Dear colleagues.

For the currency pair Euro / Dollar, after the lifting of the upward trend, we follow the downward cycle from September 24. For the Pound / Dollar currency pair, we follow the downward structure from September 20 and we continue the downward movement after the breakdown at 1.3040. For the Dollar / Franc currency pair, we expanded the potential for the top to a level of 0.9852. For the currency pair Dollar / Yen, the continuation of the upward movement is expected after the breakdown of 113.55. For the currency pair Euro / Yen, the price forms the potential for a downward movement from September 25 in correction from an upward trend. For the Pound / Yen currency pair, the key resistance for the downward movement is the level of 147.59 and the breakdown of 149.25 will have an upward tendency.

Forecast for September 28:

Analytical review of H1-scale currency pairs:

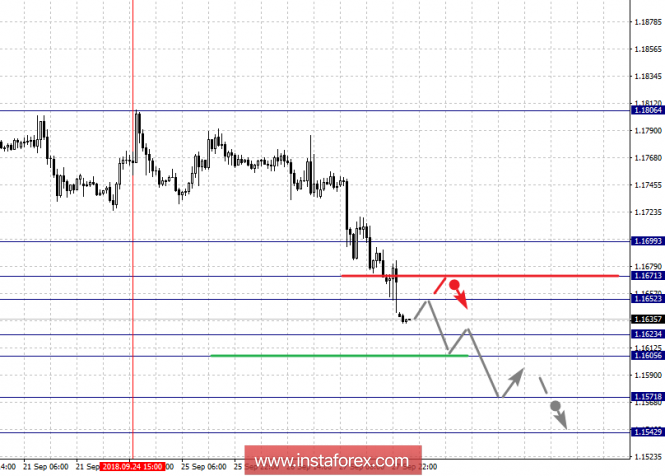

For the Euro / Dollar currency pair, the key levels on the scale of H1 are: 1.1699, 1.1671, 1.1652, 1.1623, 1.1605, 1.1571 and 1.1542. Here, after the lifting of the upward trend, we follow the development of a small downward cycle from September 24. The short-term downward movement is possible in the range of 1.1623 - 1.1605 and the breakdown of the latter value will lead to the development of a pronounced movement. In this case, the goal is 1.1571. The potential value for the bottom is the level of 1.1542, upon reaching which we expect a rollback upward.

The short-term upward movement is possible in the range of 1.1652 - 1.1671 and the breakdown of the latter value will lead to a deep correction. Here, the target is 1.1699, this level is a key support for the bottom.

The main trend is the downward cycle of September 24.

Trading recommendations:

