USD/JPY is currently quite indecisive and volatile after breaking above 110.50 with a false break recently. Despite the recent downbeat economic reports from the US, certain gain on the USD side against JPY does indicate the weakness of JPY in the process.

Citing FED Chair Powell, the US central intends to continue monetary tightening, though at a gradual pace. Less hawkish stance of the US Fed left dollar bulls indecisive. Though President Trump is not quite happy about recent rate hikes, the FED is currently considering at least 3-4 rate hikes in the year ahead. This week US Prelim GDP report is going to be published which is expected to show a slight decrease to 4.0% from the previous value of 4.1% and Unemployment Claims report which is expected to increase to 211k from the previous figure of 210k.

On the JPY side, tomorrow BOJ Core CPI report is going to be published which is expected to decrease to 0.3% from the previous value of 0.4%. On Wednesday, Consumer Confidence report is going to be published which is expected to have a slight decrease to 43.4 from the previous figure of 43.5 and on Friday Unemployment Rate report is going to be published which is expected to be unchanged at 2.4%.

Meanwhile, certain volatility is expected in the pair this week which may lead to certain indecision in the market. Though a series of economic reports will be published but forecasts are mixed which might lead to further gains on the USD side leading to further gains in the pair. Ahead of the Prelim GDP report this week, USD may lead the path if better than expected results are published.

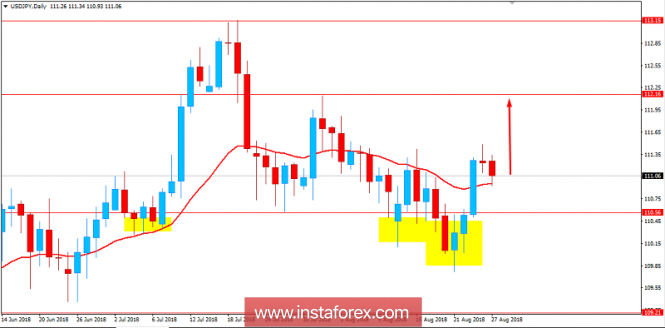

Now let us look at the technical view. The price is currently residing above 110.50 as well the dynamic level of 20 EMA. Though the price has been quite indecisive on Friday but having an impulsive bullish pressure following a strong False Break below 110.50 is expected to inject further bullish momentum in the process. As the price remains above 110.50 with a daily close, the bullish bias is expected to continue further with target towards 112.00 and later towards 113.00 in the coming days.

SUPPORT: 110.50

RESISTANCE: 112.00, 113.00

BIAS: BULLISH

MOMENTUM: VOLATILE