EUR/JPY has been quite impulsive with recent bullish gains after breaching above 129.50 and retesting it as support for a further climb. EUR is currently trying to regain strength during the global financial crisis which triggered certain volatility for banks around the world. EUR has proved to be quite strong enough to sustain the momentum it has currently.

This week economic reports from the eurozone came in line with expectations, including Final CPI remaining unchanged at 2.0% as expected and Final Core CPI was also published unchanged at 1.0% as expected. Yesterday ECB President Draghi spoke about the benefits of European Supervision where 3 important benefits were discussed – 1. Having single supervisory method to harmonize the supervisory practices for the banks 2. A system wide perspective to monitor and compare the weaknesses and strengths 3. Reducing Fragmentation in the Supervisory Framework. The speech aroused a mixed response from the market. ECB is trying hard to keep the balance despite concerns about economic growth. Today again ECB President Draghi is going to deliver a speech which is expected to clear up policies for the eurozone's economy thus providing additional hints for further momentum. Moreover, today EUR Current Account report is going to be published which is expected to decrease to 22.4B from the previous figure of 23.5B.

On the other hand, today BOJ Policy Rate report was published unchanged -0.10% as expected which did not quite help JPY to gain any momentum over EURO in the process. Moreover, at BOJ Press Conference and Monetary Policy Statement, the slow and steady growth for the future is being expected by the BOJ officials which will help to stabilize the economy for future while having no immediate impact on the current market situation. This week on Friday, Japan's National Core CPI report is going to be published which is expected to increase to 0.9% from the previous value of 0.8%, Flash Manufacturing PMI is expected to increase to 53.1 from the previous figure of 52.5, and All Industry Activity is also expected to increase to 0.2% from the previous negative value of -0.8%.

Meanwhile, EUR has more surprises to disclose this week whereas JPY is expected to remain low the upcoming economic activities. As JPY is quite optimistic with the upcoming reports, whereas EUR having new policies for the benefit of the economy to be applied, certain volatility may be observed in the market. EUR is expected to take the lead amid the current market formation and sentiment.

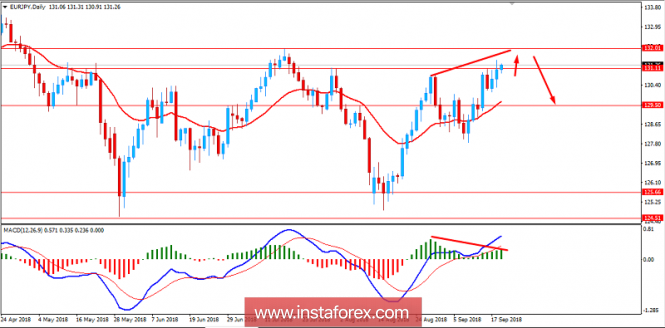

Now let us look at the technical view. The price is currently residing at the edge of 131.00-132.00 area from where certain bearish pressure may be observed as the price has formed a Bearish Continuous Divergence in the process which is expected to the price towards 129.50 area again the coming days. As the price remains below 132.00 area, certain bearish pressure can be observed in the future.

SUPPORT: 129.50

RESISTANCE: 131.00, 132.00

BIAS: BULLISH

MOMENTUM: VOLATILE