Buy 1.1652 Take profit: 1.1670

Buy 1.1673 Take profit: 1.1696

Sell: 1.1604 Take profit: 1.1573

Sell: 1.1568 Take profit: 1.1543

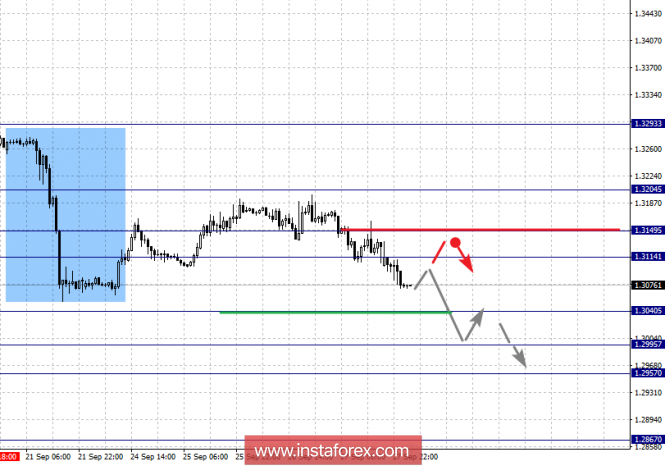

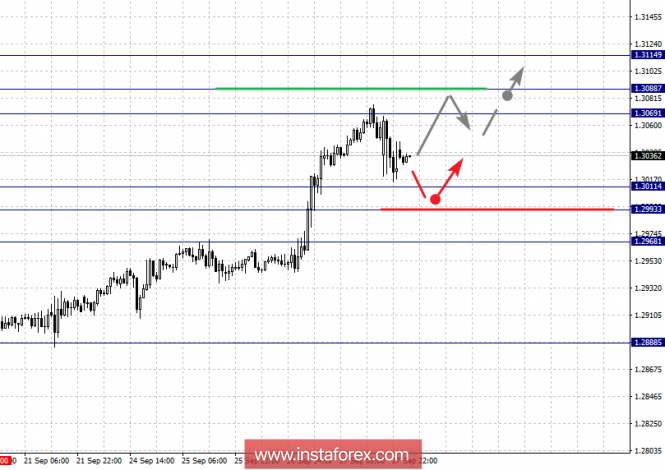

For the Pound / Dollar currency pair, the key levels on the scale of H1 are 1.3204, 1.3149, 1.3114, 1.3040, 1.2995, 1.2957, 1.2867 and 1.2803. Here, we are following the downward structure of September 20th. The continued downward movement is expected after the breakdown of 1.3040. In this case, the first target is 1.2995 and in the range of 1.2995 - 1.2957 is the consolidation of the price. The passage at the price range of 1.2995 - 1.2957 will lead to the development of a pronounced downward movement. Here, the target is 1.2867. The potential value for the bottom is the level of 1.2803, upon reaching which we expect a rollback to the top.

The short-term uptrend is possible in the range of 1.3114 - 1.3149 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3204 and this level is the key support for the downward structure.

The main trend is the downward structure of September 20.

Trading recommendations:

Buy: 1.3114 Take profit: 1.3147

Buy: 1.3152 Take profit: 1.3202

Sell: 1.3040 Take profit: 1.2995

Sell: 1.2993 Take profit: 1.2958

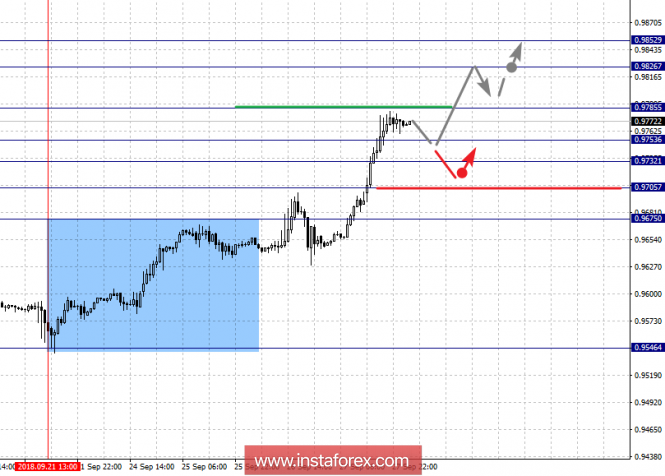

For the Dollar / Franc currency pair, the key levels on the scale of H1 are: 0.9852, 0.9826, 0.9785, 0.9753, 0.9732, 0.9705 and 0.9675. Here, we continue to follow the development of the upward cycle of September 21. The continued upward movement is expected after the breakdown of 0.9785. In this case, the target is 0.9826. The potential value for the top is the level of 0.9852, upon which we expect consolidation, as well as a pullback to the bottom.

The short-term downward movement is possible in the range of 0.9753 - 0.9732 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9705. Its breakdown will have to form the initial conditions for the downward cycle. In this case, the target is 0.9675.

The main trend is the upward structure of September 21.

Trading recommendations:

