The main public idea behind Trump's tax reform was the repatriation of capital and the improvement of competitive conditions for producers in the United States. The same goal is pursued by trade wars, with the main trading partners of the United States (China, the European Union, Canada and Mexico) building a new tariff system designed to make imports less profitable and own production more profitable.

However, reality is far from being calculated. We have already noted both the weak growth rates of industrial production, and the rather alarming reports of the regional offices of the Federal Reserve, reporting on the slowdown in business activity. We add here the reluctance of foreign capital to participate in the financing of reforms, which is indicated by a decrease in purchases on the stock market in the past few months and the withdrawal from the treasures of a number of countries.

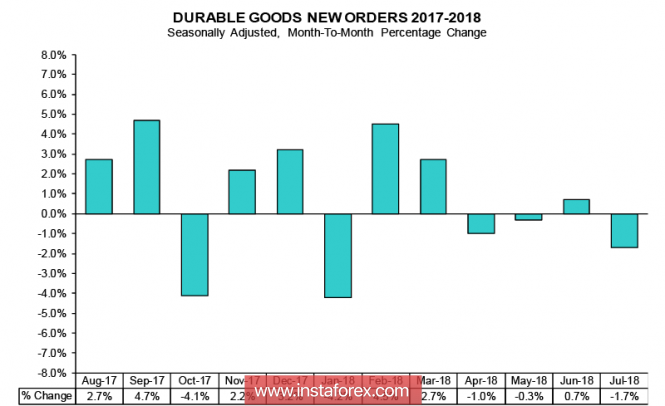

The report on orders for durable goods, published on Friday, confirms a negative trend. Orders decreased in July by 1.7%, this is the most significant decrease in the last 6 months, the largest losses in transport and military orders.

It can be argued that until the tax reform has not given a visible positive result, however, the negative consequences are no longer behind the mountain. First of all, it is about the growth of the budget deficit from the decrease in tax revenues and the growing problems of exporters from the growth of the dollar. The Budget Committee of the Congress recently warned about higher growth rates of the budget deficit, and together with the lack of any desire of companies to participate in the re-industrialization program, which prefer to direct additional revenues not to the real sector, but to the growth of capitalization through the repurchase of shares, all this becomes serious problem.

It is no coincidence that Trump criticized the Fed's policy last week, which contributes to the growth of the dollar index in the absence of real results of reforms, making them increasingly problematic. Fed Chairman Powell, speaking at a symposium in Jackson Hole, partially agreed with Trump's criticism, and his speech contributed to a rapid decline in the dollar.

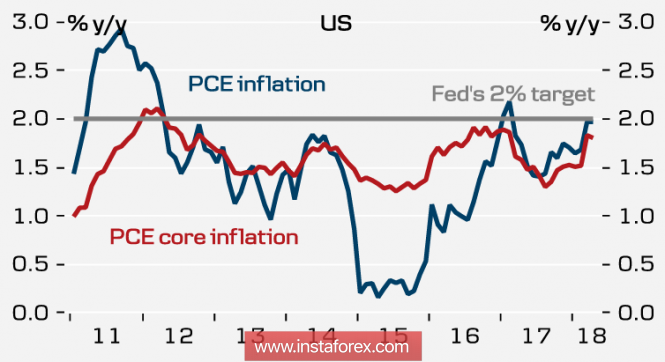

Powell, in particular, drew attention to the fact that the growth of inflation does not look convincing. Indeed, and we noted this earlier on the dynamics of yields of TIPs bonds, the growth of inflationary expectations stopped in May. Powell also noted the difficulties in determining the natural level of unemployment and interest rates, noted the absence of a risk of overheating the economy and expressed the view that the Fed should raise rates gradually to avoid mistakes.

On Thursday, data on the core inflation of the PCE for July will be published. In case the PCE index shows growth to 2.0%, the dollar will be able to return to the growth trajectory.

In general, it should be noted that the market's confidence that the Fed will raise the rate three times in 2019 has seriously shaken. There are almost no doubts about two increases in September and December, but for the next year the markets are firmly sure of only one increase. If these fears are confirmed on Thursday, the dollar's growth may end.

EUR / USD

The Euro looks stronger with the dollar after Powell's pigeon appearance. Today, it is possible to continue growing and try to reach the trend line at the level of 1.1680. On Friday, preliminary data on inflation in the eurozone for August will be published, in their expectation the demand for the euro will remain high.

GBP / USD

Today, banks in England and Wales are closed on the occasion of the holiday, so the volatility of the pound is expected to be low. The pound is most likely to spend the day in the trading range 1.2910 / 2880, given that the week will be poor for macroeconomic news, the direction of the exit from the range is still unclear.

Oil and ruble

Oil played a part of the losses on Powell's comments and a decrease in production in Iran, but further growth is still in doubt. During the day, a slight pullback is likely, for Brent the support is 74.90. The ruble has returned to the level of 67, the expansion of sanctions on its dynamics has no effect, but the Ministry of Finance's refusal to buy currency will help stabilize, it is likely that the USD / RUB will decline to 66.20 by the end of the day.

The material has been provided by InstaForex Company - www.instaforex.com