bearish momentum which lead the price to reside at the edge of 1.2950 area from where a daily close below will lead to further bearish momentum. As the US has been struggling amid recent economic reports and trade war tensions with Canada, the market sentiment is currently favoring CAD gains for the future.

Though CAD has been quite mixed on the back of recent economic reports, it managed to gain better results and sentiment in comparison to USD in the process. Yesterday Canada's Manufacturing Sales report was published with a decrease to 0.9% from the previous value of 1.3% which was expected to be at 1.0%. The worse economic report did not affect gains of CAD. Judging by the current market situation, it led to further impulsiveness with the gains. Moreover, this week Canada's ADP Non-Farm Employment Change, CPI and Retail Sales reports are going to be published. Their expectations are quite mixed which would be unable to provide any definite momentum unless actual figure is published.

On the other hand, this week USD has been quite mixed with the economic reports as well, but today's economic data may change the course for a certain period. Today US Building Permits report is going to be published which is expected to be unchanged at 1.31M and Housing Starts is expected to increase to 1.24M from the previous figure of 1.17M. Additionally, today Crude Oil Inventories report is going to be published which is expected to increase to -2.7M from the previous figure of -5.3M.

Meanhwile, CAD is still quite strong fundamentally, winning favor with investors. Pending US economic reports today are expected to provide the required information for the upcoming market momentum in the pair. If USD fails to provide better than expected results, then CAD is likely to dominate further against USD for the coming days.

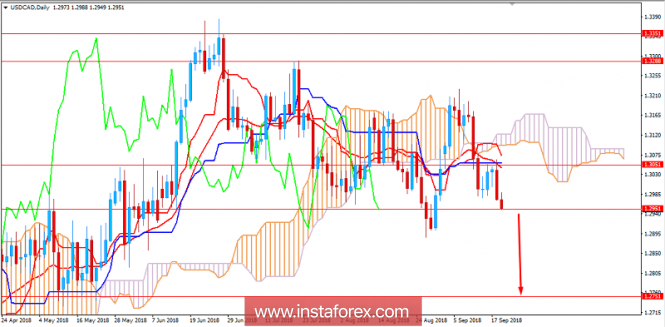

Now let us look at the technical view. The price has engulfed the previous bullish volatile price action yesterday which has the lead the price to reside at the edge of 1.2950 area currently. If the price managed to have a daily close below 1.2950 today, further bearish momentum with a target towards 1.2750 is expected in this pair. As the price remains below 1.3050 with a daily close, the bearish bias is expected to continue.

SUPPORT: 1.2750, 1.2950

RESISTANCE: 1.3050, 1.3200

BIAS: BEARISH

MOMENTUM: IMPULSIVE