Data released yesterday on inflation in the US exerted pressure on the US dollar, which fell against the euro and the pound, allowing to form new short-term upward trends in these trading instruments.

Statements made by the central banks of the United Kingdom and the eurozone did not differ much from similar statements made at past meetings. In more detail about the decision of the European Central Bank, I mentioned here . Plans and Decision of The of the Bank of England are Described in detail found here regarding, the Decision and Plans of the Bank of England.

Inflation in the US is weakening

As I noted above, inflation data in the US exerted pressure on the US dollar. Since despite the growth, the report turned out to be worse than economists' forecasts, and the base index showed a minimal increase at all.

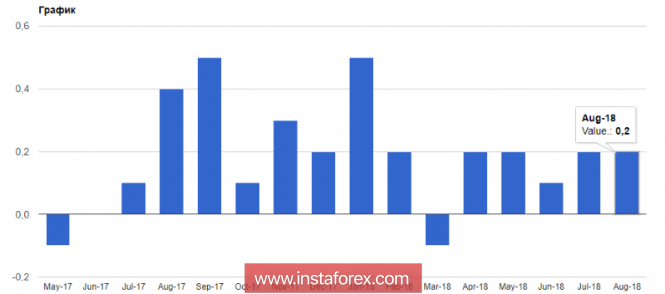

According to the US Department of Labor, the consumer price index (CPI) rose by 0.2% in August compared in July, while economists forecast an increase of 0.3%. The base index, excluding volatile food and energy prices, rose 0.1%, compared to economists' expectations of 0.2% increase.

But in comparison with the same period of the previous year, growth in general slowed. If in July the annual growth was 2.9%, then in August prices grew only by 2.7%. The base CPI index grew by 2.2% in August compared to the same period of the previous year, which is also lower than the previous month.

On the one hand, a reduction in consumer price growth will allow the Fed not to rush in raising interest rates; on the other hand, strong economic growth and growth in the labor market do not allow inflation to be inflated to the proper level, which could in the future complicate the situation in the monetary policy of the Federal Reserve System.

Positive data on the US labor market has long not surprised traders, and have also been ignored this time.

The US Labor Market

According to the report of the US Department of Labor, the initial applications for unemployment benefits for the week from 2 to 8 September decreased by 1,000 and amounted to 204,000. Economists had expected the number of applications to be 210,000.

The monthly US budget deficit in August almost doubled compared to the same period last year. This happened at the expense of a serious increase in the government's expenses, as incomes fell significantly.

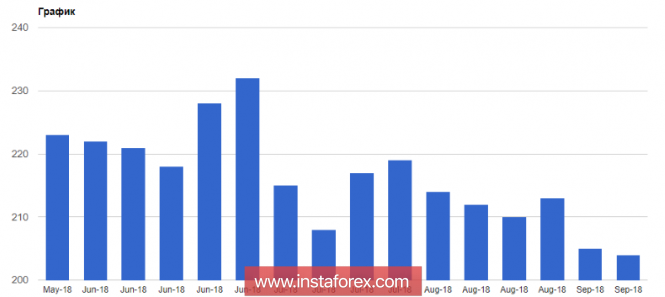

According to the data, the US budget deficit amounted to 214 billion dollars in August 2018 against 107.7 billion dollars in August 2017. The increase in government spending was 30%.

Yesterday, the WSJ survey was published, in which most economists believe that the impact of import duties on the economy will be limited. The US GDP is expected to grow by 3.1% in 2018, by 2.4% in 2019 and by 1.8% in 2020. The average probability of a recession in the US in the next 12 months is 18%.

Speeches of Fed representatives in yesterday afternoon also were ignored by the market. For example, Raphael Bostic, the president of the Federal Reserve Bank of Atlanta, said that the US economy needs a gradual increase in rates, as its condition is pretty good. Bostik does not expect a jump in inflation above 2% in the near future.

Technical analysis:

As for the technical picture of the EUR/USD pair, the gradual approach to the large monthly highs around 1.1700 and 1.1740 will limit the upside potential in the short term. However, one can already seriously talk about the resumption of an upward trend in risky assets. Longer long positions in the euro should be gathered after correction to the area of support levels 1.1675 and 1.1640, from which the lower boundary of the rising channel will be built.

The material has been provided by InstaForex Company - www.instaforex.com