EUR/USD has been quite impulsive with bullish gains recently which lead the price to reside above 1.15 area with a daily close. Due to recent downbeat economic data from the US, EURO managed to gain certain momentum over USD which is expected to be quite short-lived.

EUR has been trading with a predictable dynamic which encouraged EUR to sustain its momentum in the process. Today, EUR has been quite strong in light of the fundamentals. German Ifo Business Climate index surged to 103.8 from the previous figure of 101.7 which was expected to be at 101.9. Moreover, this week German Retail Sales, Unemployment Rate, and Flash CPI reports are going to be published.

On the other hand, this week US Prelim GDP report is going to be published which is expected to show a slight decrease to 4.0% from the previous value of 4.1% and Unemployment Claims report which is expected to increase to 211k from the previous figure of 210k.

Meanwhile, in the last week of the month, the market is expected to be quite slow and indecisive whereas any negative outcome on the EUR's side is expected to empower USD gains in the coming days which can lead to a further downward move in the process. EUR has gained certain momentum today on the back of positive economic data, but it is not enough to push the price above the key resistances.

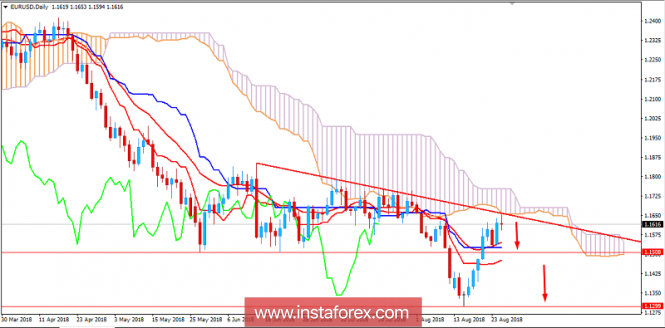

Now let us look at the technical view. The price is currently quite indecisive after the previous impulsive bullish momentum which lead the price towards the trend line resistance at 1.1650 area. The price has been also held by the Kumo Cloud resistance as well from where having confluence to push lower towards 1.1500 and later towards 1.1300 support area in the coming days. As the price remains below 1.17 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 1.1500, 1.1300

RESISTANCE: 1.1650, 1.1700, 1.1850

BIAS: BEARISH

MOMENTUM: VOLATILE