Buy: 0.9785 Take profit: 0.9824

Buy: 0.9827 Take profit: 0.9850

Sell: 0.9753 Take profit: 0.9733

Sell: 0.9730 Take profit: 0.9705

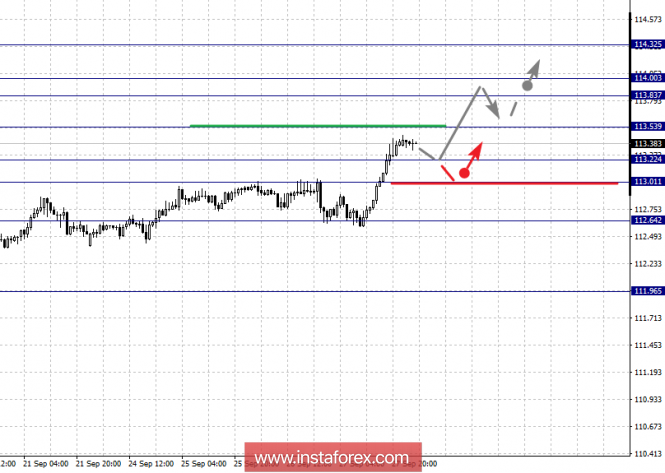

For the Dollar / Yen currency pair, the key levels on the scale of H1 are: 114.32, 114.00, 113.83, 113.53, 113.22, 113.01 and 112.64. Here, we are following the local ascending structure of September 13. The upward movement is expected after the breakdown of 133.53. In this case, the goal is 113.83, and in the range of 113.83 - 114.00 is the consolidation. The potential value for the top is considered to be the level of 114.32, upon reaching which we expect a rollback downwards.

The short-term downward movement is possible in the range of 113.22 - 113.01 and the breakdown of the latter value will lead to a prolonged correction. Here, the goal is 112.64 and this level is a key support.

The main trend: the local upward structure of September 13.

Trading recommendations:

Buy: 113.55 Take profit: 113.80

Buy: 114.03 Take profit: 114.30

Sell: 133.22 Take profit: 113.03

Sell: 112.99 Take profit: 112.68

For the Canadian dollar / Dollar currency pair, the key levels on the scale of H1 are: 1.3114, 1.3088, 1.3069, 1.3011, 1.2993 and 1.2968. Here, we are following the rising cycle of September 20th. The short-term uptrend is possible in the range of 1.3069 - 1.3088 and the breakdown of the latter value will lead to the movement to the potential target of 1.3114. Near this level, we expect consolidation, as well as rollback to the correction. In general, the upward structure of September 20 will subsequently be considered as medium-term initial conditions.

The short-term downward movement is possible in the range of 1.3011 - 1.2993 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.2968 and this level is a key support for the rising structure of September 20.

The main trend is the upward cycle from September 20.

Trading recommendations:

Buy: 1.3070 Take profit: 1.3085

Buy: 1.3090 Take profit: 1.3114

Sell: 1.3011 Take profit: 1.2995

Sell: 1.2990 Take profit: 1.2970

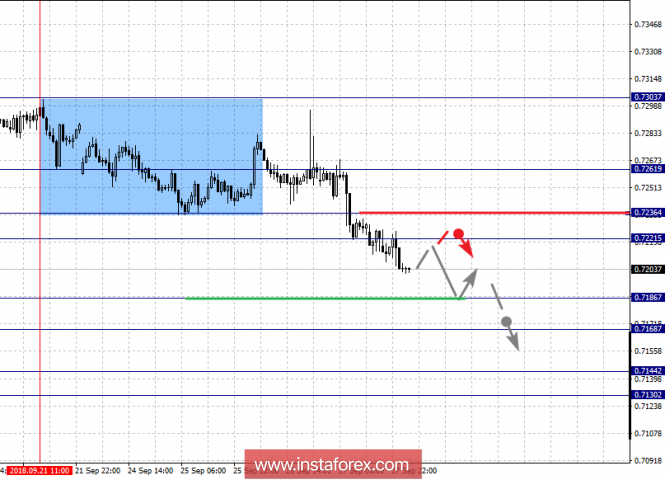

For the currency pair Australian dollar / Dollar, the key levels on the scale of H1 are: 0.7261, 0.7236, 0.7221, 0.7186, 0.7168, 0.7144 and 0.7130. Here, we are following the downward structure of September 21. The short-term downward movement is possible in the range of 0.7186 - 0.7168 and the breakdown of the latter value will lead to the development of a pronounced movement. Here, the target is 0.7144. The potential value for the bottom is considered to be the level of 0.7130, after reaching which we expect consolidation in the range 0.7144 - 0.7130, as well as a rollback to the top.

The short-term uptrend is expected in the range of 0.7221 - 0.7236 and the breakdown of the latter value will lead to a deep correction. Here, the target is 0.7261 and this level is a key support.

The main trend is the downward structure of September 21.

Trading recommendations:

Buy: 0.7221 Take profit: 0.7234

Buy: 0.7238 Take profit: 0.7260

Sell: 0.7186 Take profit: 0.7170

Sell: 0.7166 Take profit: 0.7146

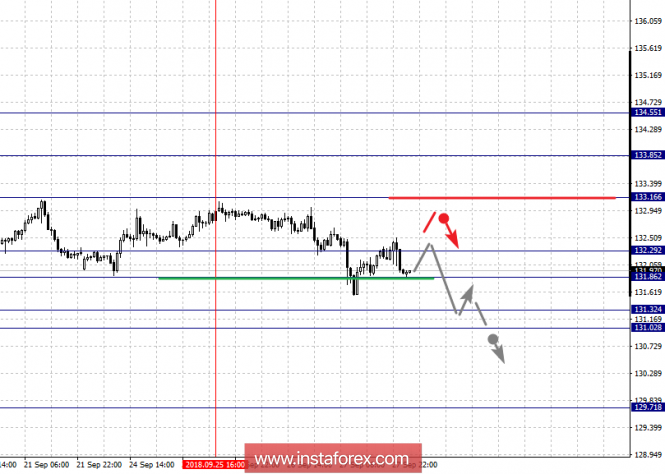

For the Euro / Yen currency pair, the key levels on the scale of H1 are: 134.55, 133.85, 133.16, 132.29, 131.86, 131.32 and 131.02. Here, the price is in correction from the rising structure on September 10 and forms the potential for the bottom of September 25. The continuation of the movement upward, we expect after the breakdown of 133.16. In this case, the goal is 133.85, near this level is the consolidation. The potential value for the upward trend is the level of 134.55, upon reaching which we expect a pullback downwards.

The consolidated movement is possible in the range of 132.29 - 131.86 and the breakdown of the latter value will lead to an in-depth correction. Here, the target is 131.32 and the range of 131.32 - 131.02 is a key support for the top.

The main trend is the upward cycle of September 10.

Trading recommendations:

Buy: 133.16 Take profit: 133.80

Buy: 133.90 Take profit: 134.50

Sell: 131.80 Take profit: 131.36

Sell: Take profit:

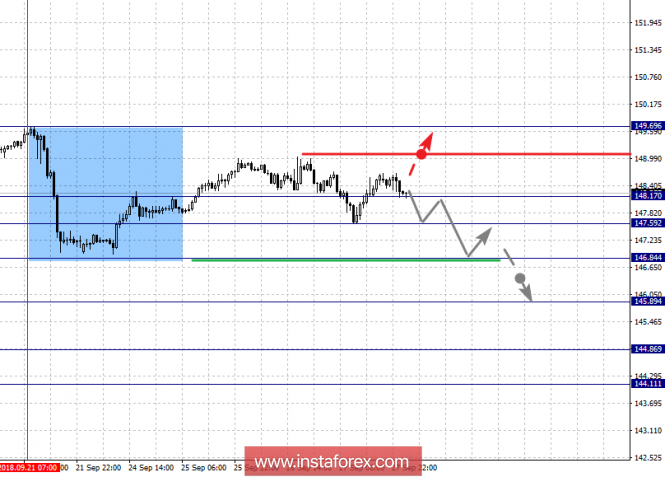

For the Pound / Yen currency pair, the key levels on the scale of H1 are 149.69, 148.17, 147.59, 146.84, 145.89, 144.86 and 144.11. Here, the descending structure of September 21 is still relevant as potential initial conditions. The short-term downward movement is possible in the range of 148.17 - 147.59 and the breakdown of the latter value will lead to the development of a downward trend. In this case, the first target is 146.84. Its breakdown, in turn, will lead to a movement to 145.89 and near this level is the consolidation. The breakdown of the level of 145.89 will lead to the development of a pronounced movement. Here, the target is 144.86. We consider the level of 144.11 to be a potential value for the bottom, after which we expect a rollback to the top.

Regarding the upward movement: to the level of 149.69 we expect the formation of a pronounced structure of the initial conditions for the subsequent definition of goals.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: Take profit:

Buy: Take profit:

Sell: 148.15 Take profit: 147.65

Sell: 147.55 Take profit: 146.90

The material has been provided by InstaForex Company - www.instaforex.com